Chances are, if you’re American, you’re a member of one or the other Amazon (NASDAQ:AMZN), Costco wholesale (NASDAQ: COST), or both. Each retailer has generated huge long-term gains for its shareholders, with Amazon dominating the online market and Costco thriving through its network of wholesale warehouses.

But which stock is best to buy right now? Let’s take a look at their latest financial results, balance sheets and future growth opportunities to find out.

The top and bottom lines

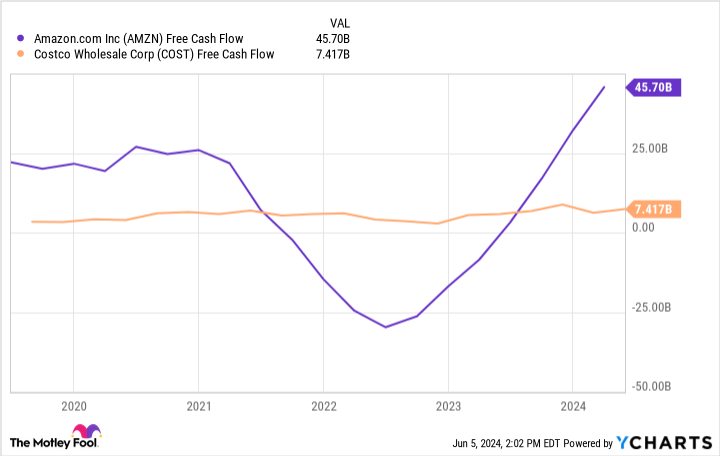

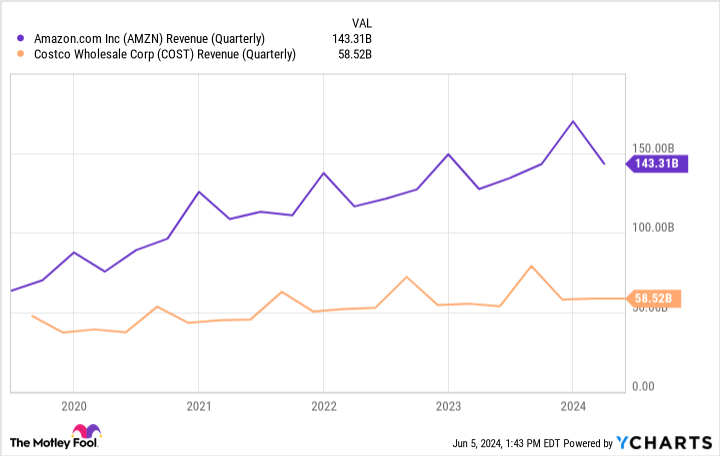

For the first category, let’s look at two essential financial indicators for any business: net sales And free movement of capital.

Amazon generated $143.3 billion in net sales in the first quarter of 2024, compared to $127.4 billion a year earlier, an increase of 12.5%. Looking ahead to Amazon’s second quarter of 2024, management expects net revenue between $144 billion and $149 billion, an increase between 7% and 11%.

For comparison, Costco recently reported net sales of $57.4 billion during its fiscal third quarter 2024, representing a year-over-year increase of 9.1%. Importantly, sales were positively affected by a shift in the company’s fiscal calendar of approximately 0.5% to 1%. Although Costco management does not have forward-looking revenue guidance, the company releases its monthly net sales results ahead of earnings reports, which totaled $19.64 billion for the retail month of May, a year-over-year increase of 8.1% from $18.16. billion.

Turning our attention to each company’s profitability, Amazon generated $46.1 billion in free cash flow over the last 12 months, a significant improvement from -$10.1 billion for the last 12 months ended March 31, 2023. For comparison, Costco generated $7.4 billion in free cash flow. over the last 12 months, an improvement of 10% compared to the last 12 months ended May 7, 2023.

Overall, Costco’s recent financial results have been strong and stable; However, Amazon wins in this category because the stock’s revenue and profitability growth is more impressive.

