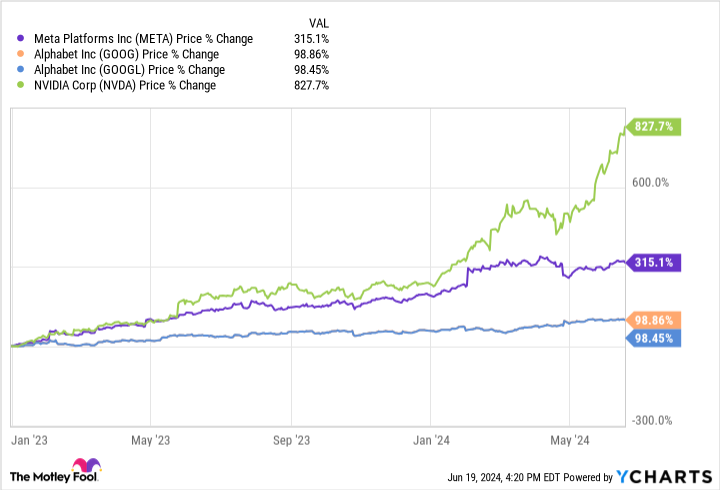

Achieving broad consensus is difficult these days, as I’m sure we all see as election season approaches. But one point of agreement, at least among billionaires hedge fund managers, does investing in big technology stocks like Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL), Metaplatforms (NASDAQ:META)And Nvidia (NASDAQ:NVDA) is wise. It’s been lucrative lately, with Nvidia leading the way, as shown below.

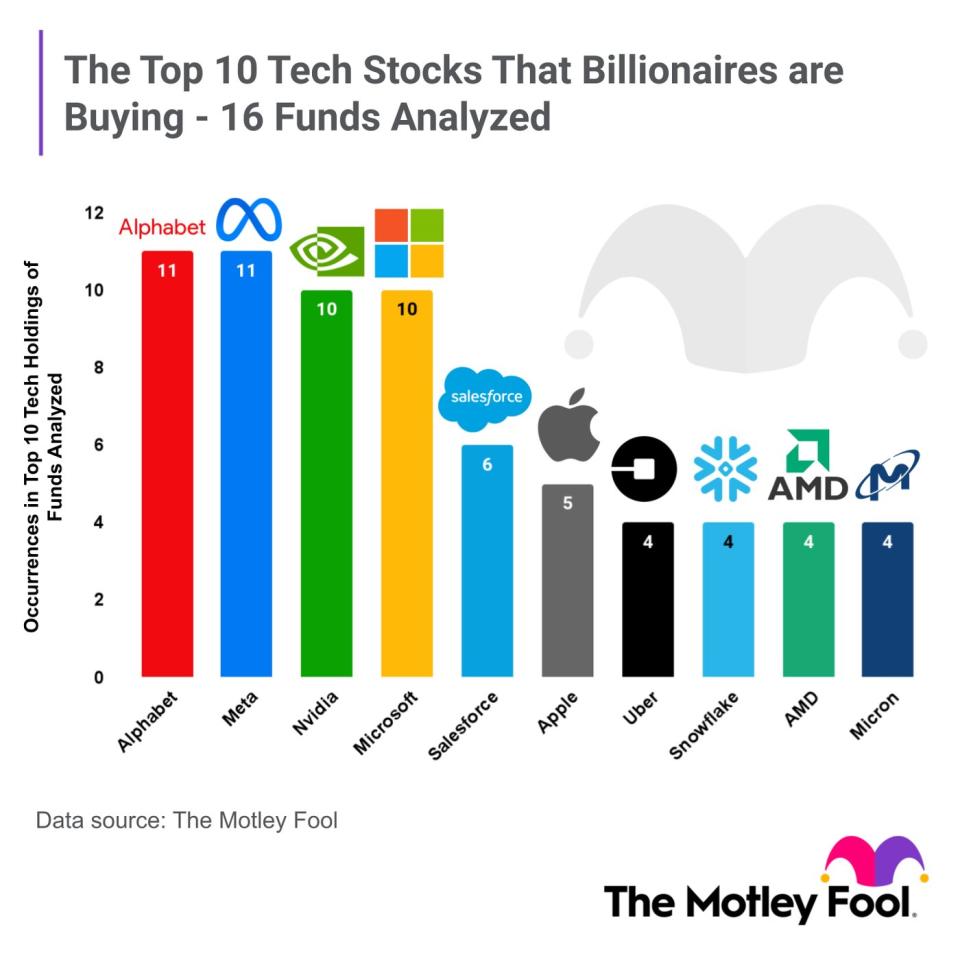

Of the 16 hedge funds analyzed by The Motley Fool, at least 10 own the three stocks listed above. among their top 10 technology stocks (starting in the fourth quarter of 2023).

Here are some reasons, so you can consider whether they should be in your portfolio as well.

Alphabet

Diving into its financial results, it’s easy to see why Alphabet is a favorite of hedge funds. In 2023, the company had revenue of $307 billion and operating profit of $84 billion. It followed that up with $81 billion in revenue and $25 billion in operating profit in the first quarter, representing year-over-year gains of 15% and 46%, respectively. The operating margin of 32% in the first quarter is particularly impressive. But perhaps the best quality is its ability to generate cash flow.

