It would be difficult not to mention Nvidia (NASDAQ:NVDA) recapping the stock market year 2023. The rise of artificial intelligence (AI) and Nvidia’s triple-digit surge are arguably among the biggest headlines of 2023.

By the end of December, Nvidia’s price had climbed to around $500 per share, a high price for many investors wanting to buy whole shares.

Will the stock split in 2024 and drive down the price of an entire stock? Should this impact investors’ decisions to continue buying stocks?

Here’s what you need to know.

Why Nvidia stock could split

Predict a stock split It’s not rocket science, and there are indications that it will happen soon with Nvidia. The company has a history of stock splits, which is when a company multiplies or divides its number of shares without changing the overall market capitalization. So, if the number of shares increases, the value per share decreases.

Nvidia’s most recent split took place in 2021. Shares were trading at $744 before the split. Nvidia isn’t at that high of a stock price yet, but it’s getting close at $500.

Before 2021, Nvidia split its shares four more times between 2000 and 2007. Shares rose 334% over those seven years. I think management likes to keep the stock price at a level acceptable to most investors.

The rapid growth of AI in 2023 has also established a growth scenario around Nvidia that could extend well into the future. In other words, Nvidia’s fundamentals seem destined to drive the stock higher over the coming years, which makes me think that an Nvidia stock split is a matter of When and not if.

But here’s the secret to stock splits

Investors need to understand what stock splits do and don’t do. Splits reduce the trading price of a stock. This makes it less expensive to own part of that company, but a split does not fundamentally affect the value of a stock. This creates a lower stock price by dividing the stock into more pieces (shares).

For example, let’s say you want a pie. You go to the store and see a pie worth $40 being sold in two halves for $20 each. You don’t want to pay $20 for a pie, so you ask the store to cut the halves to divide the pie into four quarters sold for $10 each. In this case, you pay $10 for a pie but you get a smaller piece.

Stock splits work the same way. The company has the same value, but investors pay a lower price for a smaller share of the business the stock represents. This isn’t necessarily bad, but remember that stock splits don’t change the fundamental value, only the price of the stock. Investors who can’t afford an entire share might also consider purchasing fractional shares.

Should investors buy Nvidia for 2024 and beyond?

Investors should buy Nvidia if they like the direction their business is going, not because of what management is doing with the share count. The good news is that Nvidia appears to be a great long-term buy. It is the overwhelming market leader in AI chips, which are installed in huge data centers to process intense computing workloads.

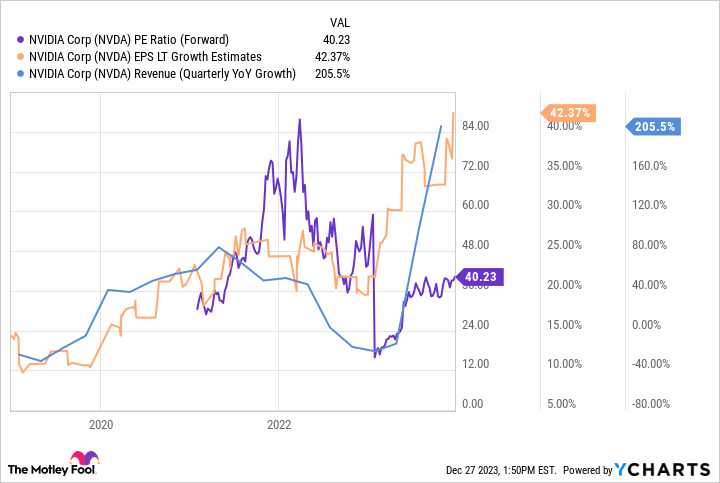

The company’s most recent quarter revenue was up 200% from last year’s quarter. Analysts forecast long-term earnings growth averaging 42% per year. Despite its massive run into 2023, the stock trades at a forward P/E of just 40. The resulting price-to-earnings-to-growth (PEG) ratio of just 1 indicates that the stock is a bargain, assuming long-term growth estimates. come to fruition.

No stock is without risk. Competition will surely come for Nvidia and hitting growth estimates is not a sure thing. But if investors intend to hold on to their securities for the long term, they should be rewarded.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns December 18, 2023

Justin Pope has no position in any of the stocks mentioned. The Motley Fool Ranks and Recommends Nvidia. The Motley Fool has a disclosure policy.

Investors have been buying this hyper-growth artificial intelligence (AI) stock in 2023. Will it split its shares in 2024? was originally published by The Motley Fool