Nvidia (NASDAQ:NVDA) has become the hottest player in the field of artificial intelligence (AI). Its cutting-edge graphics processing units (GPUs) are the most important piece of hardware in servers that run advanced AI applications.

In the category of particularly high-margin GPUs designed to run AI and other accelerated computing applications, Nvidia currently controls about 90% of the market. While competitors, notably Advanced microsystems And Intelare taking steps to expand their capabilities in the ultra-high-performance GPU space, many analysts expect Nvidia to maintain its incredible strength in the category.

With incredible performance behind it and management guiding further explosive growth, Nvidia stock is up 240% over the past year and is up 82% so far in 2024.

These gains pushed Nvidia’s market capitalization to around $2.27 trillion. It now ranks as the third most valuable company in the world and the third largest member of the “Magnificent Seven“. Applecurrently in second place, has a market capitalization of $2.65 trillion, while leader Microsoft is valued at around $3.12 trillion.

Could Nvidia soon become the most valuable company in the world?

The most influential player in AI is reaping the rewards

Starting in late 2022, incredible advancements in artificial intelligence technologies began to emerge at a rapid pace. This progress accelerated significantly in 2023 and has shown no signs of slowing down this year.

As companies and institutions have taken steps to expose themselves to AI space, demand has soared for Nvidia’s most advanced processors. Its sales and profits exploded.

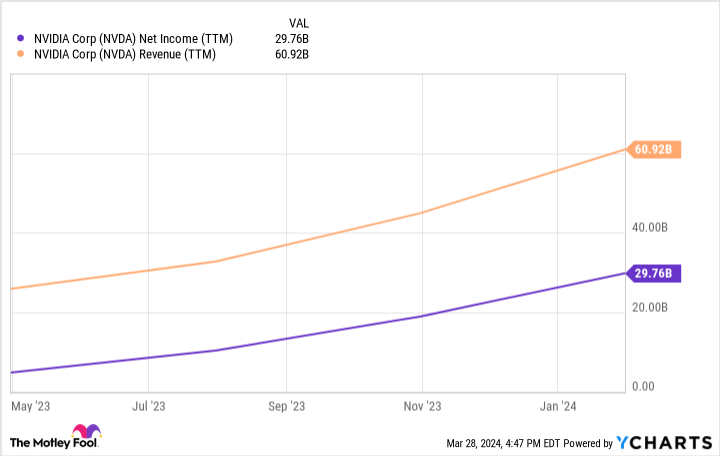

In the fourth quarter of last year, the company’s sales increased 265% year-over-year to $22.16 billion. Thanks to a dramatic acceleration in performance in the second half of 2023, Nvidia’s annual sales increased 126% to $60.9 billion.

Nvidia reported a net profit of $29.76 billion last year, or 49% of its total revenue. That’s an incredible net profit margin for a hardware-focused company; these often have lower margins than software-oriented businesses due to the higher additional costs associated with producing physical goods.

But the company’s incredible margins reflect just how in-demand its GPUs are right now. It’s reasonable to expect Nvidia’s incredible growth to slow, but the company appears poised to grow at a much faster rate than Apple and Microsoft for the next few years at least.

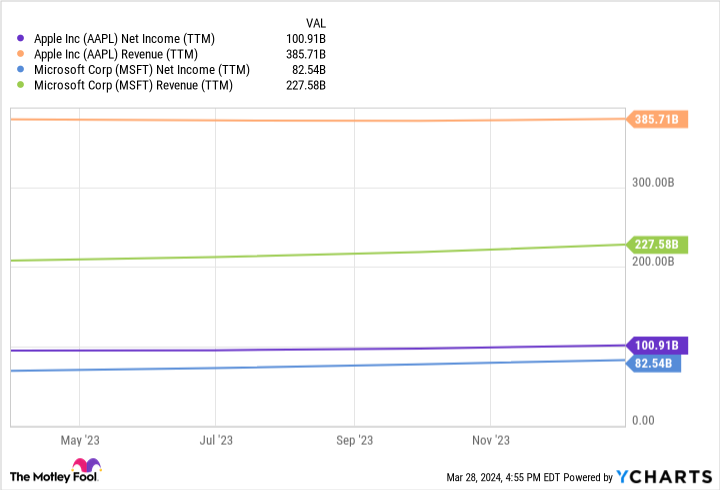

Apple and Microsoft still generate far more revenue and net income than Nvidia. On the other hand, the chip giant appears well-positioned to continue to be the biggest winner of the AI revolution and has grown much faster than the biggest tech giants.

For comparison, Microsoft grew its sales by about 10% over the past 12 months and increased its net income by 20%. Meanwhile, Apple’s revenue remained flat over this period, although its net profit increased 7%.

If demand for AI services continues to increase dramatically, there is a good chance that Nvidia will surpass Apple’s market capitalization and take the title of world’s most valuable company ahead of Microsoft in the next five years. Although the GPU leader’s business has always been shaped by cyclical trends, it still appears to be starting to benefit from the ongoing AI revolution.

Right now, Nvidia is benefiting from the emergence of unprecedented new technology, which means predicting its performance over the next five years involves a heavy dose of speculation. But given its incredible sales and profit momentum and the market’s general enthusiasm for artificial intelligence applications, it wouldn’t be shocking to see Nvidia claim the title of the world’s most valuable company.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns March 25, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Advanced Micro Devices, Apple, Microsoft and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short 405 calls $ in January 2026 on Microsoft and short $47 calls in May 2024. Intel. The Motley Fool has a disclosure policy.

Will artificial intelligence (AI) allow Nvidia to crush Apple and Microsoft and become the most valuable ‘Magnificent Seven’ stock? was originally published by The Motley Fool