After a rebound year in 2023, the technology sector continued its momentum in the first half of this year. Notable tech indices like the Nasdaq Composite Index And Nasdaq-100 are up about 20% and 19%, respectively, largely due to growth in big tech stocks.

Like most stocks associated with artificial intelligence (AI), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) has benefited from the technology’s arrival in the mainstream. Alphabet’s stock has risen nearly 32% this year and hit a new all-time high in late June.

When stocks flirt with record highs, many investors become hesitant, fearing a possible correction. Whether that will happen remains to be seen, but in general, long term investorI’m working harder for Alphabet, and here’s why.

Google will remain the king of search engine advertising

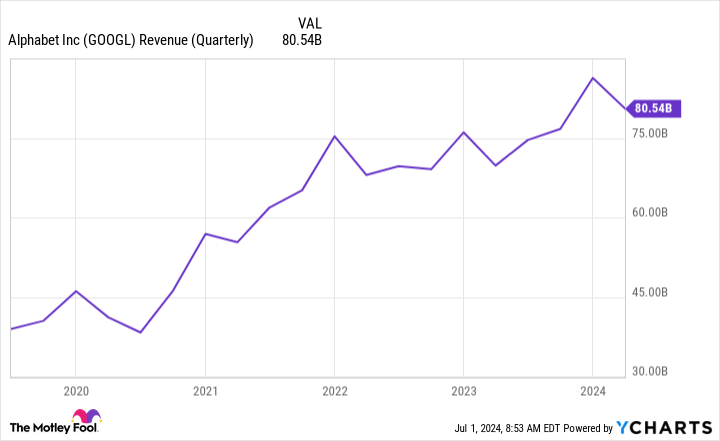

Alphabet’s bread and butter has been and will continue to be the money it makes from Google advertising. In the first quarter, Alphabet generated $80.5 billion in revenue, 76% of which came from Google advertising. The good news, however, is that this figure is lower than in previous quarters, a sign that the company is becoming less reliant on it.

Concerns about the impact of the new AI implementation on Alphabet’s ad revenue are legitimate but overblown. On the one hand, Google makes money when users click on links in its search ads. So if users’ questions are answered by Google’s AI, a slowdown is possible.

On the other hand, the integration of AI also opens up new advertising opportunities with new ad formats. Google advertising is so important to Alphabet’s business that it can be assumed that the company will not neglect the effect of implementing its AI Overview.

When you consistently hold around 90% market share in online search, you have more room to experiment and discover ways to improve user engagement and create more targeted advertising opportunities.

Google Cloud could be a huge growth area

The cloud computing industry is growing rapidly, and many believe that advances in AI will further fuel this momentum. Google Cloud is still far behind the leaders Amazon Web services (31% market share) and Microsoft Azure (25% market share) in terms of scalability, but the platform has crossed the threshold of profitability and should contribute to margin growth.

Cloud platforms have many fixed costs, such as data center operations and other infrastructure expenses. That means it takes some scale for platforms to reach sustainable profitability. Now that Google Cloud appears to have crossed that threshold, it should get a financial boost from a segment that once weighed on its margins.

Google Cloud’s revenue in the first quarter was $9.6 billion, up $2.1 billion from a year ago. Its operating income (profit from its core businesses) was up even more dramatically, increasing more than 370% from a year ago. That increased efficiency helped boost Alphabet’s operating margin to 32%, up from 25% a year ago.

Alphabet appears to be the best value in big tech

The “Magnificent Seven” is a phrase coined to describe seven of the world’s most influential technology companies. They include Microsoft, Apple, NvidiaAmazon, Meta-platforms, You’re hereand Alphabet. The tech sector is also changing, for the most part.

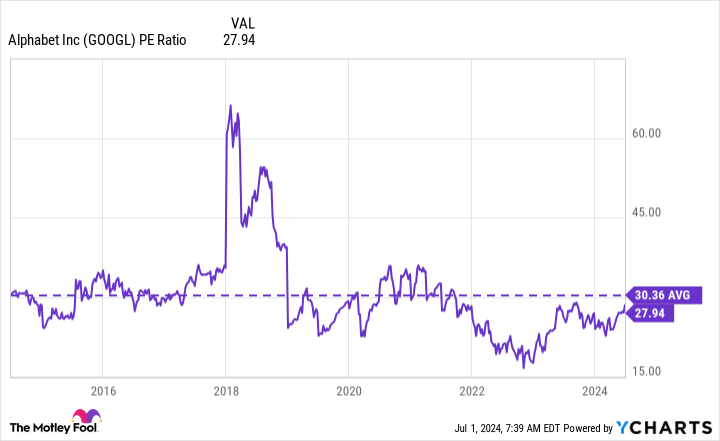

Alphabet appears to be the “cheapest” of the group, with a price-to-earnings (PE) ratio of just under 28. Being the cheapest of the Magnificent Seven doesn’t automatically make Alphabet cheap, as these stocks are consistently priced high, but Alphabet is cheaper than its average over the past decade.

This could be a great opportunity for investors to grab a piece of a world-class company at a reasonable price. Alphabet has strong growth prospects, so it’s easy to justify its valuation for long-term investors. That growth won’t happen overnight, but Alphabet’s recently announced dividend should give investors some patience.

The quarterly dividend is $0.20, with a yield of less than 0.5%, which may not be a must-have for income-seeking investors. Still, the launch of a dividend program should signal Alphabet’s confidence in its financial health and ability to maintain profitability over the long term.

Should You Invest $1,000 in Alphabet Right Now?

Before you buy Alphabet stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors Should Buy Now…and Alphabet Wasn’t One of Them. The 10 Stocks Picked Could Deliver Monstrous Returns in the Years to Come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $751,670!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Amazon’s Whole Foods Market, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a position in Apple and Microsoft. disclosure policy.

Alphabet Stock Hits New High. Here’s Why I’m Doubling Down was originally published by The Motley Fool