There is no doubt that Nvidia (NASDAQ:NVDA) is currently the darling of tech investing, and for good reason. (Despite a recent dip, the stock is up 145% so far in 2024.) The company has cemented its position as the top chip supplier for artificial intelligence (AI) after having captured around 80% of the market. You can be sure that every other semiconductor company is eager to dethrone the king.

Advanced microsystems (NASDAQ:AMD) this is certainly the case. Longtime rival Nvidia is pouring money into developing a chip that can rival its nemesis’ latest offerings. Lisa Su, CEO of AMD, said during the recent unveiling of the company’s latest chips: “AI is our No. 1 priority.”

If AMD manages to rise to the top of the AI chip field, it could allow investors to benefit from the gains that Nvidia investors have enjoyed over the past two years. But that’s a big if.

Morgan Stanley Analyst Joseph Moore is among those who isn’t sure this will happen. He recently downgraded AMD, saying there is now “limited upside potential for AI.” Ouch.

This analyst believes that expectations might be too high for AMD, but it should be taken with a grain of salt.

Moore’s point isn’t that AMD doesn’t need to do anything. He believes the company will continue to have success in video game cards and will also be successful in AI, but not enough to overtake Nvidia.

This analyst’s main concern is that the market is setting expectations too high. The market is pricing AMD at a significant premium, banking on significant expansion of its AI chip business. The stock is trading with a current price/earnings ratio around 230. Moving to the forward P/E using the estimates, the valuation is closer to that of Nvdia around 47.

But remember that analysts are not always right. In fact, they are often wrong. For every bear you’ll find a bull, and one of them will end up being wrong, right? It’s best to look at the arguments themselves and form your own opinion.

Also keep in mind that analysts adjust their ratings and price targets quite often, usually by focusing on a shorter investment horizon than individual investors should consider. Even if AMD fails to meet Wall Street’s expectations in the next quarter, its long-term prospects may remain attractive.

AMD still has a lot to prove and will struggle to topple Nvidia

I’m inclined to agree with Moore’s main point, which is that Nvidia will remain the leader in AI for the foreseeable future.

The difficulty AMD has in replicating what Nvidia is doing is enormous. Remember his expectations for AI chip sales for 2024? 4 billion dollars. Nvidia sold about $34 billion last year. That’s a long way to go.

If AMD wants to compete, it needs to offer something at least comparable to Nvidia, but it’s an uphill battle when you’re outpaced by such a large margin in research and development (R&D). Nvidia spent $2.7 billion on R&D last quarter, compared to AMD’s $1.5 billion.

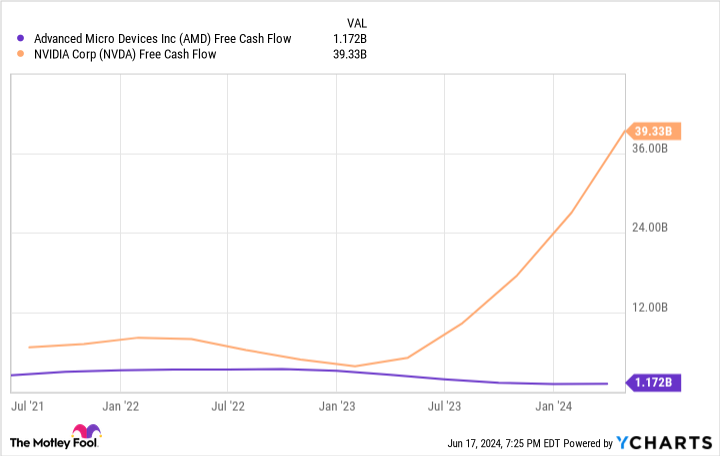

AMD, whose spending is already almost 2 to 1, also does not have the flexibility to increase this budget line like Nvidia does. Look at this chart showing the difference in free cash flow (FCF) between the two companies. FCF is a company’s income after subtracting operating expenses and capital expenditures.

Nvidia could, if it wanted, spend almost $40 billion on R&D, leaving AMD in the dust. That’s a pretty powerful position to be in.

This isn’t to say that I think AMD is a bad investment; quite the contrary. The AI market has the potential to be so large that it is not a zero-sum game. Both AMD and Nvidia can succeed. However, I think Nvidia is the better long term investment.

It has enough resources to defend its pole position. And, in my opinion, given the vision that Nvidia executives have already demonstrated, Nvidia will use these vast resources not only to defend itself, but also to expand and grow its business in ways that we cannot yet anticipate .

Should you invest $1,000 in advanced micro devices right now?

Before buying Advanced Micro Devices stock, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what it believes to be the 10 best stocks for investors to buy now… and Advanced Micro Devices was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $723,729!*

Securities Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Stock Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Forget AMD: Nvidia is still the king, according to a Wall Street analyst. What does this mean for investors? was originally published by The Motley Fool