There’s a bit more uncertainty in the markets these days. Inflation has remained stubbornly persistent, calling into question when the Federal Reserve will cut interest rates. Add to that growing tensions in the Middle East and the upcoming U.S. presidential election, and we could be entering more turbulent economic times.

Investors looking for a safety net during turbulent times have many options. Pipeline companies Enbridge (NYSE:ENB), Williams (NYSE:WMB)And Enterprise Product Partners (NYSE:EPD) stand out from some Fool.com contributors in their ability to provide safe dividends to their investors regardless of market conditions. Here’s Why They Believe They’re High Energy dividend stocks buy in the current context of uncertainty.

Enbridge simply charges tolls

Ruben Gregg Brewer (Enbridge): The big problem with oil and natural gas stocks is the huge impact that commodity prices have on the sector. But there is a niche that avoids the inherent ups and downs. That’s where you’ll find Canadian midstream giant Enbridge and its huge dividend yield of around 8%.

The bottom line is that the midstream sector is made up of energy infrastructure such as pipelines, storage and transportation assets. This infrastructure is large and expensive to build, but once in place, it becomes vital for both upstream (energy producers) and downstream (chemicals and refining) companies. They are happy to pay companies like Enbridge regular, reliable fees for the use of their assets, which allows oil, natural gas, and the products they are processed into to be easily transported around the world. Notably, Enbridge is one of the largest midstream companies in North America.

Although energy prices can fluctuate wildly, energy demand, which drives demand for Enbridge’s midstream assets, tends to be very stable over time. After all, energy is the foundation on which modern society is built. So, oil and natural gas prices are not very important to Enbridge’s ability to pay dividends. In this regard, Enbridge, an investment grade company, has increased its dividend every year for 29 consecutive years, and its distributable cash flow payout ratio of 65% is right in the middle of its target range. If you’re looking for dividend stocks in the energy sector, Enbridge should be able to continue to reward you well regardless of the turbulence in the sector.

The fuel to grow your dividend

Matt DiLallo (Williams): Williams has proven that it can provide a reliable dividend in a variety of market conditions. The gas pipeline giant has paid dividends for 50 consecutive years. Even if the company did not increase its payment every year, it has continued to increase over the decades. Williams has generated 6% compound annual dividend growth since 2018.

The natural gas infrastructure giant is currently yielding 5%, well above the S&P500 index dividend yield of 1.4%. This monster payment is activated an extremely firm foundation. Williams generates very stable cash flow supported by long-term contracts and government-regulated pricing structures (it has delivered 32 consecutive quarters of profits meeting or beating consensus estimates). The company produced enough cash to cover its dividend 2.4 times last year. This allowed it to conserve cash to finance expansion projects and strengthen its balance sheet. It is leverage ratio was 3.6 times at the end of last year, an improvement of 25% from the 2018 level.

From the company strong after dividend free cash flow and balance sheet capacity give it a lot of flexibility to finance expansion opportunities. Williams invests in 20 high-yield expansion projects to expand its natural gas transportation business, gathering and processing capacity, and operations in the Gulf of Mexico. Projects currently under construction will drive earnings growth through at least 2027. The company has more than 30 additional projects under development that could extend its growth prospects into the next decade. The natural gas infrastructure company expects annual earnings growth of 5% to 7% over the long term.

Williams regularly supplements its organic growth with acquisitions. He earned $6.1 billion of acquisitions since 2021 to enrich its portfolio and its growth profile. It has significant financial flexibility to continue to make accretive acquisitions as opportunities arise.

With a strong financial position and visible growth on the horizon, Williams stands out as a very safe energy stock to hold during turbulent times.

A constantly increasing high-yield payment

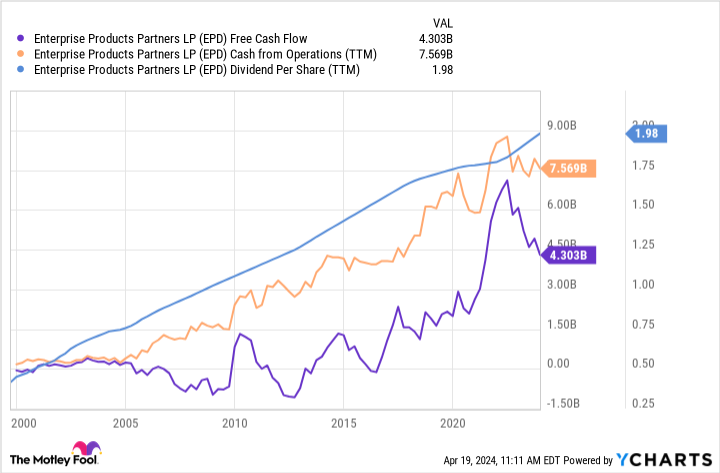

Néha Chamaria (Enterprise Product Partners): No oil and gas stock is immune to the volatility of oil and gas prices, but some can still thrive and reward their shareholders with higher dividends, even during turbulent times. Enterprise Products Partners is one such stock, and its track record is proof of the reliability and stability of its dividend: its cash flow has only increased over time and the company has increased its dividend each year for 25 consecutive years.

Enterprise Products’ business model is of course a big factor behind its dividend reliability. As a midstream energy infrastructure company, Enterprise Products provides services such as storage and transportation of natural gas, natural gas liquids, crude oil, refined products and petrochemicals to producers and consumers under long-term paid contracts. This means that the company receives compensation for these services regardless of the oil and gas price situation, which is why its cash flows are stable and can support dividends at any time.

Enterprise Products is currently in good health, having generated $7.5 billion in distributable cash flow in 2023, which could comfortably cover its dividends by 1.7 times. Simply put, the company has enough cash to cover and grow its dividends. Enterprise Products entered 2024 with $6.8 billion in organic projects under construction, including two natural gas processing plants in the Permian Basin that are expected to be completed this year and are expected to begin growing the company’s cash flow. the company. With Enterprise Products focused on growing its cash flow and committing to returning capital to shareholders, the 7.2% yielding stock is an obvious energy dividend stock to hold during turbulent times.

Should you invest $1,000 in Enbridge right now?

Before buying Enbridge stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Enbridge was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $518,784!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 15, 2024

Matt DiLallo holds positions at Enbridge and Enterprise Products Partners. Néha Chamaria has no position in any of the stocks mentioned. Ruben Gregg Brewer holds positions at Enbridge. The Motley Fool has positions with and recommends Enbridge. The Motley Fool recommends Enterprise Products Partners. The Mad Motley has a disclosure policy.

3 safe energy dividends in turbulent times was originally published by The Motley Fool