In the battle for chip supremacy, two of the main companies going head-to-head are Nvidia (NASDAQ: NVDA) And Advanced microsystems (NASDAQ: AMD). Over the past five years, both stocks have performed well. AMD grew over 433% during this period, which is remarkable. However, that return pales in comparison to Nvidia stock’s gain of over 3,000%.

Nvidia has been the best stock over the past five years, but which stock is likely to outperform over the next five years?

Nvidia vs AMD

Currently, the construction of artificial intelligence (AI) infrastructure benefits both companies, given the demand for graphics processing units (GPUs) needed to power large language model (LLM) training and artificial intelligence (AI) inference. This insatiable demand for GPUs led Nvidia’s data center segment to post revenue of $22.6 billion in the first quarter of fiscal 2025 (for the quarter ending April 28, 2024), i.e. an incredible 427% year-over-year increase. AMD’s data center segment, meanwhile, saw its first-quarter fiscal 2024 revenue climb more than 80% year-over-year to $2.3 billion.

Nvidia has emerged as the undisputed leader in AI chips, as evidenced by its data center segment generating nearly 10 times the amount of revenue generated by AMD’s data center segment. The company’s GPUs have become the dominant ones, due to its Compute Unified Device Architecture (CUDA) software platform, on which developers have long been trained to program the chips. This, in turn, has helped create a wide moat for the company’s GPUs, giving it more than about 80% market share.

However, the segment continues to grow well for AMD, as its GPUs become an alternative to Nvidia’s chips, which are in limited supply. Companies often like to have multiple suppliers so as not to be dependent on just one.

AMD is making some inroads. Last month, Microsoft (NASDAQ:MSFT) AMD has announced that it will offer clusters of AMD’s MI300X chips through its Azure cloud computing service as an alternative to Nvidia. Additionally, AMD recently said that it has received serious inquiries about creating an AI cluster with over a million GPUs. Given that AI training clusters are typically built with a few thousand GPUs, this would be a huge win for AMD if it ever comes to fruition.

While Nvidia’s results are dominated by its GPU products and data center segment, data center only accounts for 43% of AMD’s total revenue, compared to 87% of Nvidia’s revenue. At the same time, some of AMD’s other segments struggled, leading to total year-over-year revenue growth in the quarter of just 2%, compared to 262% for Nvidia.

Which stock is the best buy?

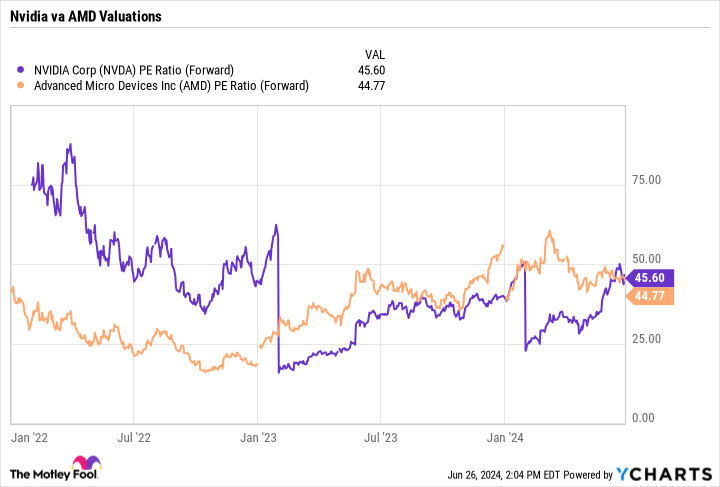

Despite Nvidia’s strong stock performance, the two stocks are actually trading at nearly identical forward P/E (price-to-earnings) valuations. Nvidia is trading at a forward P/E of 45.6, compared to AMD’s 44.8.

With valuations so similar, the question of which stock is better to own going forward should come down to which company will perform better operationally over the next few years.

AMD has the advantage of having a much smaller data center segment than Nvidia. As a smaller company, it has the opportunity to take market share from Nvidia. If the company can become a viable second source of GPU chips, it should see continued strong growth in this segment.

Meanwhile, in five years, the company’s gaming segment, which has been a major drag, is expected to see a huge improvement starting in 2027 or 2028. Microsoft is reportedly planning to launch its next-gen gaming console in 2028, while Sony is expected to launch its PlayStation 6 console in 2027 or 2028.

In 2022, AMD’s revenue from the Sony PlayStation 5 (PS5) was nearly $3.8 billion, or 16% of its revenue. Console sales typically peak in the third year after launch, and the PS5 was introduced in 2020.

The gap it has created with its CUDA platform works in Nvidia’s favor. Developers have already learned on its platform, and it takes time and training to work with other GPUs, which costs money. That should help the company maintain its lead.

Meanwhile, AMD has begun to rapidly push innovation by developing next-generation architecture GPU platforms that will be backward compatible with its existing architecture. This is expected to help generate huge demand from customers looking to stay at the forefront of AI capabilities.

If artificial intelligence is still in its infancy and data center construction is just beginning, then Nvidia is my favorite stock to buy between the two chipmakers, given the gap it has created. However, I think AMD could also be a very solid investment, especially ahead of the gaming console refresh cycle in the next few years.

Should You Invest $1,000 in Nvidia Right Now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what it believes to be the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Stock Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a position in the stocks mentioned and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. disclosure policy.

Best Semiconductor Stock: Nvidia or Advanced Micro Devices was originally published by The Motley Fool