A wise man once said that there’s nothing new under the sun—and that’s been pretty true lately when it comes to the stock market. Like last year, tech stocks are leading the gains, and AI stocks are the backbone of the tech boom.

Artificial intelligence is not a new technology—its earliest iterations date back to the 1950s—but its latest evolution, generative AI, emerged in late 2022. Today, companies of all stripes are beginning to deploy generative AI across a host of new applications. Generation AI represents a new evolution of artificial intelligence technology, the ability to generate new content and materials rather than simply analyzing and synthesizing existing data. Companies that can successfully embrace and implement generative AI on behalf of their customers will have an advantage in today’s environment.

This outlook aligns with Barclays’ Ryan MacWilliams’ view on AI-related businesses. In a recent research report, the analyst wrote: “We view the DevOps market as an attractive investment opportunity. We believe DevOps is well positioned to capitalize on near-term AI-driven demand as more enterprises prioritize increasing software development speed through investments in developer tools. We note that IDC expects the broader DevOps market to grow at a CAGR of approximately 36% over the 2023-2027 period. Additionally, we believe front-office developer roles could be among the first to return in an improving macro economy.”

In this context, we used the TipRanks Database to review two of MacWilliams’ top AI picks, both of which have a Strong Buy consensus rating. Let’s take a closer look at these selections.

JFrog (FROG)

The first stock we’ll look at is JFrog, a DevOps software company dedicated to providing a seamless path for regular, invisible software updates, with the goal of providing a simple and secure workflow directly from developers to users finals. JFrog offers its customers a set of DevOps tools compatible with all major software technologies. The company’s platform allows users to take advantage of a fully automated DevOps pipeline.

In addition to full automation, JFrog’s DevOps platform provides high levels of security and availability, for securely building robust production pipelines. The company’s tools are scalable, for any number of users or servers and any size of storage needed. Additionally, JFrog is compatible with hybrid systems, providing its customers with the flexibility to run different combinations of cloud, multi-cloud and on-premises solutions.

Recently, JFrog announced that it had entered into an agreement to acquire Qwak AI, a creator of AI and MLOps platforms. This acquisition will enable JFrog to provide a unified platform solution for DevOps, Security and MLOps players, a state-of-the-art unified functionality. For JFrog, the deal will enhance its machine learning capabilities and further streamline its development models. The acquisition deal was valued at $230 million.

Many tech companies operate at a loss, but that hasn’t been the case for JFrog most of the time. In its latest set of financial results, covering 1Q24, the company’s net income came in at 16 cents per share based on non-GAAP measures. This EPS comes from total revenue of $100.3 million, up more than 25% year over year, and more than $1.6 million higher than what had been been estimated.

When we contact the Barclays MacWilliams analyst, we find him bullish on JFrog in both the short and long term, beginning his comments by writing: “We believe FROG can capitalize on the near-term improvement in cloud demand for coding workloads (driven by generative AI) as a global leader in binary management (MSFT partnership shows strategic importance).”

Longer term, MacWilliams adds: “Longer term, AI could accelerate cloud adoption and drive incremental spending on cloud artifacts, positioning FROG as the leader in software supply chain management. Additionally, we believe FROG’s consumption-based pricing approach could provide additional upside as larger AI-enabled software development workflows could accelerate binary demand. As a result, we believe FROG’s monetization model could be more closely correlated with increased software production driven by AI.”

Quantifying this position, the analyst begins his coverage of FROG with an Overweight (Buy) rating and a $50 price target that implies a one-year gain of 33%. (To consult MacWilliams’s list of achievements, Click here)

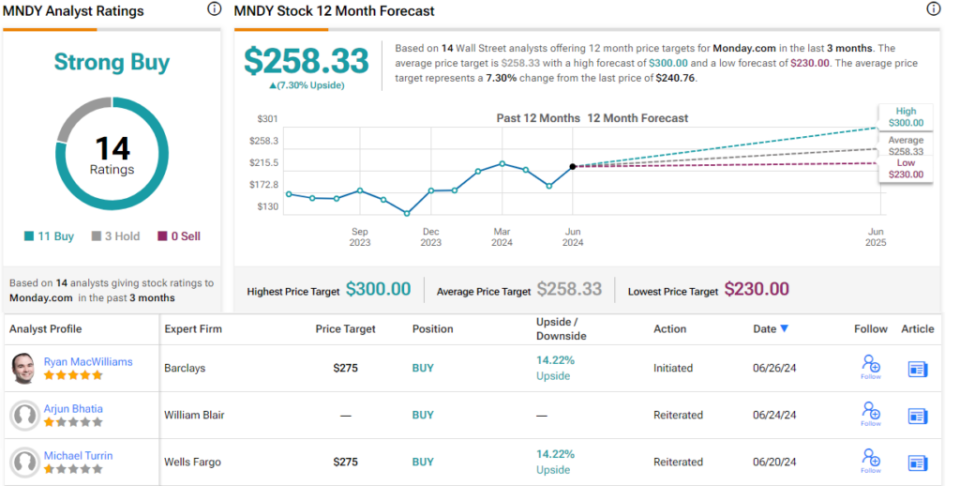

Overall, the 15 recent analyst reviews, with their 13 Buys and 2 Holds, give FROG shares a Strong Buy consensus rating, while the $46.38 average price target and the current price of $37.55 together indicate a 23.5% appreciation in the stock for the year ahead. (See JFrog Stock Forecast)

