Children Morgane (NYSE:KMI) offers investors a significant source of income. The gas pipeline giant currently yields 6.4%, which is one of the highest payouts in the world. S&P500 (where the average is 1.4%). Despite its high yield, Kinder Morgan offers one of the safest sources of income in this broad market index.

The security of its payment was evident in its first quarter report. Here’s a look at those numbers and why they put the pipeline stocks a significant dividend on a rock-solid foundation.

As stable as possible

Kinder Morgan produced $1.4 billion, or $0.64 per share, in distributable cash flow (DCF) during the first quarter. DCF was up 5% from last year on a per share basis.

It easily covered the company’s high-yielding dividend, which it recently increased by about 2%, to $0.2875 per share each quarter ($1.15 annualized). This marked the company’s seventh consecutive year of dividend increases.

The pipeline company continues to generate very stable and growing cash flow. About 68% of its profits come from take-or-pay and hedging contracts, which lock in its revenue. Most of its remaining profits come from long-term, fee-based contracts, thereby limiting its exposure to commodity price volatility.

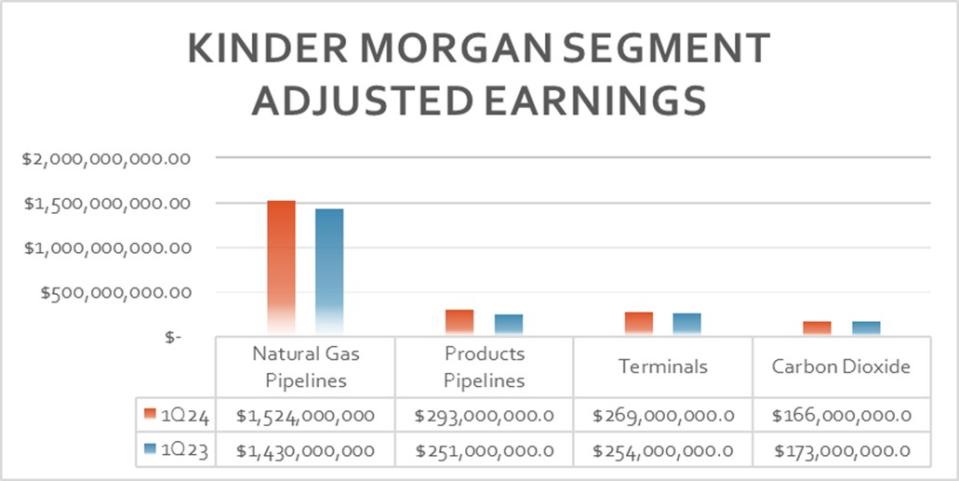

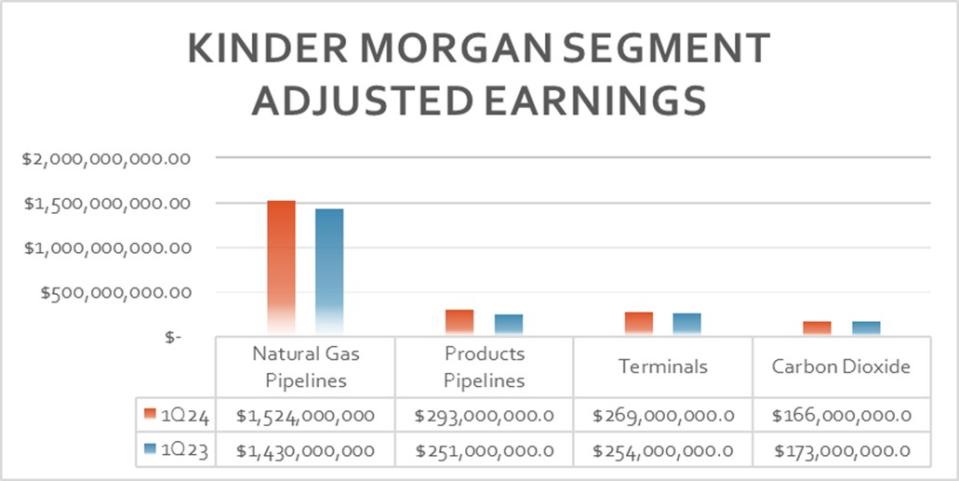

At the same time, its stable cash sources are increasing as the company expands its operations. Kinder Morgan reported profit growth in 3 of its 4 operating segments in the first quarter:

Profits at the company’s core gas pipeline business rose 7% year over year. This improvement was fueled by higher margins on its storage assets, higher volumes from its collection systems and the acquisition of STX Midstream.

Kinder Morgan’s product pipeline operations had a remarkable quarter, with profit up 17%. The company benefited from higher rates on existing assets and the contribution of recently completed capital projects. Finally, the result of its terminals increased by 6%, driven by the expansion projects of liquid terminals and the increase in tariffs on its Jones Act terminals.

Profit growth from these three segments more than offset a 4% decline in profits from its carbon dioxide business. The main drag was the decline in carbon dioxide sales volumes. Movements in commodity prices largely offset each other. Similarly, lower crude oil volumes offset higher natural gas liquids production.

Kinder Morgan generated nearly $1.2 billion in cash flow from operations during the first quarter. It paid out about half of that money in dividends ($631 million) and used about half of that to fund its capital spending ($619 million). This left it with a small deficit ($61 million) which it easily covered thanks to its strong balance sheet.

Kinder Morgan finished the period with a 4.1x leverage ratio, well within its target range of 3.5x to 4.5x. This supported the company’s credit rating.

On track for another strong year

Kinder Morgan’s strong first-quarter results kept it on track to meet its full-year guidance. The pipeline company expects to produce about $5 billion, or $2.26 per DCF share. This would put its dividend distribution rate at around 51% this year, which is very conservative for a company producing such stable cash flow.

As a result, it is expected to generate just under $2.5 billion in excess free cash flow that it can use to fund capital projects and maintain its strong financial flexibility. It expects capital spending to be at the upper end of its $1 billion to $2 billion annual range in the near term.

The company ended the first quarter with $3.3 billion of committed capital projects in its backlog, up from $3 billion at the end of last year. Kinder Morgan continues to pursue high-yield expansion projects, with the majority (80%) focused on low-carbon energy such as natural gas, renewable natural gas and renewable fuels.

The midstream company’s growing profits and projected excess free cash flow lead one to believe it will end this year with a leverage ratio of 3.9x. This gives it additional financial flexibility to make opportunistic acquisitions or share buybacks.

An extremely strong dividend stock

Kinder Morgan generates very sustainable and constantly increasing cash flow. This allows the pipeline company to pay an attractive dividend, invest in continued expansion and maintain a strong balance sheet. These features place its significant earnings on a solid foundation, making Kinder Morgan a great option for those looking to earn a steadily growing passive income stream.

Should you invest $1,000 in Kinder Morgan right now?

Before buying Kinder Morgan stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Kinder Morgan wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $514,887!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 15, 2024

Matt DiLallo holds positions at Kinder Morgan. The Motley Fool holds positions with and recommends Kinder Morgan. The Mad Motley has a disclosure policy.

This 6.4% dividend stock remains an extremely safe option for passive income was originally published by The Motley Fool