(Bloomberg) — As optimism grows among investors that a rally in U.S. Treasuries is imminent, a key bond market indicator is sending a worrying sign to anyone considering investing there.

Most read on Bloomberg

First, the good news. With mid-year 2024 in sight, Treasuries are poised to erase their losses for the year as signs finally emerge that inflation and the job market are both on the decline. actually slow down. Traders are now betting that could be enough for the Federal Reserve to start cutting interest rates as soon as September.

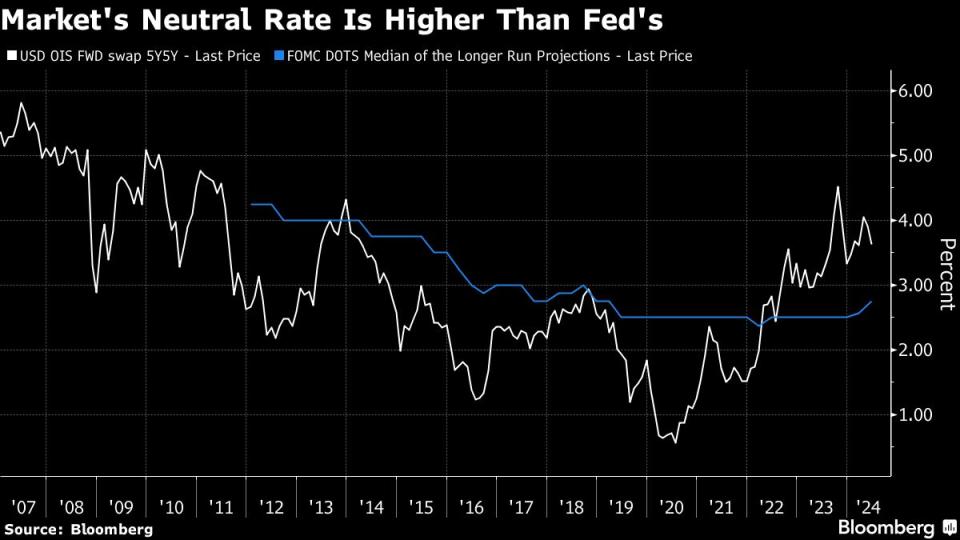

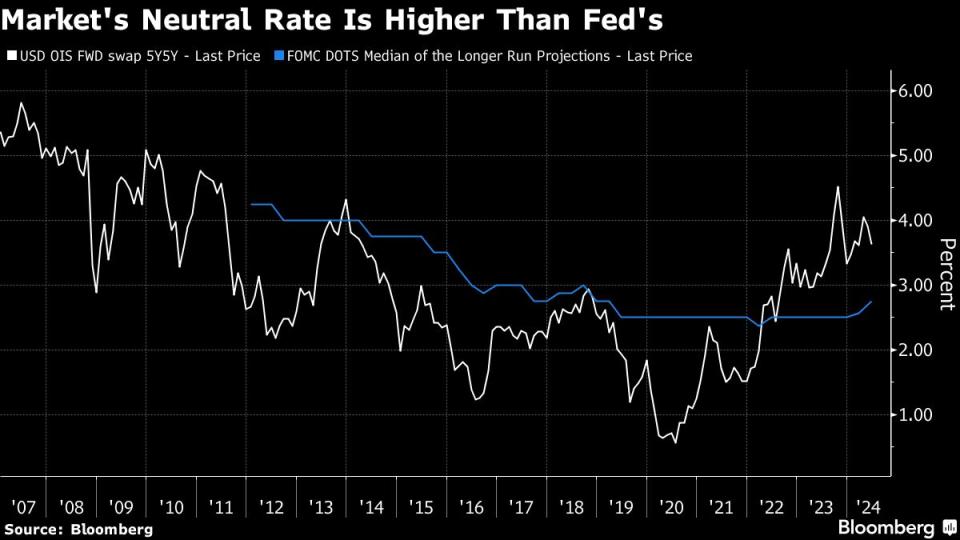

But there is a growing view in markets that the economy’s so-called neutral rate – a theoretical level of borrowing costs that neither boosts nor slows growth – is much higher than that of policymakers, which could limit the central bank’s ability to cut and thus create a headwind for bonds. are currently being planned.

“What is important is that when the economy inevitably slows down, there will be fewer rate cuts and interest rates over the next ten years could be higher than they were over of the last ten years,” said Troy Ludtka, senior U.S. economist at SMBC Nikko. Securities America, Inc.

Futures contracts referencing the five-year interest rate over the next five years — a proxy for the market’s view of where U.S. rates might move — are stuck at 3.6%. Although this figure is down from last year’s high of 4.5%, it is still more than a percentage higher than the average of the last decade and higher than the Fed’s own estimate of 2.75%.