Monday.com (MNDY)

Next on our list is monday.com, a cloud-based software company that develops and markets a range of popular work management software products. The company’s product lines include tools for office systems optimization, customer relationship and project management, marketing, and sales operations. The platform is cloud-based and targets enterprise customers at a wide range of scales. monday.com’s platform connects people and processes to bring transparency to office workflows.

A few numbers show how popular the system is. By the end of 2023, the company had over 225,000 customers, and by the end of the first quarter of this year, it had 2,491 customers with over $50,000 in annual recurring revenue each. This customer base is served by over 1,900 employees worldwide, in offices as far away as New York, Miami and Chicago, London and Warsaw, Sydney and Melbourne, Sao Paulo, Tokyo and Tel Aviv. Enterprise customers ranging from big names like Coca Cola to big tech innovators like Uber all rely on monday.com.

Word processing processes are notoriously boring, but monday.com is integrating AI by using the technology to power its automation systems. Sorting, analysis and categorization of data; learn from textual analysis; create communication summaries; implement action plans; even translating international communications – the company has integrated AI into its platform to facilitate all of these functions.

Financially, monday.com posted earnings per share of 61 cents by non-GAAP measures in the first quarter of 2024, beating forecasts of 21 cents. This EPS increased significantly compared to the previous year; earnings for the first quarter of 2023 were 14 cents per share. On the top line, the company reported total revenue of $216.9 million, about $6.3 million more than expected – and up more than 33% from the previous year.

Analyst MacWilliams begins his coverage of MNDY with an optimistic stance, writing: “We believe in MNDY’s new opportunities and upselling new products (like Monday Dev) to its existing customer base.” This enhanced cross-selling movement, improved GTM efficiency, and pricing benefits could drive CY25 Street estimates higher.

He goes on to outline a number of Monday’s highlights, adding: “MNDY recently said that approximately 1/3 of its customers were using a CRM or DevOps model in 2023 and that approximately 10% of Fortune 500 companies were using the one of these products. Since the full-scale launch of Monday Sales CRM and Dev, both products are growing faster than when monday.com first launched. We believe MNDY’s cross-selling movement and new opportunities in these markets will continue to complement its rev. LT growth, and we note that CRM (~$25 million in ARR as of December 2023) and Dev were only available to attract new customers until May 2024.”

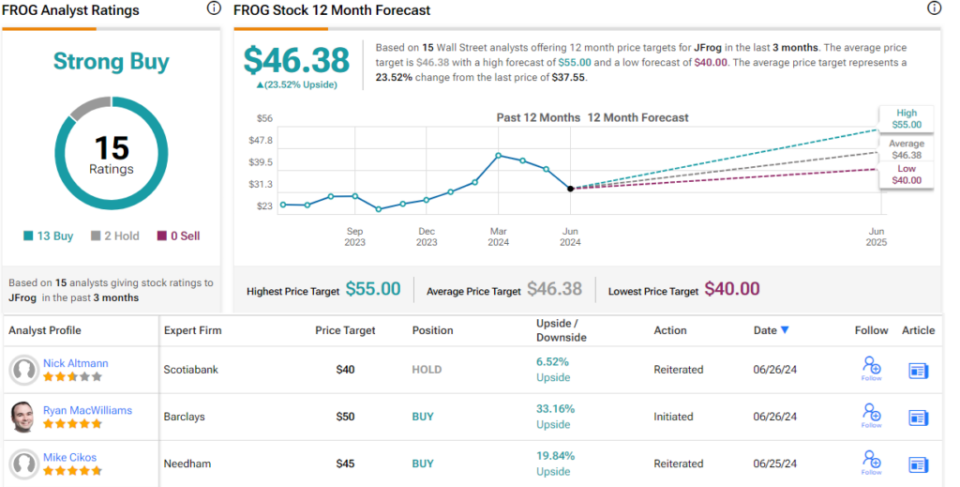

These comments, taken together, fully support MacWilliams’ Overweight (Buy) rating on MNDY shares, and his $275 price target shows confidence in a 14% one-year upside.

On Wall Street in general, this stock gets a lot of love. It has 14 recent analyst reviews with an 11-3 split favoring Buy over Hold, for a Strong Buy consensus rating. That said, the average price target of $258.33 is a bit less optimistic than Barclays’ view and implies 7% one-year upside potential from the current stock price of 240, $76. (See MNDY Stock Forecast)

To find great ideas for trading stocks at attractive valuations, visit TipRanks. Best Stocks to Buya tool that brings together all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.