Major cryptocurrency stocks have fallen as much as 20% in the past 24 hours as moves from a Mt. Gox-linked wallet spooked traders in the early hours of the Asian day, sending the market down an average of 10%.

Bitcoin {(BTC}} fell 8% to briefly drop below $54,000 before recovering slightly, in a move that erased all gains since February. Ether {{ETH}} fell more than 10%, Solana’s SOL and Cardano’s ADA fell 8%, while dogecoin {{DOGE}} plunged nearly 18%.

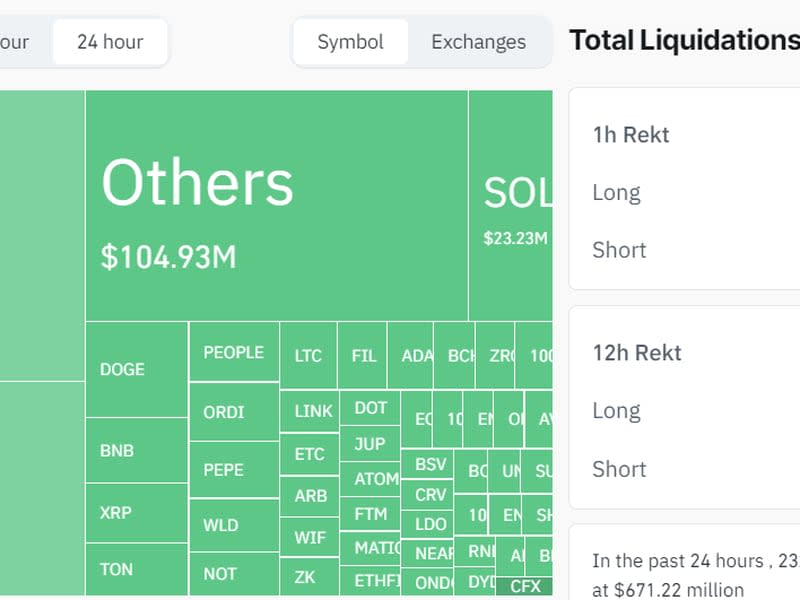

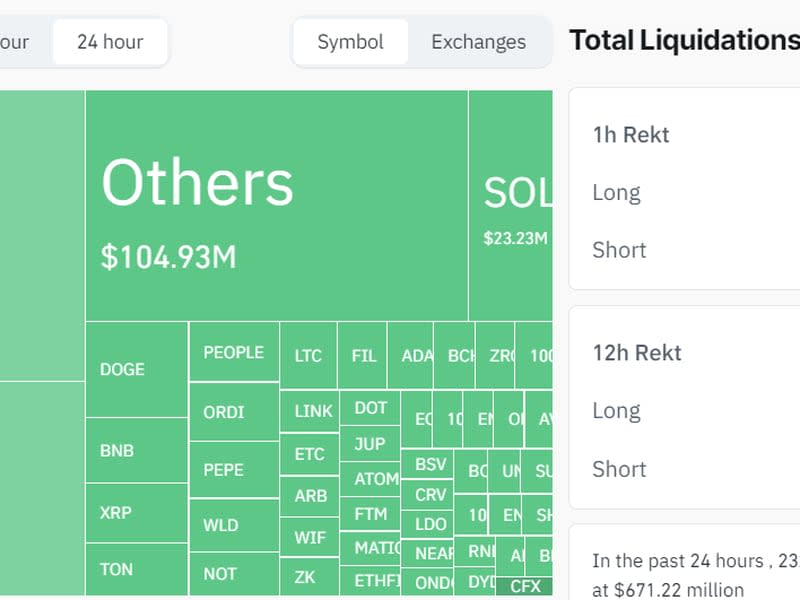

Coinalyze data shows that this led to more than $580 million in liquidations tied to long positions, or bets on higher prices, in one of the largest such events so far this year. Bullish bets on bitcoin and ether together saw more than $380 million in losses.

The largest liquidation order was made on Binance, an ETH transaction valued at $18.4 million. At the same time, open interest, or the number of unsettled futures bets, fell by 12%, indicating that money was leaving the market.

Liquidations occur when an exchange forcibly closes a trader’s leveraged position due to a partial or complete loss of the trader’s initial margin. This occurs when a trader cannot meet the margin requirements for a leveraged position (does not have sufficient funds to keep the trade open).

The moves come as defunct exchange Mt. Gox has moved significant amounts of BTC to a new wallet, potentially prepare for creditor repaymentsMt. Gox is set to begin distributing assets stolen from its customers in a 2014 hack this month, after years of delays. The repayments will be made in bitcoin and bitcoin cash, and could potentially add selling pressure to both markets as Previously reported.

Trading firm QCP Capital said in a Telegram broadcast on Thursday that it expects a gloomy market in the coming months: “We expect a subdued third quarter for BTC as the market remains uncertain about the supply coming from the Mt. Gox exit.”