If you believe the hype, artificial intelligence (AI) is one of the most important technological advances of all time. This may be an exaggeration – time will tell – but it is already clear that this technology has commercial power. Its impact on the market has been enormous, with its champion, Nvidia (NASDAQ: NVDA)join Apple And Microsoft as one of the largest companies in the world.

Nvidia’s rise has led the company to split your shares 10 for 1opening the door to more investors who had been shut out by the pricing. Now, another AI company is also splitting its shares. Broadcom (NASDAQ: AVGO)which designs, manufactures and sells hardware and network infrastructure that enables AI programs to run, will split its inventory later this summer.

So let’s think: Could Broadcom deliver the kind of returns that Nvidia does?

Revenue growth was impressive, but was boosted by a major acquisition

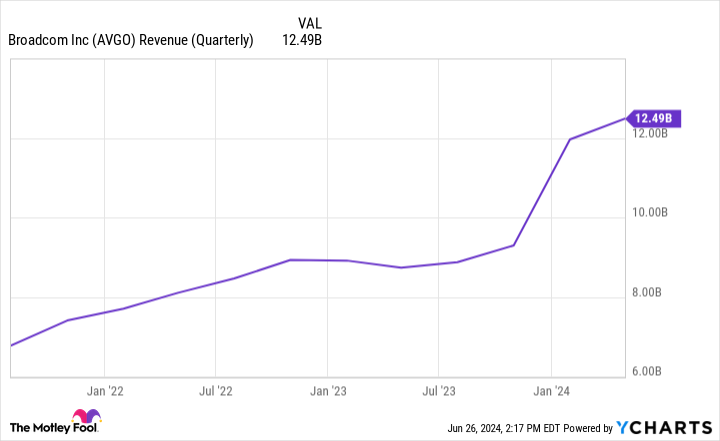

Broadcom is in growth mode, having increased its first quarter revenue 34% year-over-year and second quarter revenue 43% year-over-year in 2023.

Have you noticed the recent massive increase? That inflection point in late 2023 is important. This growth is not really organic: it is largely coming from an acquisition. The company bought VMware, a very successful cloud software company, in November 2023 for $69 billion, adding its revenue to Broadcom’s.

Excluding this additional revenue from VMware, the company grew its second-quarter revenue by 12% year-over-year, which isn’t as impressive as the headline-grabbing 43%. newspapers.

In view of future profits, the company appears reasonably valued.

Still, organic growth of 12% is nothing to sneeze at and reflects the growth of Broadcom’s AI-focused business. Communication within the AI server farms that power platforms like ChatGPT is a crucial aspect and this is where Broadcom excels. Its PCIe and Ethernet technology is one of the best on the market. This is what made its products popular.

Hock Tan, president and CEO of Broadcom, said in the company’s latest press release that “revenue from our AI products reached a record $3.1 billion during the quarter.” The combination of a growing AI business and a strong acquisition means the company expects to continue generating record revenues. It raised its forecast for this year to $51 billion in revenue, up 42% from 2023.

So what does this mean about the company’s fair value? If we look at its forward P/E, the company looks pretty solid, at around 34. This is in line with much of big tech and is significantly lower than Nvidia’s 48.

Broadcom is a solid company, but it will struggle to compete with Nvidia

Broadcom’s growth prospects, while promising, are not comparable to Nvidia’s, in my opinion. Nvidia is growing its revenue at a much higher rate than Broadcom and is doing so organically, without relying on costly acquisitions. According to consensus estimates, Nvidia is expected to report revenue growth more than twice that of Broadcom by the end of this fiscal year and again next year.

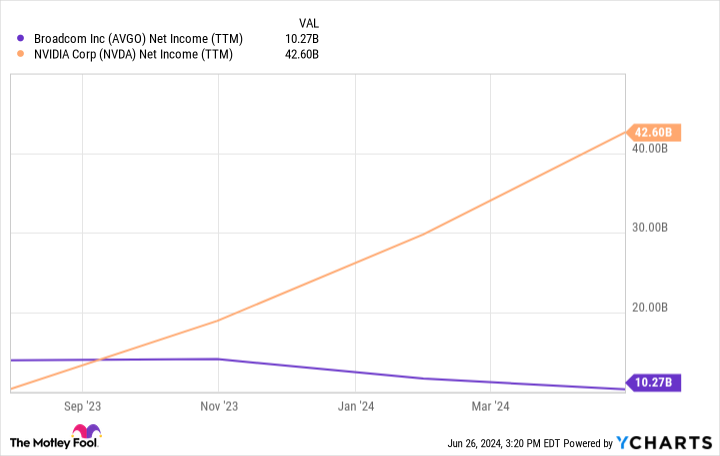

And this disparity will be even greater when considering the bottom line. Look at the difference from last year.

It’s not just the acquisition that’s affecting this. Nvidia expects to operate with margins about 20% higher than Broadcom’s this year.

Beyond the numbers, Nvidia has demonstrated immense vision as an AI pioneer. While difficult to quantify, I believe visionary leadership is a factor that cannot be underestimated. As the industry matures and competition intensifies, Nvidia’s leadership could help it maintain its leading position.

Ultimately, however, Broadcom remains a good investment, with a solid track record and optimistic outlook. Is this the next Nvidia? I don’t think so, but that’s not necessarily the case.

Should You Invest $1,000 in Broadcom Right Now?

Before buying Broadcom stock, consider this:

THE Motley Fool, securities advisor The team of analysts has just identified what it believes to be the 10 best stocks Investors should buy now…and Broadcom wasn’t one of them. The 10 selected stocks could generate monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Equity Advisor provides investors with an easy-to-follow blueprint for success, including portfolio construction advice, regular analyst updates, and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Apple, Microsoft and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Mad Motley has a disclosure policy.

Another stock split in the artificial intelligence (AI) sector is coming. Could Broadcom be the next Nvidia? was originally published by The Motley Fool