Nvidia (NASDAQ:NVDA) is the hottest company on the planet right now – and it’s not even close. Indeed, the microchip specialist is at the heart of the artificial intelligence (AI) revolution, and investors can’t seem to get enough of it.

Just a few days ago, Nvidia market capitalization exceeded $3.3 trillion and briefly exceeded Microsoft as the most valuable company in the world. With shares up about 150% so far this year, could Nvidia stock continue?

A Wall Street analyst thinks so. Hans Mosesmann of Rosenblatt Securities just raised his price target for Nvidia from $140 to $200. As of market close on June 21, a $200 price target implies a 59% upside from Nvidia’s current price. To put this in perspective, Mosesmann calls for Nvidia’s market cap to reach $5 trillion.

Let’s break down Nvidia’s rapid rise to become one of the biggest companies in the world and assess why now is a better time than ever to join the party.

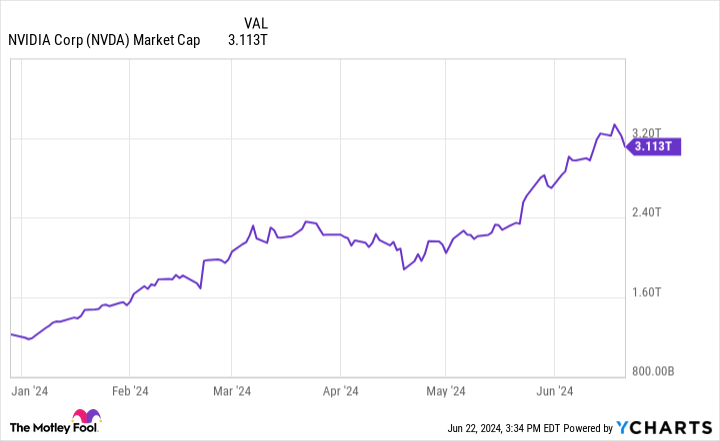

Nvidia’s path to $3 trillion

The chart shows how Nvidia’s market cap has changed so far in 2024. About six months into the year, the company has added almost $2 trillion in value. Not only is this unprecedented, but it is arguably justified.

For Nvidia’s first quarter of fiscal 2025 (ended April 30), the company reported a 262% year-over-year increase in revenue. Nvidia’s biggest source of business comes from data centers, which grew 427% year-over-year in the first quarter, to $22.6 billion.

What’s even better is that Nvidia isn’t just seeing an outsized acceleration in revenue. The company’s gross margin expanded nearly 14 basis points year over year in the first quarter. The combination of rising revenue and expanding profit margins has fueled Nvidia’s operating income and cash flow.

For the quarter ended April 30, Nvidia’s free cash flow increased 465% year-over-year to $14.9 billion.

Clearly, the company has no difficulty generating growth in any area of its business. Let’s take a look at how Nvidia reinvests its profits and what that could mean for the company’s future.

Could Nvidia stock continue to rise?

Today, Nvidia is primarily a data center and chip company. While I think both of these services will remain important to Nvidia, there are some important details to discuss.

Namely, Nvidia is far from the only company competing in data center services or the semiconductor space. Companies including Vertiv were also main beneficiaries of the AI boom, and have seen their own data center businesses take off. Additionally, Nvidia faces strong competition from Intel And Advanced microsystems in the field of graphics processing units (GPU).

Where Nvidia might have an advantage is in innovation. Right now, Nvidia’s most popular GPUs are its H100 and A100 chips. However, the company recently launched a new semiconductor line called Blackwell.

Speaking about Blackwell during Nvidia’s latest earnings conference call, management said: “Demand for the H200 and Blackwell is well above supply, and we anticipate that demand could exceed supply until ‘see you next year. »

While this is encouraging, Nvidia is not resting on its laurels. Earlier this month, Nvidia management previewed its next line of chips, dubbed Rubin. The pace at which Nvidia innovates is undeniably impressive.

Essentially, the company already created a hit with its already popular H100 and A100 lines, then quickly doubled down on its research and development efforts to create an even more superior product than Blackwell.

If that wasn’t enough to impress you, know that Nvidia is also investing in the area of AI-based robotics, as well as enterprise software. Earlier this year, the company invested in Figure AI, a humanoid robot competing with You’re hereIt’s Optimus.

Additionally, Nvidia is also investing in Databricks, one of the world’s most valuable software startups.

Is now a good time to invest in Nvidia stock?

When it comes to investing in Nvidia, there are two schools of thought. First, one could argue that the stock rose too dramatically and too quickly. Behind this reasoning, investors would say that the potential of Blackwell, Rubin and some of Nvidia’s other software and robotics initiatives is already priced into the stock.

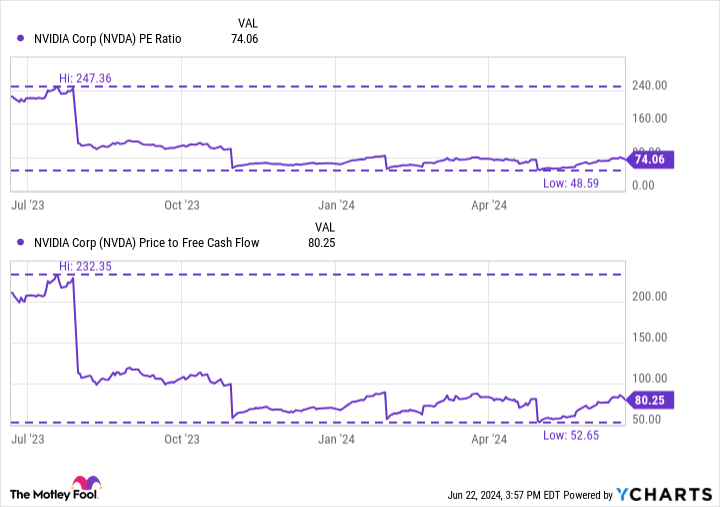

On the other hand, a closer look at valuation multiples might suggest otherwise.

The charts reflect Nvidia’s price-to-earnings (P/E) and price-to-free cash flow multiples over the last year. Did you notice anything interesting?

Despite Nvidia’s rising stock price, its breakeven valuation multiples are actually lower now that a year ago. This is happening because Nvidia’s profits and cash flow are accelerating at faster rates than the rise in the company’s value. This means that Nvidia shares are technically cheaper today than they were this time last year.

Given all the projects Nvidia is involved in, I have a hard time seeing the company falling behind in the AI race. Plus, given that the shares look reasonably valued at the moment, I think Nvidia is a no-brainer – whether or not it hits the $5 trillion milestone.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $774,526!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Adam Spatacco holds positions in Microsoft, Nvidia and Tesla. The Motley Fool holds positions and recommends Advanced Micro Devices, Microsoft, Nvidia and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short $405 calls in January 2026 on Microsoft. The Mad Motley has a disclosure policy.

A once-in-a-generation investment opportunity: Nvidia is now worth more than $3 trillion, and 1 Wall Street analyst thinks the stock can climb another 59%. was originally published by The Motley Fool