(Bloomberg) — Inflation gauges favored by the Federal Reserve are on track to post the most moderate monthly advances since late last year — a springboard for officials to start lowering interest rates , perhaps as early as September.

Most read on Bloomberg

Economists expect no change in May’s personal consumption expenditures price index and a minimal gain of 0.1% in the core measure that excludes food and energy, based median projections from a Bloomberg survey of economists.

The report, due Friday, is also expected to show annual advances of 2.6% in overall and fundamental indicators. The expected increase in the underlying measure, which gives a better idea of core inflation, would remain the smallest since March 2021.

Since their last meeting, Fed officials have said that while they were encouraged by the decline in other inflation data – including the Consumer Price Index – they needed to see months such progress before lowering rates.

At the same time, the labor market – the other part of the Fed’s dual mandate – continues to grow, albeit at a slower pace. A healthy labor market gives policymakers some flexibility on the timing of interest rate cuts.

The latest inflation figures will be accompanied by personal spending figures which will provide insight into spending on services after recent retail sales data showed less appetite for goods. The median forecast predicts a slight acceleration in nominal personal consumption as well as income.

What Bloomberg Economics says:

“We do not believe that the slowdown in inflation will be enough to convince policymakers, between now and the July FOMC meeting, that inflation is on a firm path toward the Fed’s 2% target.”

—Estelle Ou, Stuart Paul and Eliza Winger, economists. For a full analysis, click here

Other data in the coming week include June consumer confidence figures and May contract signing reports for new and used home purchases. In addition to the third estimate of economic growth for the first quarter, the government will publish durable goods order figures for May.

In Canada, central bank governor Tiff Macklem is expected to speak in Winnipeg, consumer price data for May is expected to show underlying inflation slowing for a fifth month, and the release of the gross domestic product for April as well as a flash estimate for May will also provide crucial insight.

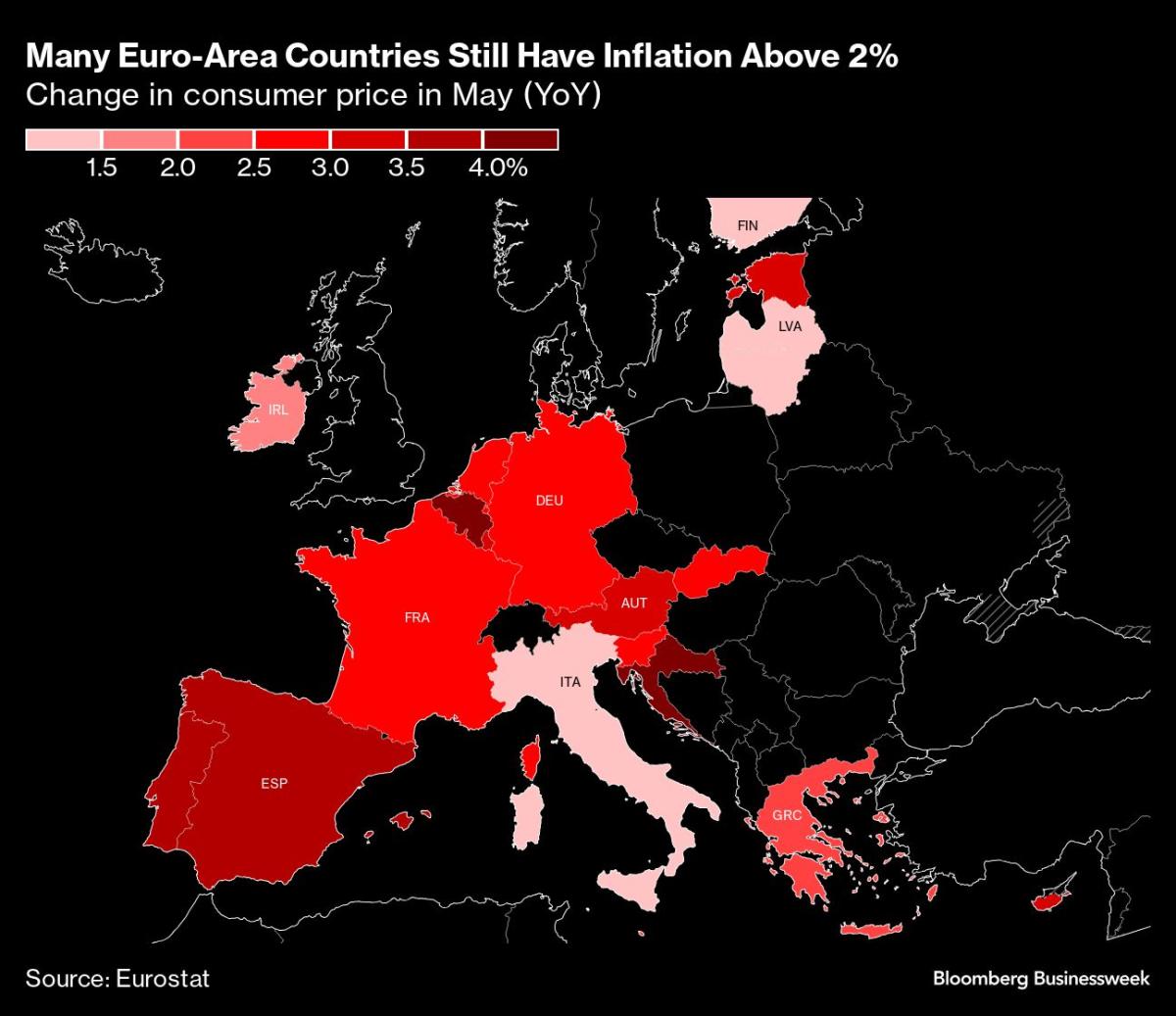

Elsewhere, inflation figures in three major euro zone economies could also encourage officials, while the central banks of Sweden and Mexico are likely to keep rates unchanged.

