News that high-profile activist hedge fund Elliot Investment Management has acquired a billion-dollar position in a building controls and heating, ventilation, and air conditioning (HVAC) company. Johnson Controls (NYSE:JCI) caused the stock to rise.

While some of these decisions are undoubtedly attributable to investors simply looking to jump on the bandwagon, it also shows that Johnson’s management could be doing a better job of generating value for investors. Here’s why the latter makes a strong case, and the hedge fund movement could be a positive catalyst for the stock.

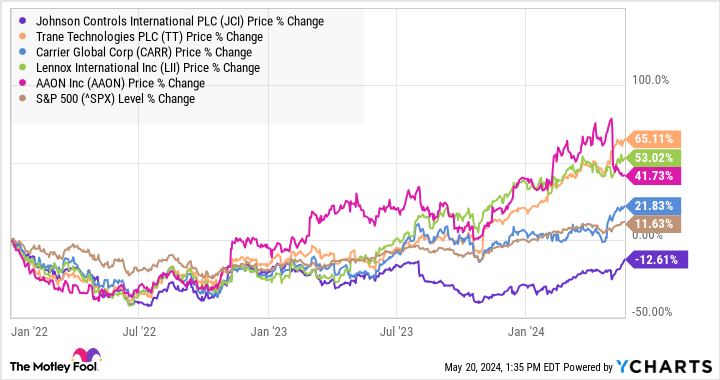

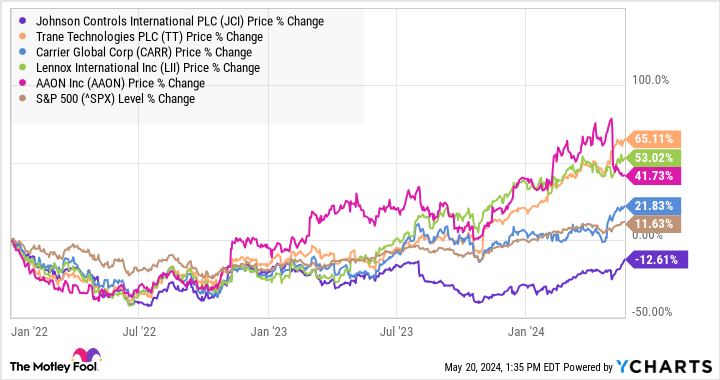

Johnson Controls underperforms

A quick look at the company’s stock chart compared to its peers in the HVAC and S&P500 says a lot. Not only has it significantly underperformed, but it’s been down since the start of 2022. It’s a great stock to buy on a dip, but not so good for long-term buy-and-hold investors.

This is surprising because the company operates in desirable end markets. Its solutions help building owners achieve their net zero emissions goals by improving building efficiency. This applies to new buildings as well as the renovation of existing buildings. Net-zero emissions goals are driving demand for Johnson Controls’ solutions, and its OpenBlue digital platform is increasing the efficiency of smart building solutions.

Missing tips

In summary, Johnson Controls’ management has overpromised and underdelivered in recent years, and valid questions also arise regarding its 2024 guidance.

The chart below shows how the company failed to meet its initial 2022 earnings guidance and barely met its 2023 sales growth guidance.

Johnson Controls: Initial Direction Versus Final Outcome | 2022 Initial | 2022 Actual | 2023 Initial | 2023 Actual | 2024 Initial | 2024 Current |

|---|---|---|---|---|---|---|

Organic revenue growth | High single digits | 9% | Between a high number and a low double digit | 8% | Mid-single digit | Mid-single digit |

Earnings per share | $3.22 to $3.32 | $3.00 | $3.20 to $3.60 | $3.50 | $3.65 – $3.80 | $3.60 to $3.75 |

Data source: Johnson Controls presentations.

What went wrong?

I’ll get to 2024 in a moment, but first, a quick recap of what happened. In 2022, management reduced its full-year profit forecast due to the supply chain crisis that has restricted the availability of semiconductor chips and other technology components, which has had a negative impact on some of its higher margin businesses. Sales went well, but margins did not, hence the absence of profits in 2022.

Fast forward to 2023, and management confirmed its initial guidance for full-year organic sales growth at 10% during the second-quarter earnings call. Three months later, during the third-quarter earnings conference call, management told investors it would be “high single-digit” growth. The reason? Management blamed this on dealers resetting their inventories as product delivery times improved. In other words, dealers were previously building inventory while Johnson Controls was struggling to deliver products, but they (dealers) are now reducing them as the company returns to delivering products on a normal schedule.

It’s getting worse; Johnson Controls missed its fourth-quarter 2024 sales and profit forecasts a few months later. As reported at the time, a cyberattack hit the company, which was unfortunate but did not fully explain the lack of sales and profits.

Johnson Controls in 2024

As the table indicates, management expects organic revenue growth for the full year in the mid-single digit range. However, adhering to these guidelines is not an easy task. For example, organic revenue growth declined 1% in the first quarter, grew only 1% in the second quarter, and guidance is only for a low-single-digit increase for the third. quarter.

During the earnings conference call, Wall Street analysts wanted to know how exactly the company was meeting its full-year sales growth target, in light of three quarters of lackluster growth. Management argued that it needed high single-digit growth in the fourth quarter to reach the midpoint of its range and 10% growth to reach the high end.

Even though a cyberattack hit last year’s fourth quarter made it easier to compare to this year, it’s still hard to imagine how Johnson Controls’ growth could jump that much in the fourth quarter.

As such, Wall Street’s earnings per share consensus of $3.58 is below the low end of management’s current forecast.

What this means for investors

Johnson Controls has plenty of upside potential, but its management needs to start following through on its forecasts. The pressure is on management to deliver on its promises in 2024, and the potential for an activist investor like Elliot to push for change will only increase if the company misses its numbers again. The downside of a possible lack of full-year guidance could be limited by the prospect of shareholder activism for change. This makes the stock attractive on a risk/reward basis.

So while investors should be aware that Johnson Controls could miss out, they should also be aware that there are good deals here and a possible catalyst for change if that happens.

Should you invest $1,000 in Johnson Controls International right now?

Before buying Johnson Controls International stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Johnson Controls International was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $652,342!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Lee Samaha holds positions in Trane Technologies Plc. The Motley Fool posts and recommends Aaon. The Mad Motley has a disclosure policy.

An activist hedge fund buys this dividend stock. Is it time to follow? was originally published by The Motley Fool