Chipotle Mexican Grill (NYSE:CMG) is doing something it has never done before in its 30-year history. The company is splitting its stock, with the operation planned for this week. The move came after shares soared by triple digits over the past few years, surpassing $2,000 last year and $3,000 this year.

The reason for these huge gains? This fast-casual restaurant has seen growth quarter after quarter – excelling even at the start of the pandemic thanks to its digital ordering system – and has built a brand that keeps customers coming back. Now, the stock split will lower the price per share of this high-flying stock, making it more accessible to a wide range of investors.

Let’s see what to expect – and see if this restaurant giant is a buy.

Why initiate a stock split?

First, a few points about stock splits in general. These transactions involve issuing more shares to existing shareholders to lower the price of each individual share. They are purely mechanical and do not change the market value of a company, the value of your holding or the valuation of shares. This means that they do not serve as a catalyst for stock performance: investors will not rush to buy a stock just because a stock split is announced.

That said, a stock split is generally positive for a company over time because it allows investors who want to make a small purchase to do so without relying on fractional shares. And these operations also suggest that a company is optimistic about its future, with the idea that the stock, from its new level, can take off again.

The new stock price is determined by the split ratio, which brings me to the topic of the Chipotle deal. In one of the largest stock splits in the history of the New York Stock Exchange, Chipotle will offer current holders 49 shares for every share they own. Shareholders will receive the shares after the market closes on June 25, and the shares will begin trading on an adjusted basis when the market opens on June 26.

Given Chipotle’s current price – around $3,214 – the price after this 50-for-1 stock split will be around $64.

Although the peak day to benefit from the split was June 18, if you purchase the shares before the split ends, don’t worry: the right to the additional shares transfers to you from the seller when you make the purchase.

Chipotle Profit Growth

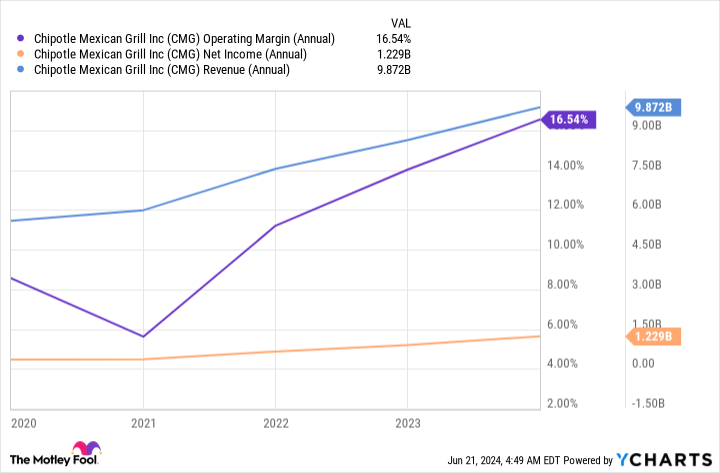

So, by mid-week, Chipotle’s price per share will make it easier to buy the stock, but otherwise the investment opportunity will remain the same as before the stock split. Now let’s see if this high-end restaurant stock is a buy. No one can say that Chipotle hasn’t been successful in growing profits and expanding margins – over time, the company has done well.

GCM operating margin (annual) data by Y Charts

And all this was achieved in expansion. Last year, Chipotle opened 271 new restaurants, and more than 85% of them have a digital order pickup window called Chipotlane. This keeps the company on track to reach its long-term goal of 7,000 restaurants in North America, more than double the current number. Chipotle also aims to reach $4 million in average unit volumes (AUV), or the average sales generated by each location, up from about $3 million currently.

Meanwhile, Chipotle customers are coming back thanks to the restaurant’s promise of fresh, healthy produce and its focused menu. This helped the company post double-digit revenue growth to $2.7 billion in the most recent quarter, as well as gains in earnings per share and operating margin.

The problem of valuation

This all sounds fantastic, but the only problem with Chipotle is its valuation. The company trades at 57x forward earnings estimates, well outpacing valuations of McDonalds And Yum! Brands. They trade around 20x. I would expect Chipotle to trade at a premium to these fast food giants – but not to this degree.

So, is this stock split a buy? It depends on your investing style. Chipotle’s business has proven its strength over time and the company has room to expand in North America and even internationally. This could increase profits in the future.

For long-term, growth-oriented investors, Chipotle stock could still generate solid returns, so you might consider opening a small position in the restaurant giant to diversify your portfolio – the post-split price gives you the possibility of doing it more easily. But given the stock’s high valuation, value investors might find more attractive opportunities elsewhere.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before buying Chipotle Mexican Grill stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Chipotle Mexican Grill wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $775,568!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool posts and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Chipotle’s stock split is happening this week. Here’s what to expect. was originally published by The Motley Fool