Artificial intelligence (AI) has the potential to be one of the greatest revolutionary technological advances the world has ever seen. Businesses are just beginning to embrace the technology and what it can do. However, early results are very promising, allowing organizations to become more efficient and better serve their customers.

But make no mistake, artificial intelligence is still in its early stages, and there are plenty of opportunities for investors to profit from companies leading the way in AI. Let’s look at some of the best actions to play with AI bull run.

Nvidia

No business benefits more from AI today than Nvidia (NASDAQ:NVDA). The graphics processing unit (GPU) maker has become the backbone of the infrastructure needed to power AI applications in data centers. GPU chips are capable of performing technical calculations faster and with less energy than central processing units (CPUs), making them ideal for use in AI training and inference.

Nvidia’s GPUs, meanwhile, have become the industry standard thanks to its CUDA software platform, which allows its chips to be directly programmed, saving customers time and money.

Nvidia will continue to be the go-to company for building the most powerful data centers needed for AI applications. Meanwhile, Nvidia is no one-trick pony, and its networking business also benefits greatly from AI.

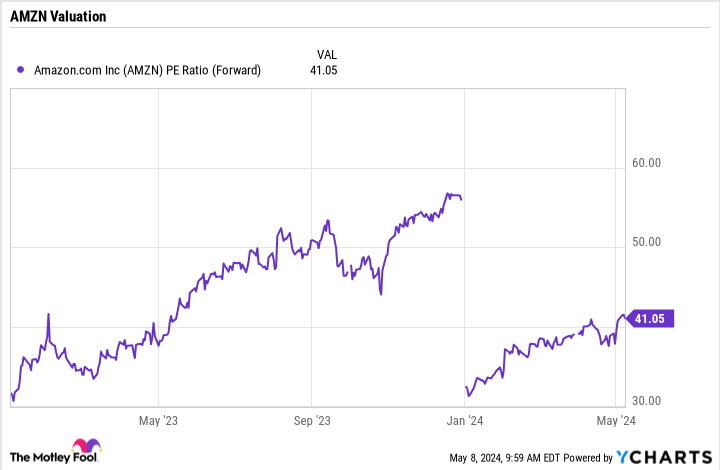

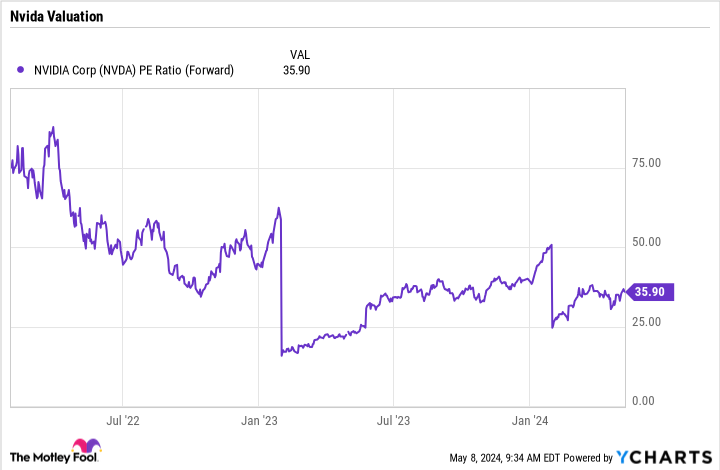

Nvidia has seen incredible growth, including more than tripling revenue in its most recent quarter. Despite this, the stock is attractively valued at just a forward P/E of 36, setting it up for upside as the company grows and investors bid up the stock price.

Amazon

When it comes to AI, Amazon (NASDAQ:AMZN) This may not be the first title that comes to mind. However, the e-commerce giant has invested heavily in technology.

The company has the largest cloud business, Amazon Web Services, or AWS, which benefits from the proliferation of AI. It also developed two chips, Trainium and Inferentia, intended to be used specifically for AI applications.

On the software side, the company has developed platforms to help customers create their own AI models and applications. Its SageMaker platform helps customers build, train and deploy machine learning models, while its Bedrock platform offers customers high-performance models from Amazon and other leading AI companies through a single API to help them to create AI applications.

Amazon has also created its own AI-based assistant for software developers, Amazon Q. The AI assistant can write, test and debug code. He can also answer questions about company policies, products and other topics.

Amazon has shown in the past that it’s willing to spend big to ultimately win big, and AI appears to be no exception. Trading at a forward P/E of around 41, the stock has room to rise given the AI growth opportunities available to the company.

AI SoundHound

Actions of AI SoundHound (NASDAQ:SON) skyrocketed earlier this year following news that Nvidia had invested in the AI-powered voice assistant company. However, more recently the stock has returned to a more reasonable level.

Soundhound’s technology helps voice assistants and humans interact more naturally, allowing users to ask more complex questions while getting better answers. The company has made strong inroads in the automobile industry and is also making good progress in the catering sector. However, applications of its technology are expected to extend far beyond these two industry verticals.

The company has an attractive recurring revenue business model through which it earns royalties based on volume, usage or product lifespan. For applications where no product is involved, such as its catering offering, it uses a subscription model.

SoundHound is still relatively small, generating just $46 million in revenue last year. However, it has a large order backlog of $661 million which, if fulfilled, will turn into revenue over the next few years. The weighted average duration of its contracts is around six and a half years, with more revenue coming down the line. Much of the company’s delay comes from its relationships with around twenty automobile brands and the integration of its technology into new models of their vehicles.

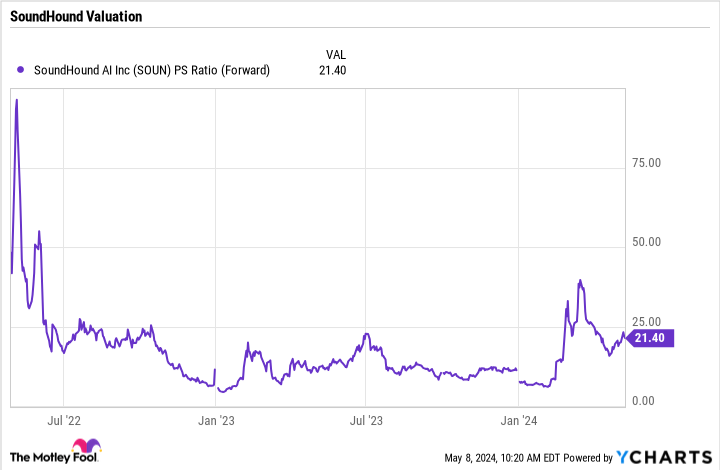

Trading at more than 21 times forward sales, SoundHound stock isn’t cheap. However, its valuation has fallen significantly in recent months and it has great growth potential if it can continue to expand its technology into more products. Getting into smartphones, for example, would be a game-changer for the company and the stock.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $550,688!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

3 Top AI Stocks Poised for a Bull Run was originally published by The Motley Fool