When choosing stocks, investors sometimes like to follow the lead of billionaires, often even if they don’t know the motivations behind those stocks. But these investment titans may have bought stocks at a lower valuation. In other cases, they might rely on years of dividend gains that are less meaningful to an investor today.

Ultimately, billionaires have their own reasons for buying and holding specific stocks. Still, some of these stocks, especially if they were recently acquired, might be suitable for small investors. Let’s look at three of these stocks right now.

Alphabet

Amid growing interest in AI, Google’s parent company Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) has attracted the interest of billionaires such as Bill Ackman of Pershing Square Capital.

Indeed, recent public interest in AI was primarily driven by other companies. When the public learned of OpenAI’s ChatGPT capabilities, investors flocked to Alphabet on the assumption that the longtime AI leader was lagging behind its peers.

However, Alphabet responded with its own generative AI product in Gemini. Additionally, it has long led the way in AI, having first introduced AI into its search engine in 2001. It became an AI-focused company in 2016 and is now driving AI innovation via Google DeepMind.

Plus, its $108 billion in liquidity gives it the resources to stay on top. HAS price/earnings ratio (P/E)out of 27, the stock also has the lowest earnings multiple among tech megacaps, an attribute that likely caught Ackman’s attention and could generate higher returns as it catches up with its peers.

Ali Baba

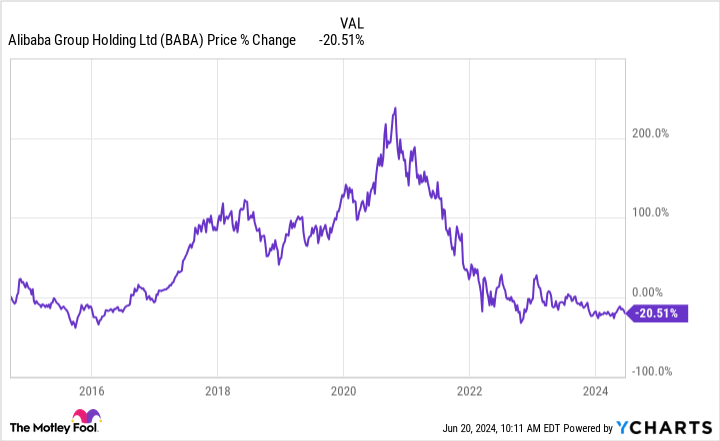

Another interesting title is Ali Baba (NYSE:BABA), which attracted the interest of billionaire David Tepper’s Appaloosa Management. Although it is China’s leading e-commerce conglomerate, its shares have suffered from political unrest. Alibaba is an American Depositary Receipt rather than a real stake in Alibaba.

Such arrangements are only of concern if one’s home country’s relations with the United States deteriorate. Unfortunately, this has been the case with Alibaba, which has lost value since its launch in 2014. initial public offering (IPO) therefore.

Still, the United States and China have a lot to lose if such a deal fails, making it more likely that Alibaba’s stock will survive.

Indeed, Alibaba’s revenue grew nearly 18 times between fiscal years 2014 and 2024. Additionally, its shares have traded in a range over the past two years. With rising profits and a price-to-earnings ratio of just 17, the company is selling at a massive discount to similar companies in other countries, like Amazon.

Ultimately, Alibaba is not suitable for risk-averse investors. Still, if one can stomach the political risk, the stock could become a great opportunity to buy an e-commerce conglomerate at a deep discount.

Snowflake

Snowflake (NYSE: SNOW) might be one of billionaire Warren Buffett’s most surprising choices. Berkshire Hathaway as Buffett has often avoided IPO investments in the past.

Still, investors should watch Snowflake for its leadership in the data cloud market. Its product allows organizations to manage, store and secure data in a central cloud-based repository. The software is so compelling that Amazon has offered it to some of its cloud customers despite selling its own data cloud product.

To be sure, investors had highly valued the stock before an earnings slowdown, and a sudden change at the CEO level shook investors. However, in the first three months of fiscal 2025 (ended April 30), its net retention rate – a measure of recurring revenue from existing customers – stood at an impressive 128%, the revenue model based on the use of Snowflake sometimes forcing customers to spend. more money on the platform.

Additionally, amid a falling stock price, its price-to-sales (P/S) ratio is at an all-time high of 14. Therefore, buying during this period of relative struggle could pay off for investors, as more customers benefit from its data cloud. product.

Should you invest $1,000 in Alphabet right now?

Before buying shares in Alphabet, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Alphabet wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $723,729!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy holds positions at Berkshire Hathaway and Snowflake. The Motley Fool holds positions and recommends Alphabet, Amazon, Berkshire Hathaway and Snowflake. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

3 Obvious Billionaire-Owned Stocks to Buy Right Now was originally published by The Motley Fool