Stock market corrections, and especially bear markets, traditionally provide some of the best buying opportunities. During a correction, investors are skeptical of a company’s short-term performance and some choose to sell stocks rather than hold them during periods of volatility. Even the best companies can see their stock prices fall along with the broader market, even if their long-term investment theses remain intact.

here’s why caterpillar (NYSE:CAT), Procter & Gamble (NYSE:PG)And Home deposit (NYSE:HD) stand out like three dividend stocks worth buying during a market correction.

Cyclical profits but a non-cyclical dividend

Lee Samaha (Caterpillar): This heavy equipment company might seem like an odd choice here, but hear me out. Although the company’s revenue and earnings will always fluctuate depending on its key end markets, its free cash flow (FCF) generation will likely cover its dividend in a variety of market conditions.

This makes Caterpillar a good reference stock for investors looking for income during a stock market downturn. In other words, if its stock falls, its dividend yield will increase, and because its dividend is sustainable, investors can buy the stock with confidence for its yield. Let’s play with some numbers to demonstrate this.

The company’s current dividend is approximately $2.6 billion. However, management’s estimate for its full-cycle machinery, energy and transportation (ME&T) FCF is $5 billion to $10 billion. In case you’re wondering, Caterpillar defines its FCF this way to eliminate the noise around its FCF number created by its financial arm.

FCF’s target range recognizes that its revenues and earnings are volatile and dependent on market conditions in sectors such as construction, mining, energy and infrastructure. Still, the key point is that even at the bottom of the cycle, $5 billion of FCF will easily cover its $2.6 billion dividend. In fact, there’s a strong argument that Caterpillar should be more aggressive in increasing its dividend.

Additionally, Caterpillar’s focus on growing its less cyclical services business (with a goal of doubling services revenue from $14 billion in 2016 to $28 billion in 2026) will reduce the cyclicality and will improve FCF generation in the future.

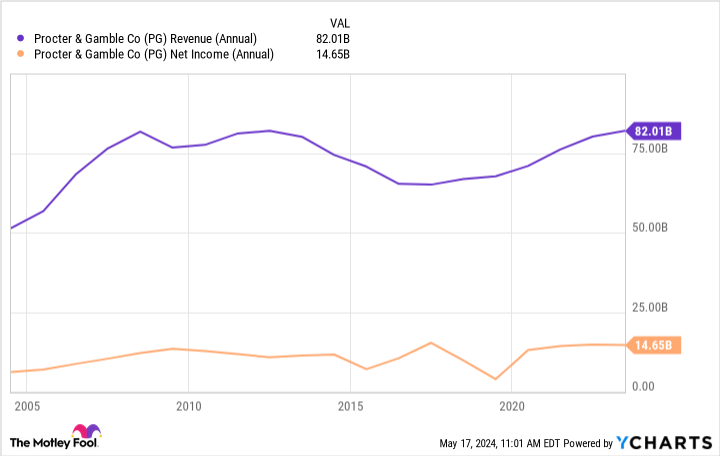

P&G is a royal choice for a safe dividend play

Scott Levine (Procter & Gamble): While the S&P500 has steadily increased throughout the first half of 2024, experienced investors know that the market rise cannot continue indefinitely. Sure, no one wants to see the value of their investments decline, but market corrections provide excellent opportunities to pick up strong stocks at a discount – strong stocks like Procter & Gamble.

With a history dating back 187 years, P&G has demonstrated considerable resilience in the face of market downturns and other challenges, making it an ideal consideration for investors looking to bolster their portfolios with a leading stock in the consumer staples sector which currently offers a forward dividend of 2.4%. .

From fabric care to beauty to grooming, P&G offers a wide variety of brands in its impressive portfolio. And while consumers may cut back on their streaming subscription services or go out to eat a little less often, it’s highly unlikely they’ll stop buying baby diapers or decide to cut back on shampoo and deodorant purchases. Many companies could see declines in revenue and profits, but P&G is well-positioned to weather the volatility.

So it’s not that hard to see why the company has amassed such an impressive history of rewarding shareholders. For 134 consecutive years, P&G has paid dividends and has increased its dividends for the last 68 consecutive years, earning it the title of dividend king.

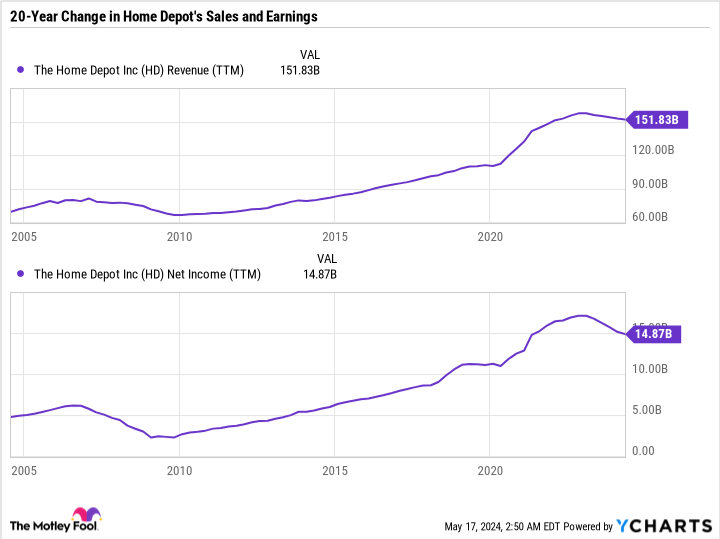

Home Depot is poised for long-term success

Daniel Foelber (Home Depot): Cyclical companies like Home Depot are more prone to downturns than recession-resistant companies like Procter & Gamble And Coca-Colawhich benefit from relatively stable demand whatever the economic situation.

Home Depot depends on the strength of the consumer and, to a lesser extent, professional contractors. A growing economy is a boon for Home Depot’s business. When consumers are financially stable, they may choose to undertake costly renovations. Likewise, the construction industry and contractors can win more business when demand is high – which, again, depends on a good economy.

Since the 2007-2008 financial crisis, Home Depot has enjoyed a virtually uninterrupted period of sales and net income growth – until recently.

The slowdown over the past two years is evident in the chart. In its first quarter 2024 earnings release on May 14, Home Depot reaffirmed its guidance for 1% sales and diluted earnings per share growth. But Home Depot’s 2024 calendar includes an extra week compared to 2023. Taking this into account, sales and profits are expected to decline slightly.

Home Depot has done a great job investing in long-term growth while managing its inventory to prepare for slowing demand. It has made some of the largest acquisitions in its history in recent months, which is against the grain given that Home Depot is facing a downturn, not an expansion. But the company can afford to take such steps because of the strength of its balance sheet.

With a payout ratio of 57%, Home Depot can afford to continue increasing its dividend even if earnings growth slows. The company has increased its dividend by 65% in the last five years alone. With a yield of 2.6%, Home Depot can be a solid source of passive income and the ideal leading business to pick up if it falls out of favor for short-term reasons.

Should you invest $1,000 in Caterpillar right now?

Before buying Caterpillar stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Caterpillar was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $635,982!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Daniel Foelber holds positions at Caterpillar. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool posts and recommends Home Depot. The Mad Motley has a disclosure policy.

3 Super Safe Dividend Stocks to Buy in a Market Correction was originally published by The Motley Fool