Oil prices have been volatile over the past 12 months. WTI, the U.S. benchmark, peaked at over $90 in late September and fell just below $70 in December. It is currently at $82 a barrel, a high price that is a boon for an industry that is also generating record production. The IEA projects that by 2030, U.S. crude production will increase by 2.1 million barrels per day from last year’s baseline.

Additionally, the high energy demand environment, particularly as the summer driving season intensifies, creates a favorable scenario for investment in energy actionsStock prices have fallen in line with the decline in crude oil prices, offering investors an opportunity to invest in a sector with attractive valuations and solid short-term prospects.

Stephens analyst Michael Scialla therefore recommends energy stocks. He sees solid upside potential, up to about 46% in one case, for two names in particular. We used the TipRanks Platform to see the broader analysis of Scialla’s choices. Here they are, accompanied by the analyst’s comments.

SM Energy Company (SM)

The first stock on our list is SM Energy, an independent oil and gas exploration and production company. The Denver, Colorado-based company has over a century of history and focuses on acquiring and developing high-quality energy assets in the lower 48 states. SM’s primary operating assets are currently in Texas, where it holds a net position of approximately 111,000 acres in the famous Midland Basin in the western part of the state and an additional approximately 155,000 acres in the Eagle Ford and Austin Chalk formations to the south. SM’s assets include crude oil, natural gas, and natural gas liquids.

SM’s holdings are not the largest compared to its peers, but the company has focused on acquiring top-tier assets, with the aim of maximizing value by applying the latest hydrocarbon extraction technologies. The company had 1,323 net producing wells at the end of 2023, generating an average net production of 152 MMboe/d. SM’s proved reserves, at the end of last year, were approximately 605 MMboe. These reserves were distributed as follows: 38% crude oil, 42% natural gas and 20% natural gas liquids.

In its latest quarterly results, released for the first quarter of 2024, SM reported total revenue of $559.9 million. That was down 2.4% from the prior year, but it beat expectations by just over $3.2 million. Ultimately, the company’s non-GAAP earnings came in at $1.41 per share. Not only did that beat expectations by 13 cents per share, it was up from $1.33 in the prior year quarter.

SM’s success in developing high-end production numbers from its assets was the catalyst that caught analyst Scialla’s attention. The Stephens energy expert writes of the company: “A pioneer in identifying and developing key assets in areas the industry previously considered non-core, SM offers investors differentiated option value by expanding the resource boundaries in the Midland Basin and South Texas. SM’s Rockstar acreage in Howard County, which was supposed to be located east of the Midland Basin core when the company acquired it in 2016 and 2017, has spawned some of the region’s most prolific oil producers over the past 5 years.”

The analyst goes on to outline the company’s strong return potential going forward, saying: “With approximately 40% of the production mix in the form of natural gas and over 85% of projected production for next year unhedged, SM is significantly exposed to a potential rebound in natural gas prices in 2025. Additionally, an underleveraged balance sheet positions the company to enhance returns for investors, in our view.”

For Scialla, this position supports an Overweight (Buy) rating on SM, complemented by a $63 price target suggesting a 46% one-year upside potential. (To follow Scialla’s track record, Click here)

Overall, SM Energy gets a Moderate Buy consensus rating from the exchange, based on 12 recent analyst reviews that include 7 Buys and 5 Holds. The stock is listed at $43.23 and its average price target of $58.58 implies a gain of 35.5% over the next 12 months. (See SM Stock Market Forecast)

Matador Resources Company (MTDR)

The second company we’ll look at, Matador Resources, is another player in the oil and gas exploration and production sector. Matador acquires energy assets in the United States, with a particular focus on oil shale and natural gas plays (the same plays that brought us the fracking revolution earlier this century) as well as other unconventional energy fields. Currently, Matador has active operations in three main areas: the Wolfcamp and Bone Spring plays in the Delaware Basin that straddle the New Mexico-West Texas border; the Eagle Ford shale play in South Texas; and the Haynesville shale and Cotton Valley energy fields in northwest Louisiana.

As part of its business strategy, Matador has focused on unconventional energy projects, using high-yield methods to maximize the extraction of hydrocarbon resources from these assets. In addition to operational efficiency, Matador follows rigorous financial practices to maintain a strong balance sheet to ensure that equity and debt capital serve the broader objective of profitable operations.

Matador’s operational execution exceeded the upper end of the company’s Q1 2024 guidance. Total production was reported at 149,760 boe per day, compared to a maximum guidance of 146,500 boe/d. Of this total, 84,777 barrels per day were produced by oil and 389.9 MMcf per day by natural gas. Oil and gas guidance was 84,000 and 375 at the upper ends.

The production forecast beat led to a revenue and profit beat. Matador’s revenue was $787.7 million, more than $46 million above estimates – and more than 40% better than the prior-year figure. Matador reported non-GAAP earnings per share of $1.71, up from $1.50 in the first quarter of 2023 and 18 cents per share above expectations.

In his coverage of Matador, Scialla likes the company’s strategy, particularly how it targets robust production from low operating costs. He says: “A pioneer in the Northern Delaware Basin, MTDR offers investors differentiated organic growth from a robust, low-cost drilling inventory. We expect organic production growth of 19% year-over-year in 2024, compared to an average of 3% for our mid-cap peers. The company’s “brick-by-brick” approach to building its land position is a core tenet of its value proposition and contributes to its high margins. MTDR’s 2024 CF/Boe and FCF/Boe estimates are among the best in our mid-cap peer group.”

Based on this stance, Scialla rates MTDR as Overweight (i.e. Buy). He sets a price target of $83, showing confidence in a 39% upside for the year ahead.

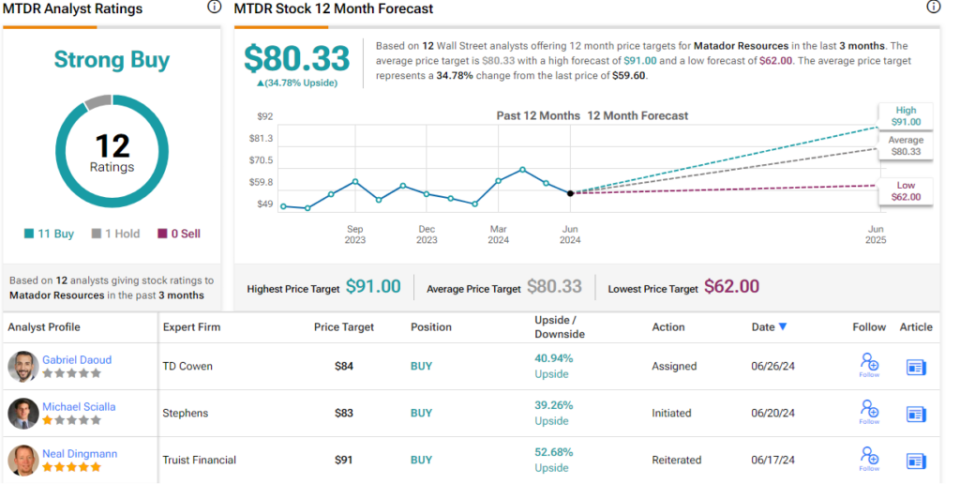

Matador’s twelve recent analyst ratings include 11 to Buy and 1 to Hold, for a consensus rating of Strong Buy. The stock is listed at $59.60, and its $80.33 average price target implies the stock has a 35% one-year gain in store. (See MTDR Stock Market Forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks. Best Stocks to Buya tool that brings together all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.