(Bloomberg) – One of the main beneficiaries of sanctions on Russian and Venezuelan oil? American suppliers have established themselves in markets once dominated by OPEC and its allies.

Most read on Bloomberg

U.S. oil exports have set five new monthly records since Western countries began imposing sanctions on Russia in 2022. And with trade restrictions on Venezuela expected to be renewed in April, U.S. barrels are starting to replace the crude sanctioned by India, one of the largest buyers of illicit oil. oil.

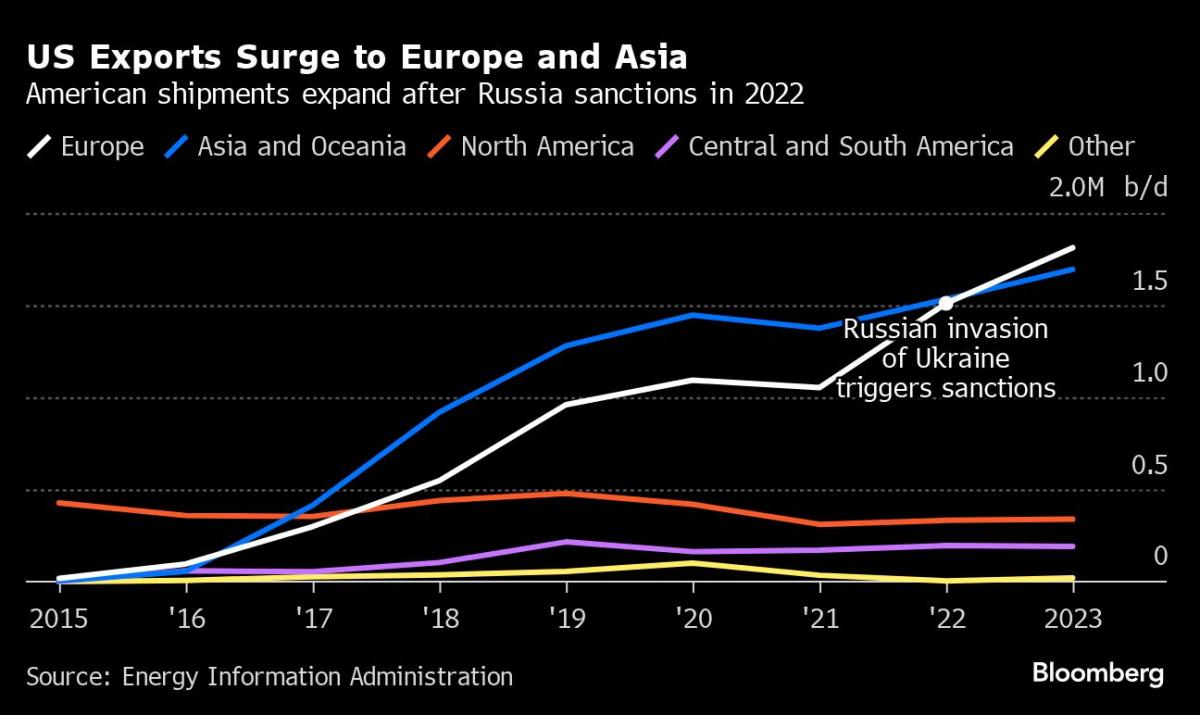

The move underscores how sanctions have helped U.S. crude capture market share around the world. While American oil has long been the world’s flexible barrel of reference, the disruption of energy flows after Russia’s invasion of Ukraine has created a new attraction for American barrels. Shipments to Europe and Asia then surged, turning the United States into one of the world’s largest exporters.

READ MORE: Sanctions finally start to hurt Moscow’s oil supply chain

Record U.S. production — just as OPEC and its allies are cutting their own supplies — has also helped U.S. producers gain a greater foothold in foreign markets. Physical oil prices reflect this, with WTI in Houston trading near its highest levels since October and sour benchmark Mars not far behind.

“U.S. production is increasing while OPEC and Russian production is decreasing — so the U.S., by definition, is going to have more market share,” said Gary Ross, a veteran oil consultant turned fund manager speculative investors at Black Gold Investors LLC.

India – third crude importer and second buyer of Moscow after China – is the latest market to see an influx of American oil. U.S. shipments to India are expected to rise in March to their highest level in almost a year, according to data from crude tracking firm Kpler.

At the same time, Russian oil imports have fallen by about 800,000 barrels per day since last year’s peak, according to Bloomberg’s oil tanker tracker. Russian shipments could decline further as Indian oil refiners no longer accept cargoes from tankers owned by state-owned Sovcomflot PJSC, which was recently sanctioned by the United States.

READ: India stops Russian oil supplies from sanctioned oil giant

Although U.S. supplies can’t entirely replace Russian crude due to differences in oil quality and travel times, “there’s definitely a bit of a shift toward extracting more U.S. crude,” Matt Smith said. , senior US oil analyst at Kpler.

Indian refiners have also suspended purchases from Venezuela before the US sanctions waiver expires in the middle of next month. These supplies are now on track to reach their lowest levels this year.

READ: Indian buyers of Venezuelan oil stop imports due to sanctions fears

Even before the latest round of trade restrictions, the United States had quickly become a key supplier to Asia, where U.S. imports hit an annual record last year, according to the EIA.

And in Europe, which has largely avoided Russian oil since the start of the war in Ukraine, U.S. shipments will reach a record 2.2 million barrels per day in March, according to ship tracking data compiled by Bloomberg.

Of course, Europe’s appeal is not entirely due to sanctions. Imports to the Netherlands have surged since West Texas Intermediate was included in the dated Brent benchmark last year, ensuring that American crude would become part of the European diet.

READ: World’s biggest oil price gets influx of US crude

But shipments increased sharply after sanctions were imposed as European countries sought non-Russian sources of supply. U.S. imports to France jumped nearly 40% between 2021 and 2023, while those to Spain increased 134%.

“As U.S. production continues to gradually increase, each additional barrel produced will likely be exported,” Kpler’s Smith said.

–With help from Julian Lee.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP