Well, that’s it. It’s almost time to officially bid farewell to 2023 and stunning stock market performance. THE S&P500 sees the year up 24%, but even that represents small change from the tech-heavy NASDAQ’s 43% return.

There’s no doubt that this has been the year of the tech giant, with stocks dubbed the Magnificent 7 driving the bullish narrative. So, can we expect a similar situation in 2024 or will it be more like the bear market of 2022? While that remains to be seen, Wedbush analyst Dan Ives believes another vintage year for tech is about to unfold. “In our view, the new tech bull market has now begun and tech stocks are poised for a strong 2024, with tech stocks we expect to rise 25% over the next year,” he said. said the 5-star analyst.

And right at the top of that pyramid is the biggest Big Tech of them all. After gains of 48% in 2023, Ives expects another show of strength for Apple (AAPL) in 2024. “Apple remains our Top Tech Pick with a strong iPhone 15 upgrade cycle rolling out with a strong, drama-free holiday season (compared to the supply chain turmoil of December last) which seems to be humming until 2024 despite the growing noise and competition from Huawei in China. ,” he explained.

Despite what Ives calls the “China iPhone demise narrative,” based on his supply chain audits in Asia, it’s nothing more than a “big fictitious story.” concocted by the bears and does not reflect “mainland China’s underlying growth” which has remained strong. in the December quarter.

iPhone aside, Ives believes the increasingly important services segment is now back to “steady double-digit growth,” estimating that on a standalone basis the business is worth between $1.5 trillion and $1.6 trillion. of dollars. “In a nutshell,” Ives summarized, “2024 is the year for Cook & Co. to once again showcase iPhone growth and further monetize its gold installed base that Cupertino has built.”

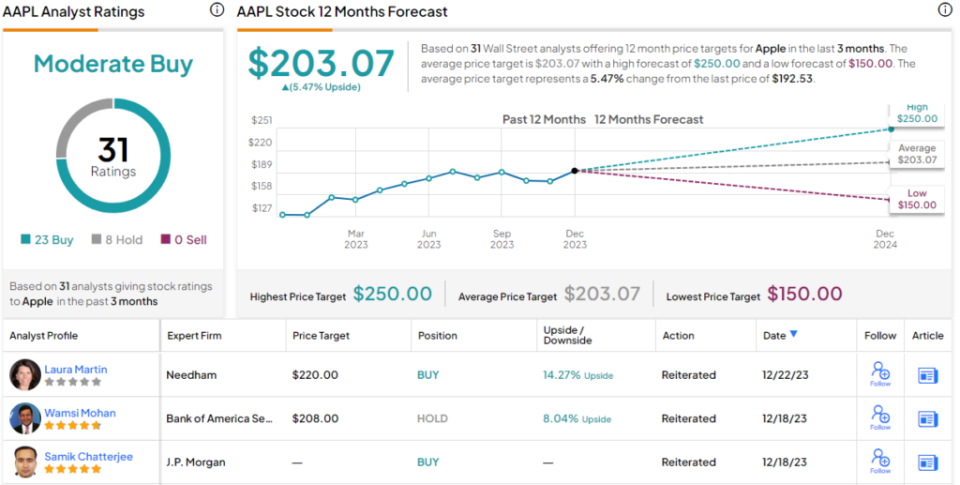

To that end, Ives has maintained an Outperform (i.e. Buy) rating and a $250 price target, which suggests shares will see another 30% growth over the course of the year. next year. (To see Ives’ track record, Click here)

Elsewhere on the Street, the stock receives 22 Buys and 8 Additional Holds, all for a Moderate Buy consensus rating. Most seem to think that the upside potential is now capped; by surpassing the average target of $203.07, a year from now, shares will deliver modest returns of 5.5%. (See Apple stock forecasts on TipRanks)

To find great ideas for trading stocks at attractive valuations, visit TipRanks. Best Stocks to Buya tool that brings together all the information about stocks from TipRanks.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.