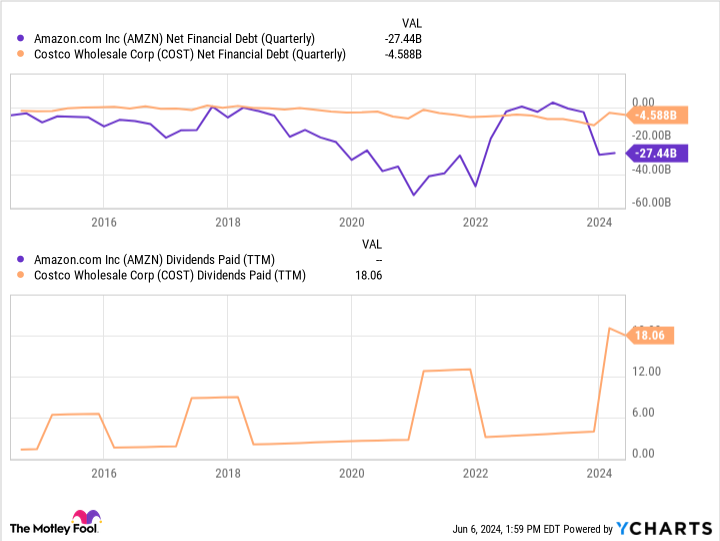

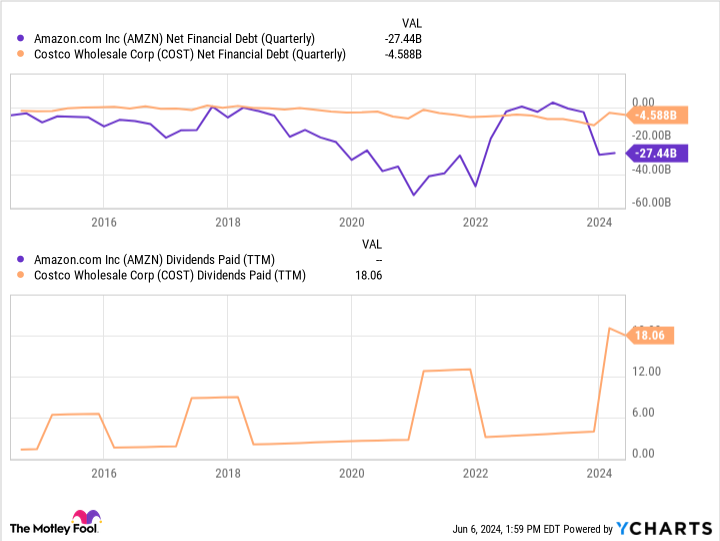

Financial health and return of capital to shareholders

A company’s balance sheet is a crucial snapshot illustrating its financial health. The balance sheets of Amazon and Costco demonstrate financial stability without debt. Specifically, Amazon has $27.4 billion in net cash (cash and cash equivalents minus total debt), compared to Costco’s $4.6 billion in net cash.

In an era of relatively high interest rates, Amazon and Costco can avoid snowballing debt due to high interest charges. Instead, companies can operate from a position of strength and, for Costco, return capital to shareholders in the form of dividends, which allows shareholders to reinvest their money in the company or raise cash for themselves .

Costco currently pays a regular quarterly dividend of $1.16 per share, which equates to an annual yield of 0.6%, which might not impress income-seeking investors. However, the company is known for frequently paying special cash dividends – five in the last 11 years – with the most recent coming in January 2024.

Amazon currently pays no dividend and is unlikely to follow other tech giants like Alphabet And Metaplatforms, which recently announced its intention to pay dividends for the first time. During Amazon’s latest earnings conference call, CFO Brian Olsavsky said the company had no news to share regarding dividends. He emphasized that management’s top priority is to invest in growth opportunities and long-term initiatives. These investments focus on generative artificial intelligence (AI), which is expected to generate capital investments in 2024 above the $48.4 billion in the previous year.

So, despite Amazon’s slightly stronger cash position, this category goes to Costco due to its consistent history of returning capital to shareholders and the high likelihood that it will continue to do so.

Growth Opportunities

Although both stocks have a long history of outperforming, potential buyers should focus more on each company’s future growth opportunities.

As noted, Amazon is eyeing its next phase of growth in generative AI, with plans to implement it in almost every area of the company. Amazon Web Services (AWS), which helps companies create AI products and services, is already benefiting. As a result, AWS’s growth rate is “accelerating” to a projected annual revenue rate of $100 billion, up from $90.8 billion in 2023.

While the AI market is in its infancy, Statista, a global data and business intelligence platform, predicts exponential growth. Specifically, Statista estimates the AI market to be worth $184 billion in 2024, with an expected annual growth rate of 28.5%, which would translate to a market volume of $827 billion by 2030 .

In comparison, Costco has two main growth drivers: international expansion and increased dues. At the end of the third quarter of fiscal 2024, the company had 876 locations, including 752 in North America. Management aims to open 25 to 30 net new locations each year, with the greatest potential for expansion in China. Since opening its first Chinese warehouse in 2019, Costco’s membership has climbed to about 200,000 in its fiscal second quarter 2024 and recently opened a seventh location. Notably, Amazon closed its online marketplace in China in 2019 and has yet to return.

Second, Costco has a history of increasing its member dues approximately every five years, with the last increase being in 2017. With a base of 74.5 million members contributing approximately $4.8 billion in high-volume revenue margin, even a $5 increase in contributions could bring in additional money. $372 million per year.

Asked about increasing membership prices during the company’s latest earnings conference call, Costco CFO Gary Millerchip said that “it’s always a question of when we raise fees versus to increase fees.

Overall, both companies are well positioned for future growth and each is taking a different approach. Costco wants to grow slowly and steadily, while Amazon seeks to grow at breakneck speed. Given Costco’s safer growth, this category is difficult to reach, but let’s reward Amazon for its higher growth potential.

Is Amazon or Costco the better buy?

Amazon and Costco are exceptionally well-managed companies poised for long-term success and worthy of every investor’s portfolio. That said, right now, Amazon seems like the better buy, especially when you consider the valuation. Amazon trades at 42.8 times its free cash flow, below its 10-year median of 62.9. For comparison, Costco currently trades at 50.5 times free cash flow and its 10-year median is 31.1 times free cash flow.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Amazon was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $740,690!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Colin Brantmeyer holds positions at Amazon, Costco Wholesale and Microsoft. The Motley Fool holds positions and recommends Amazon, Costco Wholesale, Meta Platforms and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Mad Motley has a disclosure policy.

Best Stock to Buy Right Now: Amazon vs. Costco was originally published by The Motley Fool