THE S&P500 has been very hot over the past year. The general market index increased by almost 28%. This brings it to an all-time high.

However, not all stocks participated in the rally. Energy Stocks have only risen about 1% over the past year, so the sector is trading at a historically low valuation. This suggests that energy stocks have significant upside potential over the coming months. sector rotation.

Scrape the bottom of the recovery barrel

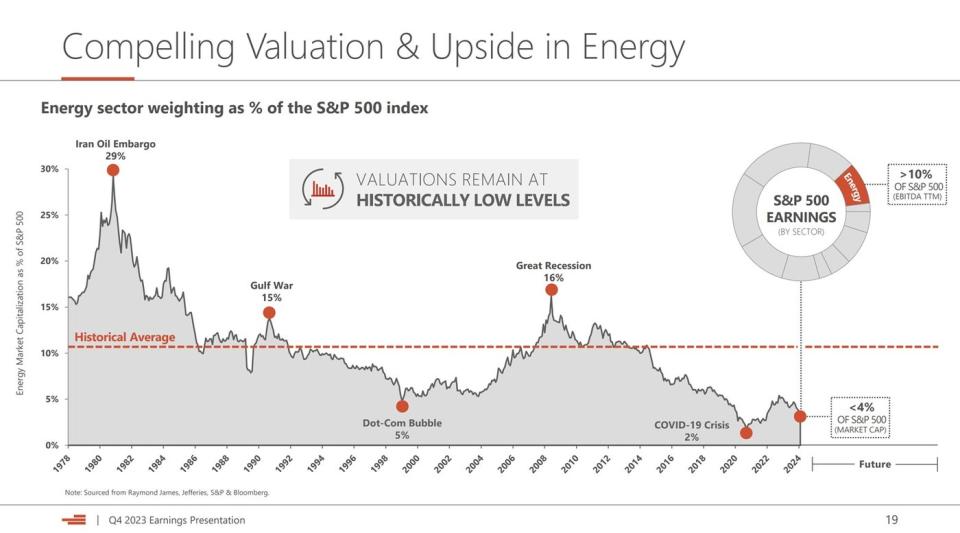

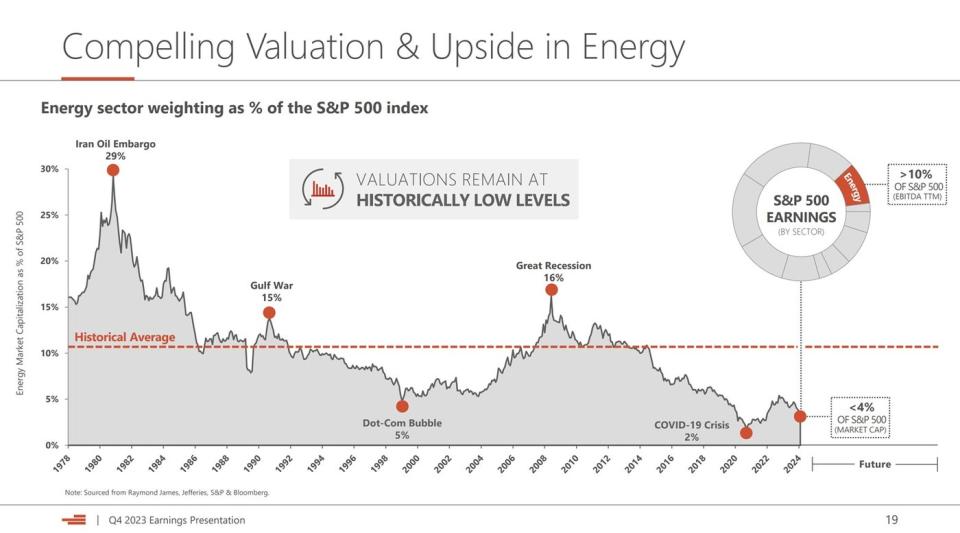

The energy sector currently has a historically low weighting in the S&P 500:

This chart shows that energy stocks represent less than 4% of the S&P 500 in terms of market capitalization. This is the second lowest level in recent decades, even lower than that of the dotcom bubble. Given that energy stocks represent 10% of S&P 500 earnings, the sector should have a weighting of around 10% since it has historically tracked its earnings contribution. This would bring it closer to the historical average.