Click here to find out what happened last week and below you’ll find our summary of what’s happening in the global economy.

Asia

Asia kicks off with the release of the minutes of this month’s Bank of Japan board meeting.

The document is attracting increased interest after authorities pledged to reduce bond purchases, while specifying that investors will have to wait until the end of July before getting details on the scale of the reductions. Clues could emerge on Monday.

Separately, Reserve Bank of Australia Deputy Governor Christopher Kent spoke on Wednesday, and Deputy Governor Andrew Hauser a day later, with emphasis on any further hints of hawkishness after the governor said the board was considering a hike at its meeting this month.

They are speaking out after data on Wednesday was expected to show Australian inflation rose in May.

Japan will see a leading indicator of domestic inflation trends with the release of the Tokyo CPI for June. Bloomberg Economics expects inflation in the capital to have risen to 2.1%, driven by an increase in utility prices after the government cut energy subsidies.

Other countries releasing pricing updates include Malaysia, Singapore, and Uzbekistan.

Separately, China’s industrial profits on Thursday may reflect the benefits of an official push for equipment upgrades, and trade data are due this week from New Zealand, Vietnam, Sri Lanka, Thailand and in Hong Kong.

South Korea has two indicators indicating domestic demand: retail sales and consumer confidence.

Europe, Middle East, Africa

The Riksbank’s decision on Thursday will be a highlight, with economists widely expecting Swedish officials to pause their easing cycle after an initial rate cut last month – presaging a similar move planned for the bank to remain in place European center in July.

As policymakers become increasingly convinced that Sweden is on the verge of bringing inflation under control, they could ratify two more cuts this year to support an economy that European Union officials say is expected to experience the one of the weakest expansions of the entire block.

Here’s a quick overview of other central bank decisions in the wider region:

On Wednesday, Zimbabwe is expected to cut its policy rate for the first time since it introduced a new currency, ZiG, in April to combat deflation.

Czech policymakers could cut borrowing costs by 25 or 50 basis points on Thursday, but would not go so far as to claim inflation has been defeated.

On the same day, Turkey’s central bank will likely keep its benchmark rate at 50% as it waits for consumer price growth to slow from last month’s 75% figure. Officials are confident that borrowing costs will begin to fall significantly in the second half of the year.

In the eurozone, inflation data in three of the four largest economies will arrive towards the end of the week. Reports are expected to show a slowdown in France and Spain, with price growth remaining weak in Italy.

The figures could be encouraging for officials after last month’s setback, when inflation accelerated more than expected in the region. The ECB’s survey on consumer price expectations will also be published on Friday.

Other reports include the Ifo German Business Confidence Index released on Monday, which is expected to show further gradual improvement in business confidence in the region’s largest economy.

Policymakers expected to speak include Bank of France Governor François Villeroy de Galhau, whose economy is facing intense investor scrutiny ahead of upcoming legislative elections. Appearances by ECB chief economist Philip Lane and heads of the German and Italian central banks are also on the agenda.

In the UK, meanwhile, Bank of England officials – whose June 20 decision moves closer to a possible August rate cut – will continue to avoid public communications ahead of the July 4 general election . The data includes the final GDP release for the first quarter on Friday, including current account figures.

Turning to Africa, Zambia’s growth statistics for the first three months of 2024, due Thursday, could reveal some of the impact of a devastating drought. The dry spell is expected to reduce expansion to 2.5% this year, from 5.2% in 2023.

The following day, Kenyan June inflation will provide a further indication of the impact of floods and heavy rains on food prices in that country.

Latin America

Mexico’s central bank gets its final consumer price reading Monday ahead of Thursday’s monetary policy decision, and the data likely won’t leave Banco de Mexico completely impressed. With inflation heating up again and drifting above target again, Banxico is almost certain to keep the rate at 11% for a second meeting.

The central bank is at the center of attention in Brazil as it publishes the minutes of its June 18-19 monetary policy meeting on Tuesday and its quarterly inflation report on Thursday. In between is the mid-month reading of the benchmark consumer price index.

Maintaining the key rate at 10.5% was not a surprise, although the relatively mild tone of the post-decision statement raised some eyebrows.

Argentina’s economy likely fell into a technical recession in early 2024, with deep quarter-over-quarter and year-over-year declines. Analysts polled by Bloomberg forecast a fall of 5.4% year-on-year, the biggest drop since the pandemic.

With many of the region’s other major inflation-targeting central banks either marginalized or increasingly hawkish, Colombia’s BanRep is expected to cut half a point to 11.25% — 200 basis points lower than last year’s peak of 13.25% — and is on track to end inflation. 2024 at 8.5%.

–With help from Brian Fowler, Robert Jameson, Laura Dhillon Kane, Piotr Skolimowski, Monique Vanek and Paul Wallace.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP