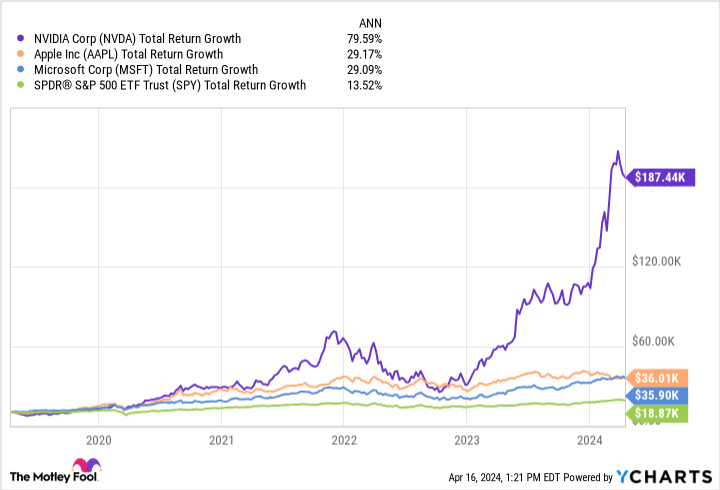

It’s hard to find a stock that performs better than Nvidia over the last five years. Since 2019, its stock has seen a staggering 79% compound annual growth rate (CAGR). This means that $10,000 invested five years ago would be worth $187,000 today.

Unfortunately, it is not possible to turn back time. So what can investors do today to recreate some of that Nvidia lightning in a bottle? One solution – at least in part – could be to invest in an exchange-traded fund (ETF) focused on the technology sector.

So let’s look at today Avant-garde Information Technology ETFs (NYSEMKT:VGT).

What is the Vanguard Information Technology ETF?

First of all. The Vanguard Information Technology ETF is an exchange-traded fund, meaning it is a basket of tradable stocks focused on the technology sector. Major titles include Microsoft, Apple, Broadcomand yes, Nvidia.

Company Name | Symbol | Percentage of assets |

|---|---|---|

Microsoft | MSFT | 18.3% |

Apple | AAPL | 15.4% |

Nvidia | NVDA | 11.8% |

Broadcom | AVGO | 4.2% |

Selling power | RCMP | 2.1% |

Advanced microsystems | AMD | 2.1% |

Adobe | ADBE | 1.7% |

Accenture | ACN | 1.6% |

Oracle | ORCL | 1.5% |

Cisco Systems | CSCO | 1.5% |

Data source: Avant-garde.

An important aspect of the fund is that it is an index ETF, which means it is not actively managed. The fund rather seeks to replicate the performance of the MSCI US Investable Market/Information Technology Index 25/50 — a basket of small, medium and large technology sector stocks.

This design keeps the fund’s fees low and, as a result, the fund’s expense ratio is tiny: 0.1%. This means that for every $10,000 invested in the fund, investors only pay $10 in fees per year.

Why is the Vanguard Information Technology ETF a smart investment?

In general, ETFs can be a smart choice for most investors thanks to their built-in diversification. And in the case of the Vanguard Information Technology ETF, investors gain exposure to a wide range of technology stocks for minimal fees.

Certainly, the fund is very heavy, with around 45% of its holdings concentrated in Microsoft, Apple and Nvidia. However, this is not necessarily a bad thing. Over the past five years, each of these stocks has hit the market. S&P500.

Regardless, owning shares of the Vanguard Information Technology ETF is a way for investors to gain exposure to Nvidia without directly owning Nvidia shares. This can be useful, particularly if investors want to reduce the volatility of their portfolio.

Additionally, because the fund owns hundreds of stocks, including small-cap stocks, there is upside potential, particularly if one of these small-cap stocks becomes the “next Nvidia.”

Finally, there is passive income. Certainly, the fund’s dividend yield is meager: only 0.7%. However, that’s more dividend income than an investor would get by just owning Nvidia stock, which has a dividend yield of just 0.2%.

Is the Vanguard Information Technology ETF a Buy Now?

The Vanguard Information Technology ETF is a well-constructed, affordable ETF that is a smart buy for many investors. That said, it’s not for every wallet. In particular, its high concentration of technology stocks – Apple, Microsoft and Nvidia in particular – makes it unsuitable for investors who already have excessive exposure to these stocks. Plus, given the fund’s undersized dividend yield, income-seeking investors would be wise to look elsewhere.

However, for those looking for a tech-focused ETF with a low expense ratio, this fund is one to keep in mind. Indeed, it could be a great vehicle for investors who may have missed Nvidia’s incredible five-year run but don’t want to miss out on the next big tech stock.

Should you invest $1,000 in the Vanguard World Fund – Vanguard Information Technology ETF right now?

Before purchasing shares of Vanguard World Fund – Vanguard Information Technology ETF, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $518,784!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 15, 2024

Jake Lerch holds positions at Adobe and Nvidia. The Motley Fool holds positions and recommends Accenture Plc, Adobe, Advanced Micro Devices, Apple, Cisco Systems, Microsoft, Nvidia, Oracle and Salesforce. The Motley Fool recommends Broadcom and recommends the following options: long January 2025 $290 calls on Accenture Plc, long January 2026 $395 calls on Microsoft, short January 2025 $310 calls on Accenture Plc, and short 405 calls $ in January 2026 on Microsoft. The Mad Motley has a disclosure policy.

Did you miss Nvidia? Buy this exceptional Vanguard ETF instead. was originally published by The Motley Fool