Benzinga and Yahoo Finance LLC may earn commissions or revenue from certain articles through the links below.

Doubling your money is a milestone for any investor, and the time it takes to reach this goal depends on the rate of return generated by your investments. An 8% return, in particular, can be a powerful tool for growing your wealth over time. To determine how long it would take to double your money with an 8% return, we’ll look at two scenarios: doubling your investment with compounding returns and doubling your money without compounding returns.

Understand the basics

An 8% yield refers to the annual return on your investment that is returned to you in cash, expressed as a percentage of your initial investment. For example, if you invest $10,000 in a stock that yields 8%, you can expect to earn $800 in returns over the course of a year.

Compounding returns refers to the process of reinvesting your income back into the investment, allowing your money to grow exponentially over time. Non-compound returns, on the other hand, involve withdrawing your income from the investment each year, resulting in linear growth of your money.

Double Money with Compound Returns

Compound interest is a powerful concept that allows your money to grow at an accelerated rate. The formula for compound interest is:

A = P(1+r)^n

Where A is the final amount, P is the initial principal, r is the annual interest rate, and n is the number of years.

A quick and easy way to estimate how long it will take to double your money with compound interest is the rule of 72. Simply divide 72 by your annual interest rate. In the case of an 8% return, it would take about nine years to double your money (72/8 = 9).

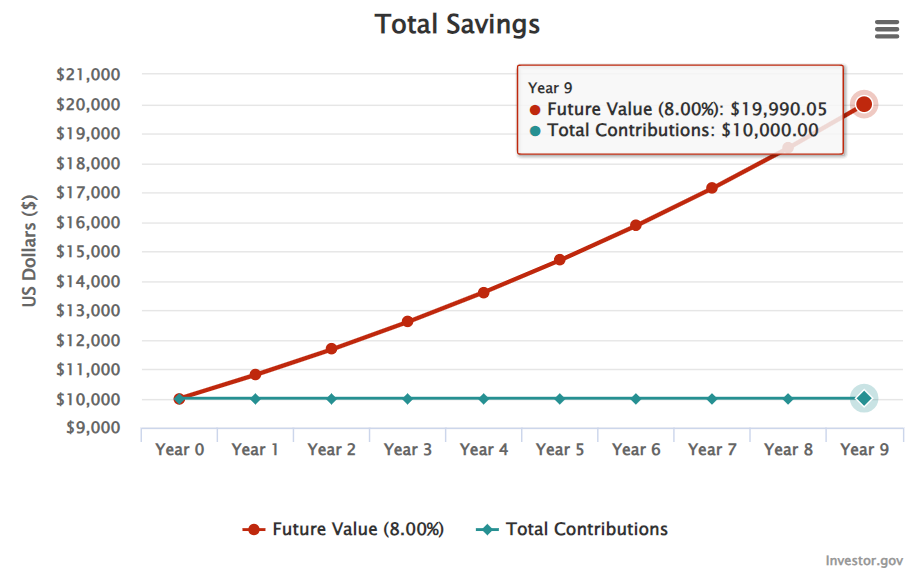

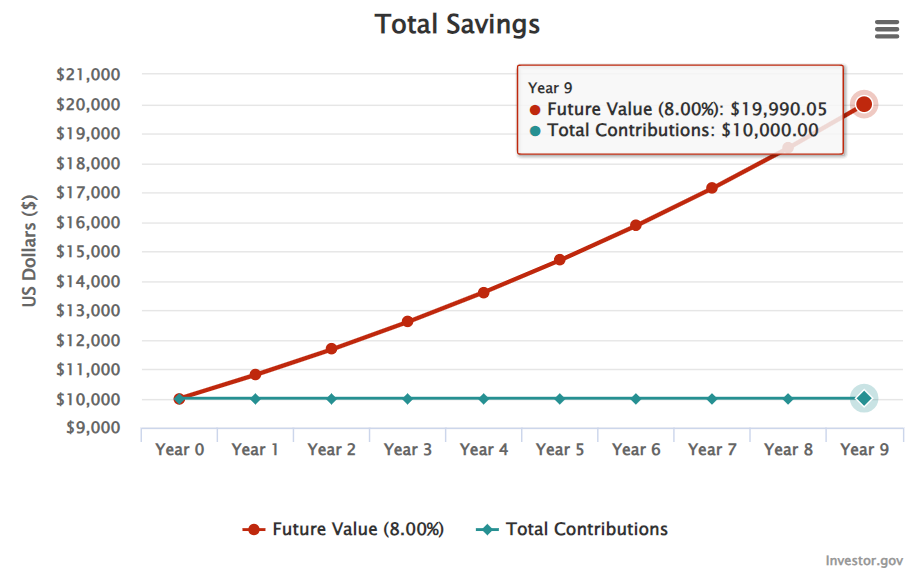

Let’s see how it works with a detailed example. If you invest $10,000 with an annual return of 8%, compounded annually, here is how your money will grow:

