Billionaire hedge fund pioneer Paul Tudor Jones of Tudor Investment has reduced his stake in the chip giant Nvidia in the first quarter, no doubt making a nice profit on the sale. He then put that money into a new investment in a struggling fintech company. PayPal (NASDAQ:PYPL).

Jones wasn’t the only investor to make this move, as Philippe Laffont of Coatue Management made a similar move, reducing his stake in Nvidia while strengthening his position in PayPal. The investor, worth an estimated $6 billion, invested in PayPal stock, growing his holdings from 27,200 shares at the end of 2023 to more than 8 million shares at the end of March.

Let’s see what might have attracted these billionaires to PayPal and whether investors should follow their lead and buy back the shares.

Cheap stock

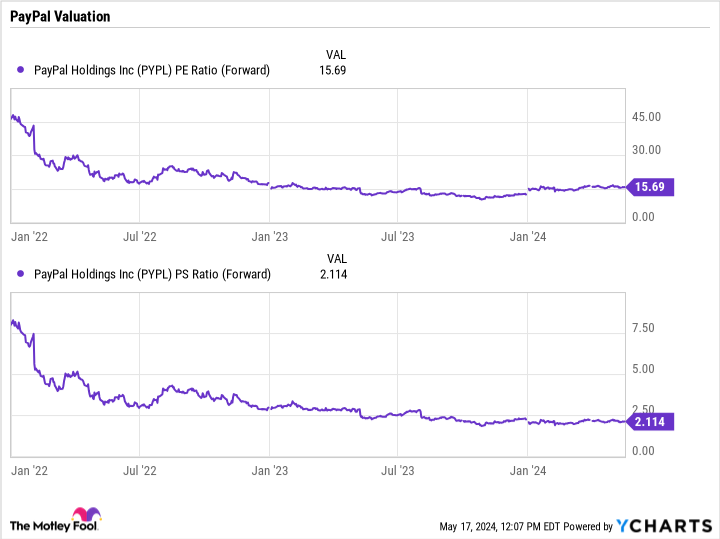

One of the first things that likely attracted Tutor Investment and Coatue Management to PayPal stock was its valuation. The stock has struggled in recent years, down more than 40% over the past five years.

Meanwhile, PayPal still solidly grew revenue; however, gross margin has been under some pressure over the past two years. Nonetheless, this left the shares at a very attractive valuation.

The company trades only at a forward price/earnings (P/E) ratio of just over 15.5 times and counting price-to-sales ratio (P/S) ratio close to 2 times. That doesn’t tell the whole story, as the company also has $8 billion in cash and net investments, including about $1.8 billion in equity investments. Excluding that, its forward P/E gets closer to 13.5 times.

That’s an inexpensive valuation, but a cheap stock alone isn’t a good enough reason to invest in PayPal.

An opportunity for recovery

The other big factor that likely attracted these billionaire investors to PayPal is CEO James Chriss and his plans to turn around the company and position it for the future. Chriss took the reins as CEO of PayPal last September, after leaving Intuition where he led the company’s small business and self-employed group.

He quickly established himself as a strong leader pushing PayPal to innovate. Since Chriss took over, the company has made a number of advancements based on artificial intelligence (AI). Perhaps the most interesting is its Fastlane product. This new payment solution allows a merchant’s customers to pay with just one click without having to create an account and provide credit card information with different merchants. Online retailers lose a significant portion of their business potential when consumers do not complete their purchases.

In early testing, PayPal merchants testing Fastlane saw an 80% increase in conversion rates. This is a big win for retailers and makes a product like Fastlane highly desirable. The company will begin rolling out the product nationally in the second half of the year.

PayPal has also introduced a number of other value-added solutions. It announced a few marketing-focused products, such as Smart Receipts and Advanced Offer Platforms, which will allow merchants to build personalized recommendations and personalize offers using data based on what customers purchased in the past, either on their own websites or across the world. the Internet. It also introduced a fraud management solution.

Through innovation, the company is also looking to change the pricing of its solutions. One of the problems PayPal has faced in recent years has been deteriorating gross margins as businesses have turned more to its low-margin, unbranded solution, BrainTree. Chriss believes that the value of PayPal solutions far exceeds that of competing offerings, so he plans to start pricing based on value. During PayPal’s first-quarter earnings call, Chriss said that while this process will take time, the company is already having conversations with its key customers about pricing and is focused on business results.

Is it time to buy the stocks?

PayPal is a cheap stock with a strong balance sheet that has continued to grow revenue solidly. Gross margins are an issue, but the company clearly has a plan in place to address this through innovation and value-based pricing.

It’s an attractive combination and is why the stock is starting to attract the attention of well-known billionaire investors. While there is always a risk that PayPal’s new products will not gain traction or that its pricing power will be limited, given its valuation, this seems a good opportunity to invest in the stock ahead of a possible recovery. As such, now is still a great time to buy fintech stocks.

Should you invest $1,000 in PayPal right now?

Before buying stock on PayPal, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and PayPal wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $566,624!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Geoffrey Seiler has positions at PayPal. The Motley Fool ranks and recommends Intuit, Nvidia, and PayPal. The Motley Fool recommends the following options: Short June 2024 calls at $67.50 on PayPal. The Motley Fool has a disclosure policy.

Forget Nvidia. Two billionaire investors just reduced their positions – and they both bought the same Fintech stocks. was originally published by The Motley Fool