Rick Muncrief, CEO of an oil and gas producer Devon Energy (NYSE:DVN)discussed the energy sector’s currently compelling value proposition on its fourth quarter conference call. He commented on what is likely driving this gap, saying: “I believe this gap exists due to the extreme valuations of the technology sector, combined with a pervasive misunderstanding of hydrocarbon demand over time. »

While energy stocks have barely moved over the past year, technology stocks are up more than 50%, driving much of the S&P 500’s rebound. Many tech companies today trade at valuations extremely frothy, due to the hype around artificial intelligence. For example, the tech-heavy Nasdaq 100 is currently trading at a Forward P/E ratio above 30, while the S&P 500 sells for around 21 times forward earnings. Both indexes have seen significant expansion in their multiples over the past year. The Nasdaq 100’s P/E ratio was below 25 a year ago, while the S&P 500’s was around 18.

The other factor weighing on energy stocks is the mistaken belief that demand for oil and gas is declining. This is not the case. Muncrief noted that: “As global energy demand is expected to increase by 50% by 2050, the world will need growth from all energy sources, including oil and natural gas. oil demand is not in sight and our industry will be a significant contributor to energy growth for the foreseeable future. » Energy sector valuations should reflect this growth, not the decline that the market is currently pricing in for most energy stocks.

Drilling for value in the energy sector

Devon Energy is a great example of the valuation disconnect. The oil company is on track to increase its free cash flow by 20% this year, fueled by service cost deflation and capital efficiency gains. This assumes that oil costs on average around $80 per barrel, which is slightly above the current price. Even at a more conservative $75 per barrel (slightly lower than today’s price), Devon Energy trades with a free cash flow yield of 9%. That compares to 4% for the S&P 500 and 3% for the Nasdaq, meaning it’s significantly cheaper. This discount fuels Devon’s capital return strategy of prioritizing share buybacks in 2024 to capitalize on its dirt-cheap shares.

Another oil and gas producer Diamondback Energy (NASDAQ:FANG) is also trading at a very low price. With oil at $70, Diamondback can produce over $15 per share in free cash flow. This puts its free cash flow yield at over 8%. Meanwhile, it can generate over $19 per share in free cash flow at $80 oil, giving it a free cash flow yield of over 10%. That’s a cheap price for a growing company. The company expects its oil production to increase 5% per share this year, while its free cash flow could rise more than 15% per share if oil averages around $80 per barrel .

Producers exposed to commodity prices aren’t the only energy stocks trading at low valuations. Gas pipeline giant Children Morgane (NYSE:KMI) plans to increase its free cash flow 8% this year to $2.26 per share. This gives it a monster yield of 13% in free cash flow. Kinder Morgan uses half of its regular cash flow to pay dividends (currently yielding 6.5%). It uses the rest to finance investments to increase its cash flow, buy back its shares at low prices and strengthen its already excellent balance sheet. The company plans to increase its cash flow by capitalizing on the expected 19% increase in natural gas demand by 2030.

A potentially historically attractive entry point

Energy stocks are trading at low valuations as investors bid up the stakes on technology stocks and overlook the sector’s upcoming growth. This makes the sector very attractive. Valuations are expected to improve as investors realize that strong growth remains to be expected in oil and gas demand and begin to move away from high-octane technology stocks. In this case, energy stocks could soar.

Should you invest $1,000 in Devon Energy right now?

Before buying shares of Devon Energy, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Devon Energy was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns February 26, 2024

Matt DiLallo holds positions at Kinder Morgan. The Motley Fool holds positions with and recommends Kinder Morgan. The Motley Fool has a disclosure policy.

History shows that these stocks are ridiculously cheap and could generate phenomenal returns in the future was originally published by The Motley Fool