Year 1: $10,800

Year 2: $11,664

Year 3: $12,597

Year 4: $13,605

Year 5: $14,693

Year 6: $15,869

Year 7: $17,138

Year 8: $18,509

Year 9: $19,990

By the end of year nine, your initial investment of $10,000 would have nearly doubled to $19,990. This exponential growth is the result of reinvesting your returns each year, allowing your money to compound over time.

This example shows how your investment would grow with returns compounded annually. If it were compounded quarterly or monthly, it would increase slightly faster. That same $10,000 compounded quarterly would be $20,398.87 after nine years and $20,495.30 if compounded monthly.

Trend: If there was a new Jeff Bezos-backed fund offering a 7-9% target return with monthly dividends, Would you like to invest in it?

Double money without increasing returns

Simple interest, on the other hand, involves earning a fixed rate of return on your initial investment each year, without reinvesting your earnings. The simple interest formula is as follows:

A = P(1+rt)

Where A is the final amount, P is the initial principal, r is the annual interest rate, and t is the number of years.

If you were to invest $10,000 at a simple interest rate of 8%, your money would grow by $800 each year. To double your initial investment it would take 12.5 years ($10,000 / $800 per year = 12.5 years).

Compared to the compound scenario, in which it only took nine years to double your money, the simple interest scenario requires an additional 3.5 years to achieve the same goal.

The power of compound interest

The difference between compounded and non-compounded returns becomes even more pronounced over longer time periods. For example, if you were to invest $10,000 with an 8% return for 30 years, your money would reach:

– $100,627 with compound interest

– $34,000 with simple interest

This stark contrast highlights the importance of reinvesting your returns. By reinvesting your earnings into your investment, you allow your money to work harder for you over time, resulting in significantly greater wealth accumulation.

Find investments with an 8% return

To achieve the goal of doubling your stake with an 8% return, it is crucial to choose the right investments. Let’s look at two potential options: a dividend stock and a high-yielding alternative investment.

Dividend Stocks

Finding a reliable high-yielding dividend stock is one way to get an 8% annual return. Many dividend stocks have a history of increasing their payout each year, which means the yield will continue to grow. Stocks also have price growth potential, providing even greater returns over time. However, high-yielding dividend stocks tend to experience slower price growth because much of their profits are paid out to shareholders instead of being used to grow the business.

One option to consider is Altria Group, Inc. (NYSE:MO), a well-established company in the tobacco industry, known for its strong dividend yield and consistent distribution history. With a forward dividend yield of 8.57% and 54 consecutive years of dividend growth, Altria is an attractive option for income-oriented investors.

The annual dividend distributed by the company is currently $3.92 per share, with a payout ratio of 78.86%. While the tobacco industry faces some regulatory challenges, Altria’s strong brand portfolio and pricing power have allowed it to maintain its impressive dividend history.

High yield alternative investment

Investors looking to diversify beyond traditional dividend stocks might find that the Ascent Income Fund of EquityMultiple offers an interesting opportunity. This fund focuses on private credit investments, targeting stable income from senior commercial real estate debt positions.

Historically, the Ascent Income Fund has generated a distribution yield of 12.1%, significantly higher than the 8% benchmark we discussed. If the fund can maintain this level of performance, it could significantly reduce the time it takes to double your money. In fact, it would only take about six years. In just 10 years, you could more than triple your initial investment.

EquityMultiple’s strong track record and focus on capital preservation make the Ascent Income Fund an attractive option for investors seeking higher returns and potentially faster wealth accumulation. Click here to learn more and claim a first time investor bonus.

The essential

The time it takes to double your money with an 8% return depends on whether your returns compound or not. With compound interest, you can expect to double your money in about 9 years, while it would take 12.5 years with simple interest.

The power of compound interest lies in reinvesting your returns, allowing your money to grow exponentially over time. By choosing investments that offer high returns and compounding potential, such as high-quality dividend stocks or alternative investments like Ascent Income Fund, you can accelerate your wealth-building journey.

To explore more high-yield investment opportunities, check out the list of Benzinga’s Favorite High-Yield Investments and discover a range of carefully selected investment options across various asset classes and risk profiles.

Continue reading:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This item How long does it take to double your money on an investment with an 8% return? originally appeared on Benzinga.com