The year 2024 is off to a flying start. THE S&P500 has reached record highs as large-cap technology stocks, in particular, continue to fuel the artificial intelligence (AI) narrative.

The benchmark index had last bottomed around October 2022. Much of the market rebound since then, particularly in 2023, has been influenced by enthusiasm for AI, and this positive sentiment continues. ‘s reflected so far this year.

In particular, the actions of the “Magnificent Seven”, Microsoft, Alphabet, Apple, Amazon, You’re here, MetaplatformsAnd Nvidia (NASDAQ:NVDA), played a major role in pushing the market higher. Of this exclusive club, Nvidia is perhaps the most important. Demand for the company’s graphics processing units (GPUs) is off the charts, with generative AI rising to the top of IT budgets.

Despite a 264% share price rise over the last year, many investors see even brighter days ahead for Nvidia. Hans Mosesmann of Rosenblatt Securities has a $1,400 price target for Nvidia stock, implying ~61% upside from current trading levels.

Let’s take a look at why Nvidia could go even higher and assess whether now is a good opportunity to pick up some shares.

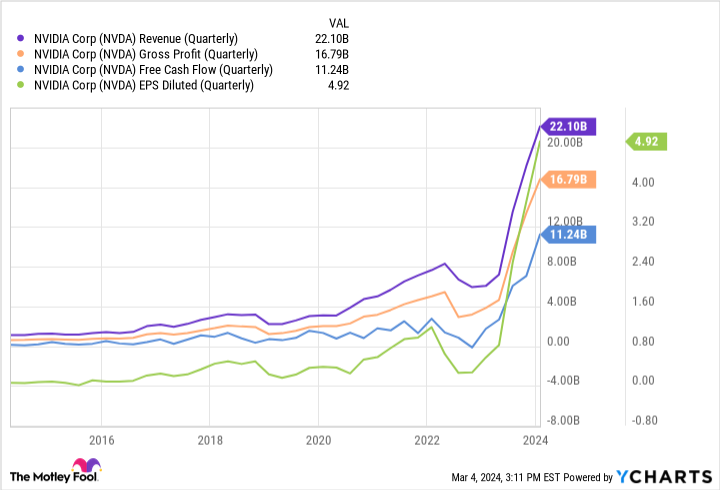

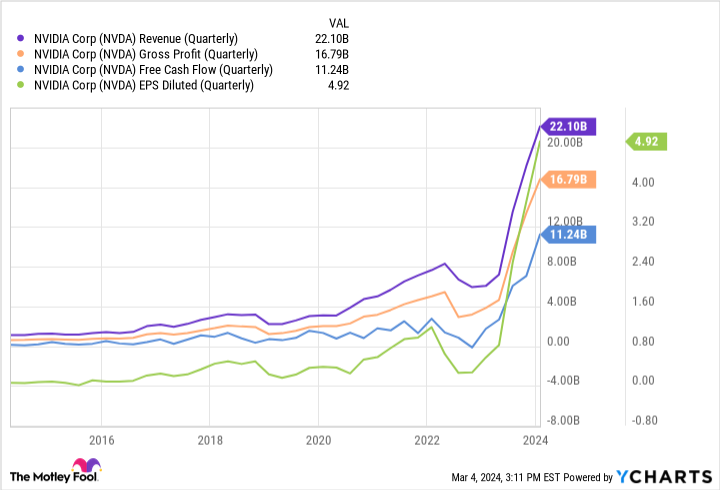

Nvidia is a money printing machine

The A100 and H100 are at the heart of Nvidia’s record growth. GPU. These GPUs help drive generative AI applications in machine learning, accelerated computing, and more.

The chart above illustrates just how much growth Nvidia is currently experiencing. Even though revenue is growing over 100% annually, it’s the company’s margin profile and cash flow generation that really excites me.

Nvidia’s free cash flow grew more than sixfold last year, while gross margin increased nearly 16 percentage points. One of Nvidia’s biggest strengths right now is its superior pricing power. The company’s semiconductor chips are widely considered the best in the industry, outperforming fierce competition from companies such as Advanced microsystems And Qualcomm.

While the above analysis paints an encouraging picture, Nvidia is far from just a chipmaker. The company has quietly hinted at where it sees future growth.

Some catalysts to watch out for

Over the past few weeks, investors have gotten a glimpse of how Nvidia is rolling out its new cash flow. Following a 13F filing in mid-February, investors learned that Nvidia invests in voice recognition software developer AI SoundHound. At the moment, SoundHound AI is a small company, generating only about $46 million in revenue in 2023. The most curious aspect of this deal is Why Nvidia could be interested in this area of artificial intelligence.

Apple has invested heavily in voice assistants, as evidenced by its acquisitions of Siri and Shazam. Additionally, Amazon and Alphabet both leverage similar technology in their Internet of Things (IoT) smart home appliances. While the details of Nvidia’s investment are still subject to speculation, I’m intrigued by its interest in voice recognition software, given that its cohorts have integrated the technology into many aspects of their respective businesses.

In addition to SoundHound AI’s participation, Nvidia has also invested in a unicorn startup called Figure AI. Figure AI is developing a humanoid robot, similar to Tesla’s Optimus. Humanoid robots are still in the early stages of development, but their ability to disrupt the job market should not be overlooked.

Goldman Sachs recently called humanoid robots an “AI accelerator” and predicts a $38 billion addressable market by 2035. This represents a potential market size more than six times that of Goldman’s initial research one year ago. The investment bank’s bullish forecast attributes higher-than-expected spending in areas such as large language models (LLMs) and capital expenditures (i.e. hardware). These are two areas where Nvidia not only disrupts, but dominates.

Finally, one area that I think is currently very neglected at Nvidia is software. The company is best known for its chips – for now. But during the fourth-quarter earnings conference call, investors learned that Nvidia has a billion-dollar enterprise software business. This could end up being an extremely lucrative source of growth in the long term, as software growth is expected to contribute to any deterioration in margins compared to operating existing hardware as competition in the chip space increases .

A well-deserved premium valuation

Nvidia is currently trading at a price-to-earnings (P/E) multiple of 72.7, well above its 10-year average of 55.5. Given the share price’s dizzying rise in a short period of time, this premium should come as no surprise.

The biggest question to think about is whether Mosesmann’s predictions could come true or if it is a lofty projection outside of reality. My opinion? Nvidia stock is rising. However, whether it hits a $1,400 price target is less of a concern to me.

The company dominates the market for AI-powered chips. And while I expect increased competition, I’m encouraged and impressed by the company’s investments in other growth areas. I believe Nvidia is establishing itself as a full-spectrum solution for AI applications – from data centers, chips and software. Despite its higher valuation compared to historical levels, I think now is a better time than ever to buy Nvidia stock. The long-term journey seems to have only just begun.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns March 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco holds positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. The Motley Fool holds positions and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Goldman Sachs Group, Meta Platforms, Microsoft, Nvidia, Qualcomm and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Mad Motley has a disclosure policy.

A bull market is here. 1 Magnificent Artificial Intelligence (AI) Stock to Buy with a 61% Upside, According to 1 Wall Street Analyst was originally published by The Motley Fool