Discussions about renewable energy are no longer limited to solar and wind power. Nowadays, hydrogen is emerging as a popular alternative to diversifying the energy landscape. Therefore, for forward-looking investors, hydrogen stocks like Socket Power (NASDAQ: CAP) seem like interesting opportunities.

But Plug Power is far from being a wise investment. The company has been hemorrhaging cash continuously for years and is still far from profitable. Instead, investors would be better off padding their portfolios with other hydrogen names such as Air Some products (NYSE:APD), Bloom Energy (NYSE: BE)And Linde (NASDAQ:LIN).

1. Air products

Specializing in the production and distribution of industrial gases, Air Products is making concerted efforts to expand its hydrogen operations. In 2023, Air Products took a major step towards developing the world’s largest green (i.e. zero carbon emissions) hydrogen production plant in Saudi Arabia after finalizing financial arrangements for the $8.4 billion project. By 2026, Air Products expects the project to achieve daily hydrogen production of 600 tonnes.

In the United States, Air Products partners with AES to develop a $4 billion green hydrogen production facility in Texas. The state’s Lone Star facility, which is expected to begin commercial operations in 2027, will have a daily hydrogen production capacity of 200 tons and will be the largest facility of its type in the United States.

Unlike Plug Power, Air Products generates considerable organic cash flow. This makes the stock much more attractive to conservative investors who are uncomfortable with Plug Power’s constant need to raise capital through debt and equity financing. Additionally, Air Products is one of the top dividend stocks, offering investors an attractive yield of 2.7%. dividend yieldso shareholders can get paid while Air Products increases its hydrogen footprint.

2. Flowering Energy

More directly resembling Plug Power, Bloom Energy is also a leading fuel cell manufacturer. The two companies, however, contrast on one very important point: profitability. Bloom Energy has consistently generated a gross profit over the past five years. During this period, it averaged an annual gross profit of 16.2%. On the other hand, Plug Power recorded gross losses in 2021 and 2022, and its average annual gross margin is negative 109% from 2018 to 2022.

Further down the income statement, the difference between the two companies is even more apparent. When presenting its third quarter 2023 results, Bloom Energy reaffirmed its forecast that it would generate positive adjusted operating income for 2023. Plug Power did not provide such guidance, and it is quite possible that it will not fails to publish gross profit again. for 2023.

Of course, the discussion between Bloom Energy and Plug Power in terms of profitability doesn’t matter if Plug Power ends up going bankrupt – an issue management raised during the third quarter 2023 earnings presentation when it stated his lack of confidence in the company’s “ability to continue as a going concern.”

3. Linde

Like Air Products, Linde is a leader in the production and distribution of industrial gases and is also committed to advancing the development of the hydrogen economy.

More recently, Linde has expressed interest in a partnership with Equinor develop a blue hydrogen production plant in the Netherlands. The project is in the early stages of development and financial details have not been disclosed, but the facility is expected to have a daily production capacity of more than 575 metric tons.

As for the company’s U.S. operations, Linde recently expanded hydrogen production at a facility in Alabama to 30 metric tons per day, and is developing a blue hydrogen production facility in Texas that is expected begin operations in 2025.

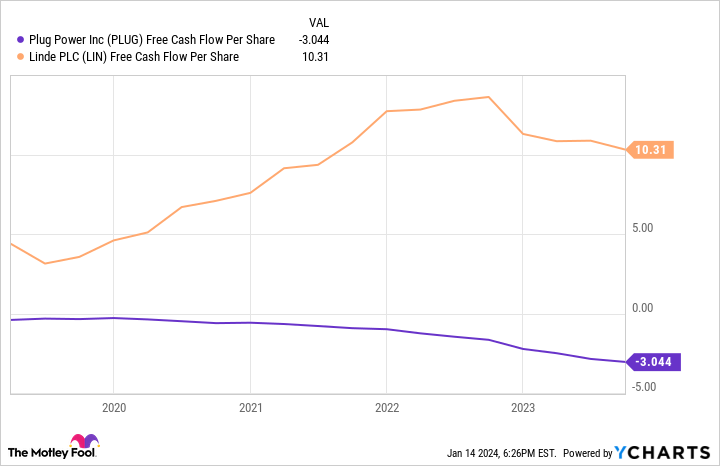

Financially, Linde is in a completely different league from Plug Power, particularly when it comes to its cash flow. Linde is a free cash flow machine, generating huge amounts of organic cash.

Given Plug Power’s inability to generate even a semblance of organic cash flow, it’s clear that Linde is a much wiser choice for risk-averse investors.

Which hydrogen-powered heavy-duty truck is best suited?

Plug Power may have a cult following, but its popularity belies the considerable risk surrounding the stock. Therefore, those who want to gain exposure to hydrogen but would like to do so with a more judicious approach would do well to stock their portfolios with Air Products and Linde – two industrial gas stalwarts that also offer stable passive income through their dividends.

Those interested in a more robust growth opportunity and comfortable with a higher degree of risk, however, would be better served by choosing Bloom Energy.

Should you invest $1,000 in Plug Power right now?

Before buying Plug Power stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Plug Power wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Scott Levine has no position in any of the stocks mentioned. The Motley Fool posts and recommends Linde. The Motley Fool recommends Equinor Asa. The Mad Motley has a disclosure policy.

Forget Power: Here Are 3 Obvious Hydrogen Stocks to Buy in 2024 was originally published by The Motley Fool