Exchange-traded funds (ETFs) take the guesswork out of investing. They make it easy for everyone to build a portfolio that meets their investment needs.

A great way to use AND F is to generate passive income. You can easily invest in a portfolio of dividend paying stocks Or fixed income investments. THE Schwab US Dividend Stock ETF (NYSEMKT:SCHD), JPMorgan Equity Premium Income ETF (NYSEMKT: DONOR)And iShares 0-3 Month Treasury Bond ETF (NYSEMKT:SGOV) stand out as excellent ETF options for income-seeking investors considering purchasing in February.

Blue chip dividend stocks

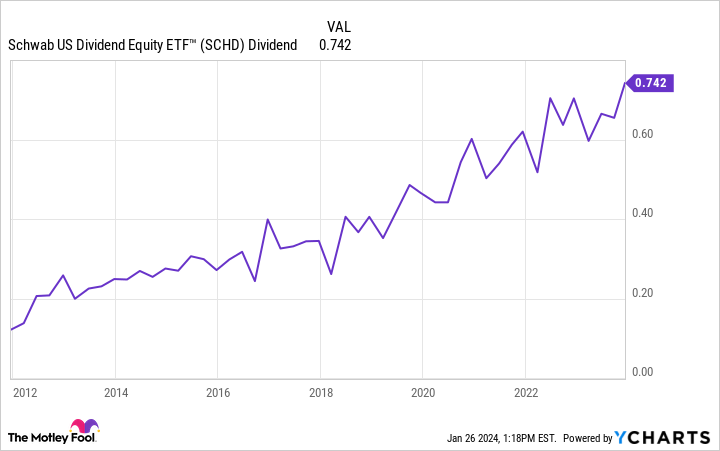

There are hundreds of great dividend paying stocks. This can make it difficult to choose the best ones to own. The Schwab US Dividend Equity ETF makes it easy to invest in some of the biggest dividend stocks through a simple vehicle. It tracks an index focused on companies that pay sustainable, quality dividends.

The ETF currently holds just over 100 stocks. Its top 10 holdings include notable names such as Verizon, ChevronAnd Coca-Cola. Two common threads run through the ETF’s holdings. Companies tend to pay higher yielding dividends (the ETF’s distribution yield over the past 12 months is 3.5%, more than double the S&P500(i.e. a dividend yield of around 1.5%). They also have an excellent track record of increasing their payouts. Many of the ETF’s holdings have increased their dividends every year for more than a decade. For this reason, the ETF has historically paid an increasing cash distribution to its holders.

The Schwab US Dividend Equity ETF gives investors access to a diversified portfolio of high-quality dividend stocks at a minimal cost (the ETF expense ratio is only 0.06%). As a result, investors keep more of the dividend income generated by these stocks.

Double income generators

The JPMorgan Equity Premium Income ETF offers investors two sources of income: dividends and subscription income. purchase options. It has a diversified portfolio of dividend-paying stocks. It holds more than 130 shares, including Microsoft, MasterCardAnd Visa currently among its 10 biggest titles. These stocks generate dividend income that the ETF passes on to investors.

In addition to this, it sells out-of-the-money call options on the S&P 500 index. Selling these options generates additional income that the fund returns to investors.

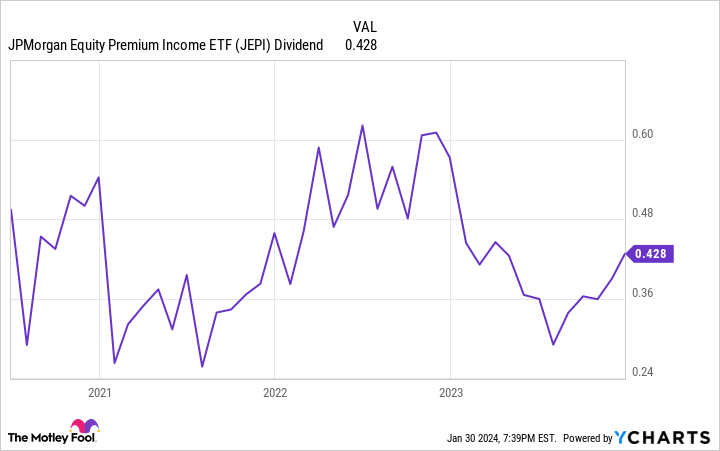

Over the past 12 months, the ETF has paid an attractive yield of 9.8%. Meanwhile, it charges investors a reasonable ETF expense ratio of 0.35%.

There is one caveat to this ETF, however. Income distributions can vary significantly from month to month because volatility significantly affects the income it can generate from the sale of call options.

This income variability does not suit everyone. However, it is an attractive option for investors who are willing to trade some payment fluctuations for a higher-yielding income stream with more upside potential.

Take advantage of higher rates

The Federal Reserve has raised interest rates significantly over the past two years. The federal funds rate is currently between 5.25% and 5.5%. As a result, most fixed income investments currently offer a higher yield, including U.S. securities. Treasures.

The iShares 0-3 Month Treasury Bond ETF focuses on the shortest duration Treasury bonds (those that mature within the next three months). Treasuries are currently yielding the most as the market expects the Fed to cut rates later this year. This ETF recently had a 30-day yield of around 5.4%.

This ETF makes it easy for investors to put their idle cash to work and earn a higher return than they would likely get on the interest paid by their broker. It charges very low fees (ETF expense ratio of 0.07%), making it a great option for investors looking to generate short-term income on their cash flow.

These Best ETFs Make It Easy to Generate More Income

ETFs offer investors many ways to generate more passive income. They also make it easier since investors don’t need to take the time to research the best dividend stocks, learn how to trade options, or manage the maturities of a Treasury portfolio. While there are many income-focused ETFs, the Schwab US Dividend Equity ETF, JPMorgan Equity Premium Income ETF, and iShares 0-3 Month Treasury Bond ETF are great models to consider adding to your portfolio. your income portfolio this month.

Should you invest $1,000 in the Schwab US Dividend Equity ETF right now?

Before buying shares of the Schwab US Dividend Equity ETF, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and the Schwab US Dividend Equity ETF was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns effective January 29, 2024

Matthew DiLallo has positions in Chevron, Coca-Cola, JPMorgan Equity Premium Income ETF, Mastercard, Verizon Communications, Visa and iShares Trust-iShares 0-3 Month Treasury Bond ETF. The Motley Fool ranks and recommends Mastercard, Microsoft and Visa. The Motley Fool recommends Chevron and Verizon Communications and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

3 Best ETFs to Buy for Easy Income in February was originally published by The Motley Fool