Apple (NASDAQ:AAPL) And Oracle (NYSE:ORCL) reached all-time highs on Wednesday.

Apple is up more than 14% over the past month – with the recent rally fueled primarily by a positive answer at its annual Worldwide Developers Conference. Apple is integrating artificial intelligence (AI) into several key product categories. Meanwhile, Oracle is up 19% over the past month, getting an extra boost from its recent financial results and guidance.

Since Oracle is listed on the New York Stock Exchange, you won’t find it in the Nasdaq Composite or focused on the Nasdaq exchange traded funds (AND F). But you will find both Apple and Oracle in the Vanguard Total Stock Market ETF (NYSEMKT:VTI)THE Vanguard S&P 500 ETF (NYSEMKT: VOL)and the Vanguard Information Technology ETF (NYSEMKT:VGT). Here’s a look at each fund, why all three funds just hit all-time highs, and the best to buy now.

Diverse exhibition

The Total Stock Market ETF and the S&P 500 ETF are the two largest Vanguard ETFs, both with over $1 trillion in net assets. Both funds have expense ratios of 0.03%, or $3 in annual fees per $10,000 invested. The low cost and simplicity of these funds make them an excellent choice for those looking for a passive but effective way to reflect the performance of the market as a whole.

The Vanguard Total Stock Market ETF has 3,719 holdings, compared to 504 holdings for the Vanguard S&P 500 ETF. However, the largest companies are so valuable that the S&P 500 represents about 80% of the market capitalization of the U.S. stock market. This dynamic makes the performance of the two ETFs very similar.

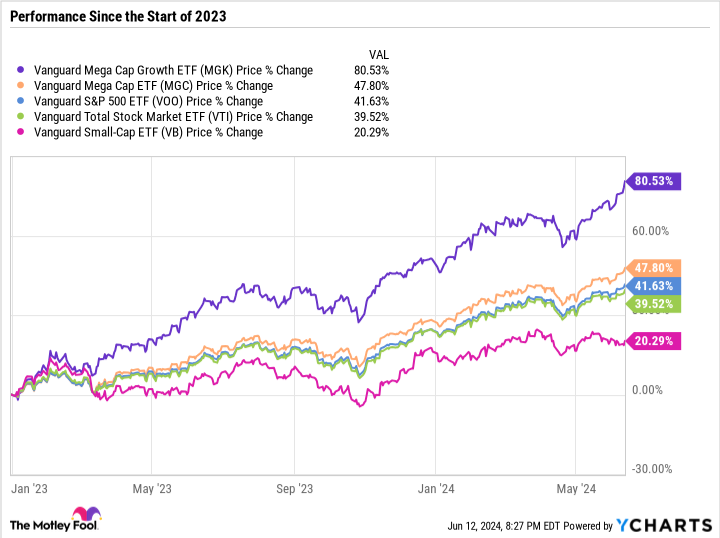

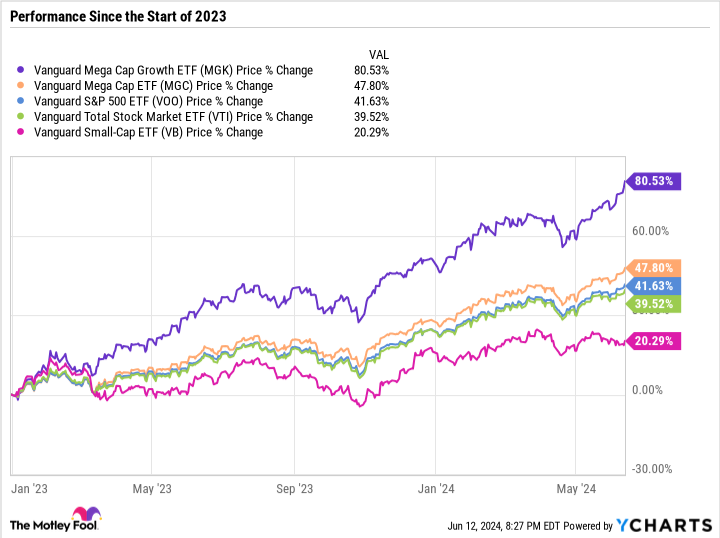

The Vanguard S&P 500 ETF will generally do better than the Vanguard Total Stock Market ETF if large- and large-cap stocks outperform mid- and small-cap stocks. The last 18 months or so is a great example of what can be expected when mega-caps lead the market higher.

As you can see from the chart, mega-cap growth has crushed the S&P 500, while mega-cap stocks have performed well, while mid- and small-cap stocks have performed poorly. But even under these circumstances, the Vanguard S&P 500 ETF only outperformed the Vanguard Total Stock Market ETF by a few percentage points.

Thus, despite the significant difference in terms of the quantity of securities between the two funds, the two funds have practically the same performance because the S&P 500 represents a very large part of the broader market.

A low-cost way to invest in the hottest stock sector

The easiest way to invest in companies like Apple and Oracle without racking up significant fees is with the Vanguard Information Technology ETF. Its expense ratio is higher, at 0.1%, compared to 0.03% for the largest Vanguard funds. But that’s only a difference of $7 per $10,000 invested.

The technology sector is full of high-octane growth stocks, including the three most valuable companies in the world: Apple, Microsoft (NASDAQ:MSFT)And Nvidia (NASDAQ:NVDA). But it also includes more pick-and-shovel games, like material and component suppliers.

Still, the fund will basically boom or bust depending on the performance of its three largest holdings and the two largest industries, semiconductors and software.

The semiconductor industry has been a big winner from the AI-driven market surge. The two best examples are Nvidia, which became the third company valued at over $3 trillion, and Broadcomwhich surpassed $800 billion in market capitalization on Friday after shattering earnings expectations.

While the technology sector represents 30.6% of the S&P 500 and the semiconductor industry represents 27.6% of the technology sector, some simple math tells us that the industry now represents approximately 8.5% of the entire S&P 500. For context, this means that the semiconductor industry has roughly the same weighting as the entire industrial or energy, utilities, and materials sector. combined.

The technology sector includes companies that provide the computing power needed to run complex AI models, as well as companies that invest in ways to apply AI to businesses and consumers. For this reason, it stands out as the best sector to invest in if you want to gain exposure to the growing trend.

A well-deserved premium valuation

The danger of buying hot tech stocks right now is valuation. The Vanguard Information Technology ETF has a price-to-earnings (P/E) ratio of 42.6. Earnings growth has been strong, but much of the gains are due to an expansion in valuations.

Apple’s P/E ratio is up at 33.2 from its three-year median of 28.1. Microsoft has a P/E of 38.2, while its three-year median is 33.3. Oracle’s P/E is 37, compared to a three-year median of 30.2. The list is lengthened increasingly.

Over the long term, technology companies are perfectly positioned to deploy capital toward high-margin opportunities that lead to profit growth. The sector is certainly a little overextended at this point from a valuation perspective, but it still has what it takes to be a good investment. And for this reason, the Vanguard Information Technology ETF is a better buy than the Vanguard S&P 500 ETF or the Vanguard Total Stock Market ETF if you have a high risk tolerance.

Should you invest $1,000 in the Vanguard World Fund – Vanguard Information Technology ETF right now?

Before purchasing shares of Vanguard World Fund – Vanguard Information Technology ETF, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $808,105!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Oracle, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard Index Funds-Vanguard Total Stock Market ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Mad Motley has a disclosure policy.

Apple and Oracle helped propel these 3 Vanguard ETFs to all-time highs. Here is my favorite to buy now. was originally published by The Motley Fool