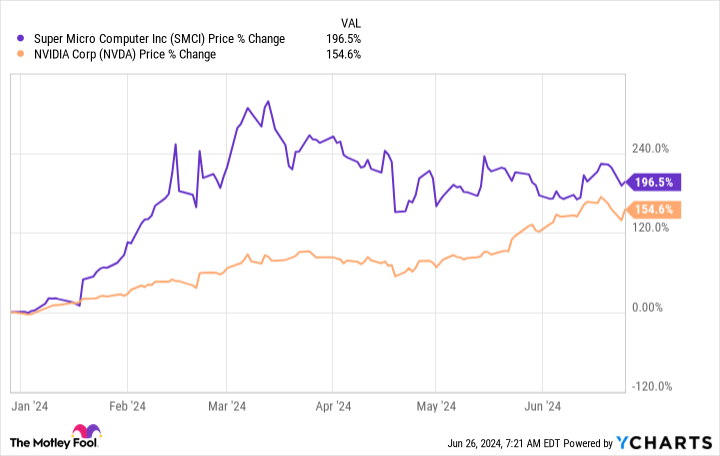

Super microcomputer (NASDAQ: SMCI) was one of the biggest artificial intelligence (AI) investments of the year, surging more than 300% between the start of the year and mid-March. Since then, the stock is down about 30% and has remained fairly stable since late March.

So should investors be interested in an AI stock that has been successful but has been dormant for a while? After all, it was one of the best-performing stocks on the market earlier this year.

Supermicro is operating in a much more competitive space than Nvidia

Super Micro Computer (often referred to as Supermicro) makes servers and data center components. This industry is clearly benefiting from the AI arms race, which is essentially the same trend that is driving Nvidia upper. As a result, investors saw this as a second chance to get into Nvidia after missing out on the move in 2023 (even though Nvidia is up over 150% in 2024 so far).

If you had this idea on New Year’s Day and put it into practice the next trading day, you’d still beat Nvidia. But with Nvidia’s steady rise, that might not last long.

But why has Supermicro stagnated for so long? This is largely due to high expectations. After Nvidia posted several consecutive quarters of revenue tripling, investors expected Supermicro to report similar numbers, as it is affected by the same trend.

However, this is a flawed analysis, as the industry that Supermicro competes in is much more competitive. With competition from big hitters like Dell And Hewlett PackardSupermicro has its work cut out for it. The main differentiator for Supermicro is the customization of its servers, which can be adapted to any workload or size.

This still makes Supermicro a top choice in the field, but it doesn’t make it the cheapest.

Another factor behind Supermicro’s relatively slower growth is that larger customers may build some of their servers in-house. While they still source components from Supermicro, it’s not the same as if they bought everything from the company.

With all these factors falling short of incredibly high expectations, reality has set in and investors have sold stocks off their highs. But have they gone too far?

The stock is still highly valued

In its earnings report for the third fiscal quarter of 2024, ending March 31, management reiterated its long-term goal of generating $25 billion in annual revenue. Given its fiscal 2024 revenue forecast of $14.7 billion to $15.1 billion, Supermicro still has a ways to go.

What if this goal was achieved?

If Supermicro could generate $25 billion in annual revenue at its current profit margin (10.5%), then it would produce a hypothetical annual profit of $2.63 billion.

Now, if we divide its current market capitalization by this earnings figure, we would obtain its price/earnings (P/E) valuation. This calculation gives a P/E of 18.8, which is not a bad price for a stock. At Supermicro’s peak in mid-March, this calculation gave a P/E of 25.6, which is much higher.

So, is this a price worth paying? I would say no. For this projection to hold up, everything has to go well and be sustainable. Any deviation to the downside renders this analysis null and void and would make it a bad investment. With so little margin for error, I would pass on Supermicro stock, even if the company can continue to succeed.

Should You Invest $1,000 in Super Micro Computer Right Now?

Before you buy Super Micro Computer stock, consider the following:

THE Motley Fool, securities advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors should buy now…and Super Micro Computer wasn’t one of them. The 10 stocks we picked could deliver monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005…if you invested $1,000 at the time of our recommendation, you would have $757,001!*

Securities Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Down 30% from its all-time high, should you buy an artificial intelligence (AI) superstar super microcomputer? was originally published by The Motley Fool