One of the easiest ways to generate passive income is to invest in companies that regularly pay out to shareholders dividend. If you’re looking for reliable dividend stocks, Dividend Kings might be a good place to start. These companies have a track record of good capital management, allowing them to increase their dividend payments for at least 50 consecutive years.

Global S&P (NYSE:SPGI) is a company that has increased its dividend payout for 52 years. If you’re an income investor and wondering if the stock deserves a place in your portfolio, consider the following.

S&P Global has a strong economic moat around its credit rating business

S&P Global has a long history of increasing its dividend payout, thanks to a robust business model that generates stable cash flow. The company is the largest credit rating company in the United States, with a 50% share of the total market. Moody’s Corporation comes in second with 32%, and Fitch Ratings is a distant third with 12%.

Ratings companies play a crucial role for bond markets because they inform investors about the health of a company, its ability to repay its debts and the risk associated with holding that debt. This industry is incredibly difficult to break into, giving S&P Global a strong economic moat around its business.

The company’s profits fluctuate with the amount of credit extended by businesses and governments, which has been lackluster in recent years. In 2022, the Federal Reserve aggressively raised interest rates throughout the year to curb inflation, which had reached a year-over-year high. in four decades.

As a result, corporate debt sales fell and S&P Global’s core business struggled to generate growth. In 2022, its operating profit from its rating activity fell by 36%. Its data and analytics business, boosted by the acquisition of IHS Markit, took over and helped the company deliver strong results despite a challenging operating environment.

Income investors might not like its dividend yield

S&P Global’s long history of increasing its dividend payout is impressive. This is a testament to its business model and strong economic position, enabling it to generate stable cash flows over time.

Despite this, it’s not necessarily an impressive dividend stock if you want to generate significant income from your portfolio. Indeed, the stock’s yield is a modest 0.84% and is lower than the market as a whole. SPDR S&P 500 ETF Trust, which yields 1.27%. In other words, for every $10,000 invested in S&P Global stock, you would earn $84 in dividends per year.

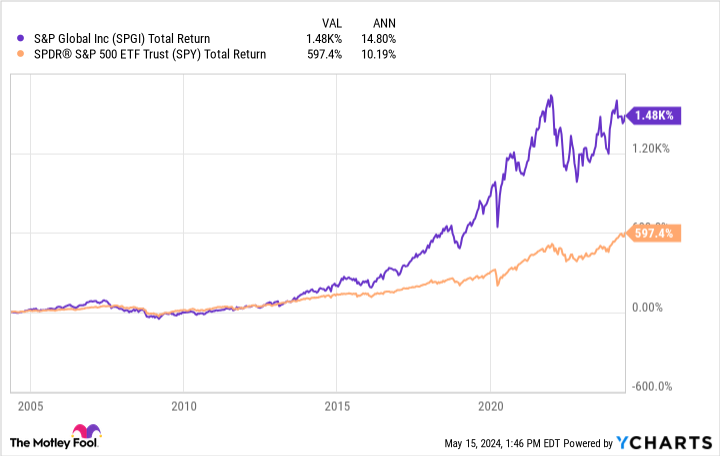

Although its dividend yield is modest, when combining its stock price performance with its dividend, S&P Global has been a solid performer for long-term investors. Over the past two decades, it has generated a total return (taking into account reinvested dividends) of 14.8% per year, exceeding the S&P500 index over this same period.

Is S&P Global Stock Right for You?

S&P Global is a solid stock that investors can hold for the long term. It has a strong economic base and excellent cash flow that supports its dividend payout, which has increased every year for five decades. Additionally, corporate sales recovered in the first quarter, which could be favorable to their businesses.

When deciding whether the stock is right for your portfolio, consider your investment objectives and goals. If the modest payout suits you, S&P Global is a solid player that can deliver a growing dividend and stock price appreciation over the long term.

However, if you want to generate significant income from dividend stocks, S&P Global may not be the stock for you. In that case, you might want to consider some of these higher-yielding alternatives.

Should you invest $1,000 in S&P Global right now?

Before buying S&P Global stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and S&P Global was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $579,803!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Moody’s and S&P Global. The Motley Fool has a disclosure policy.

Hey, income investors: This stock has increased its dividend for 52 consecutive years. Does it fit your wallet? was originally published by The Motley Fool