Alphabet produced $102 billion in cash from operations (CFO) in 2023 and $29 billion in the first quarter of 2024, putting it ahead of the 2023 figure. Cash from operations is an important metric because it shows how a company’s core business operates and how much of the profits are converted into cash. With CFO still higher than operating profit, this confirms that Alphabet’s earnings are of high quality.

It’s been decades since the dominance of Google Search was truly challenged. However, the release of ChatGPT and Microsoft’s investment to bring it to Bing was a wake-up call. Since then, Alphabet has responded with its own artificial intelligence (AI) tools. The company has been developing them for years, but they are finally coming to market.

Gemini is its most advanced generative AI chatbot yet, capable of answering complex queries, assisting with coding and much more. For example, if you want to update your resume, you can list your experience and qualifications and Gemini will produce a sample resume almost instantly.

Alphabet’s current price-to-earnings (P/E) ratio is 27, close to its five-year average. With its huge cash flow and continued growth, the stock makes a great long-term investment.

Metaplatforms

Meta, formerly Facebook, is making a big push to lead the AI arms race. Meta AI is a large language model (LLM) virtual assistant capable of answering complex queries, solving complex problems, and other functions. It is Meta’s answer to ChatGPT and is available on platforms like Facebook, Messenger, Instagram and WhatsApp.

At its core, Meta is an advertising company; 98% of first quarter revenue came from advertising. The more users and time spent on its applications, the more revenue it will generate. Meta AI could prevent users from leaving the app for competitors, like ChatGPT or Google, when looking for chatbot-like services.

Meta’s total revenue reached $36.5 billion in the first quarter, with an impressive 27% year-over-year growth. Operating profit increased from $7.2 billion to $13.8 billion.

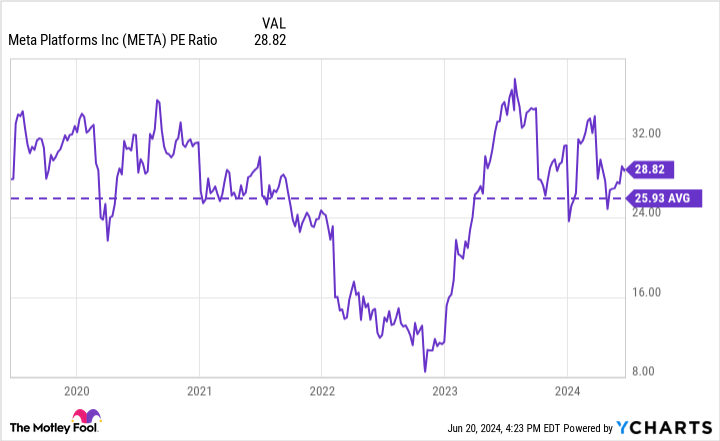

Tiger Global Management appears to be Meta’s biggest fan, as 19% of its tech portfolio is dedicated to its stocks. Meta’s current P/E ratio is slightly above its five-year average; however, the average is biased downward by the stock’s huge decline in 2022, as shown below.

This means the stock is probably close to fair value. Meta also introduced its first-ever dividend this year. The yield is low today, at less than 1%, but given the company’s profitability, it could increase significantly over time. Meta’s recent results have been tremendous, making it easy to see why it is a favorite of billionaires.

Nvidia

Nvidia’s rise to becoming the most valuable company on the planet is incredible, and it’s built on our endless appetite for data. Nvidia’s graphics processing units (GPUs) and software are crucial components for data centers and are in even greater demand due to the rise of AI.

Cloud software, data processing and storage, streaming services, and banking services all depend on the operation of data centers. According to one source, so-called hyperscaler data centers (many exceeding 100,000 square feet) are expected to grow by more than 100 per year over the next decade, giving Nvidia a long runway.

Nvidia did not disappoint in the first quarter, posting a 262% year-over-year increase in total revenue to $26 billion. Its data center sales exploded again to $23 billion, an increase of 427% year-over-year. The 10-for-1 stock split has also excited investors, even though the stock split has no direct effect on the value of the company or its shareholders.

Of the 16 billionaires’ portfolios studied, Nvidia is among the top 10 out of 10 tech stocks, with several of them placing it in the top three. However, new investors in Nvidia should consider the valuation before jumping in with both feet.

Its current P/E is above 70. It falls to 47 on a forward basis but still eclipses MicrosoftIt is (NASDAQ:MSFT) own high evaluation.

Nvidia will have a long and prosperous future, but consider cost averaging or waiting for a decline to accumulate shares now.

Most billionaires didn’t get rich by chance. These hedge funds study data, hire industry experts, and make smart stock purchases. While investors shouldn’t blindly follow their lead, reviewing their top picks is a great place to get ideas.

Should you invest $1,000 in Alphabet right now?

Before buying shares in Alphabet, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Alphabet wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $775,568!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Bradley Guichard holds positions at Alphabet and Nvidia. The Motley Fool holds positions and recommends Alphabet, Meta Platforms, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Alphabet, Meta and Nvidia: 3 technology stocks popular with billionaires was originally published by The Motley Fool