This is important because it means the market is pricing in a much higher yield floor. The practical implication is that there are potential limits to the scope of obligations. That should worry investors preparing for the type of epic bond rally that saved them late last year.

For now, investor sentiment is increasingly optimistic. A Bloomberg gauge of Treasury yields was down just 0.3% in 2024 on Friday, after losing as much as 3.4% for the year at its lowest point. Benchmark yields are down about half a percentage point from their annual peak in April.

In recent sessions, traders have stocked up on contrarian bets that could benefit from greater chances that the Fed will cut interest rates as early as July and futures demand that a rally in the bond market is booming.

But if the market is correct that the neutral rate – which cannot be observed in real time because it is subject to too many forces – has risen permanently, then the Fed’s current benchmark rate of above 5% is perhaps not as restrictive as we think. Indeed, a Bloomberg gauge suggests that financial conditions are relatively loose.

“We’ve only seen a fairly gradual slowdown in economic growth, which suggests the neutral rate is significantly higher,” said Bob Elliott, CEO and chief investment officer at Unlimited Funds Inc. Given economic conditions current prices and limited risk premia, in long-dated bonds, “cash seems more attractive than bonds,” he added.

The true level of the neutral rate, or R-Star as it is also known, has become the subject of heated debate. Reasons for a possible upward shift, which would mark a reversal of a decades-long downward drift, include expectations of large and prolonged government budget deficits and increased investments to combat climate change .

Further gains in bonds could require a steeper slowdown in inflation and growth to cause faster and deeper interest rate cuts than the Fed is currently considering. A higher neutral rate would make this scenario less likely.

Economists expect next week’s data to show the Fed’s preferred gauge of underlying inflation slowed to an annualized rate of 2.6% last month, from 2.8%. . Although this is the lowest figure since March 2021, it remains above the Fed’s 2% inflation target. And the unemployment rate has been at or below 4% for more than two years, the best performance since the 1960s.

“While we are seeing pockets of households and businesses suffering from higher rates, overall as a system we have clearly managed the situation very well,” said Phoebe White, head of strategy for US inflation at JPMorgan Chase & Co.

The performance of financial markets also suggests that Fed policy may not be restrictive enough. The S&P 500 hit record highs almost daily, although shorter-dated inflation-adjusted rates cited by Fed Chairman Jerome Powell as a measure of the impact of Fed policy , have jumped nearly 6 percentage points since 2022.

“You have a market that has been incredibly resilient in the face of higher real yields,” said Jerome Schneider, head of short-term portfolio management and financing at Pacific Investment Management Co.

What Bloomberg strategists say…

“In the space of a few points, the Federal Reserve raised its estimate of the nominal neutral rate from 2.50% to 2.80%, showing how central banks around the world are still trying to get a handle on the scale neutral rates. economic expansion and inflation observed in this cycle. That’s why current market pricing of nearly two full rate cuts from the Fed this year appears overestimated. »

— Ven Ram, multi-asset strategist

With the exception of a few Fed officials, like Gov. Christopher Waller, most policymakers are leaning toward the higher neutral rate camp. But their estimates varied within a wide range between 2.4% and 3.75%, highlighting the uncertainties in forecasting.

Powell, in his discussions with reporters on June 12, at the end of the central banks’ two-day policy meeting, appeared to downplay its importance in the Fed’s decision-making, saying “we can’t really know.” whether neutral rates have increased or not. .

For some market players, this is not unknown. This is a new, higher reality. And that’s a potential obstacle to a rally.

What to watch

Economic data :

June 24: Dallas Fed manufacturing activity

June 25: Philadelphia Fed non-manufacturing; National activity of the Chicago Fed; FHFA Home Price Index; S&P CoreLogic; Conference Board Consumer Confidence; Richmond Fed Manufacturing Index and Business Conditions; Dallas Fed Services Activity;

June 26: MBA mortgage loan applications; new home sales

June 27: Advanced merchandise trade balance; First quarter GDP (third reading); wholesale/retail stocks; Initial jobless claims; durable goods; pending home sales; Manufacturing by the Kansas City Fed

June 28: Personal income and expenses; PCE deflator; INM Chicago PMI; University of Michigan Sentiment (final reading); Kansas City Fed Service

Fed Timeline:

June 24: Fed Governor Christopher Waller; Mary Daly, President of the San Francisco Fed

June 25: Michelle Bowman, Governor of the Fed; Lisa Cook, Governor of the Fed

June 28: Thomas Barkin, president of the Richmond Fed; Archer

Auction schedule:

June 24: invoices from 13 to 26 weeks

June 25: 42-day CMB; 2-year notes;

June 26: reopening of the FRN for 2 years; Bills at 17 weeks; 5 year notes

June 27: invoices 4 to 8 weeks; 7 year old tickets

Most read from Bloomberg Businessweek

©2024 Bloomberg LP