Are you hoping to become a self-made millionaire? It’s certainly possible even if you’re not an artist or professional athlete. The key for most ordinary people is simply to invest what you can when you can, select the right stocks, and then leave them alone long enough to let them do the heavy lifting.

Here’s a look at three magnificent stocks that have not only helped many investors become millionaires, but will likely continue to do the same well into the distant future.

1. Coca-Cola

There’s nothing particularly exciting about The Coca-Cola Company (NYSE:KO). Of course, it’s the name of the most popular soft drink in the world. It also owns several other familiar brands, such as Gold Peak tea, Minute Maid juices, Powerade sports drinks and Dasani water, to name a few. But the beverage industry is crowded, competitive and limited in terms of growth potential.

But that market saturation doesn’t really matter when you’ve perfected the art – and science – of convincing people to buy your product again and again, which is precisely what this company did. From a brilliant combination of ongoing lifestyle branding efforts (most Gen Leveraging its size when negotiating pricing, production, and product placement with its retail and bottling partners, Coca-Cola has become the parent company of many of the most recognized companies in the world. beverage brand names.

Investors are also on board. Fifty years ago, a $10,000 investment in Coca-Cola stock would be worth about half a million dollars today. And that’s just the stock price appreciation. By reinvesting all dividends paid in the meantime into more shares of Coca-Cola, your original investment would now be worth more than $2 million. Slow and steady clearly wins the race.

The hardest part of owning a stake in this slow dividend payer is, of course, remaining patient enough to let your reinvested dividends build enough cash-generating critical mass to matter. Not everyone is willing or able to wait and watch, knowing that big returns are to be expected.

This might help: The Coca-Cola Company has increased its dividend every year for the past 62 years. The adjusted quarterly dividend of $0.195 distributed in 1994 has now increased to $0.485 per share. It is also worth remembering that there will never be a time when people are not thirsty.

2. Alphabet

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) don’t pay a significant dividend. Its current yield stands at just under 0.5%. Google’s parent company has instead taken a more direct approach to turning its investors into millionaires. Since the company’s IPO in 2004, shares have gained an incredible 7,000%.

Granted, the company’s best days are probably in the past. Search engines aren’t exactly a high-growth business anymore, now that much of the developed world is already online regularly. It’s also a crowded market, with alternative search engines like MicrosoftIt’s Bing who is gaining ground.

This line of thinking, however, goes beyond a few important realities about Alphabet.

One of those realities is the fact that while the search engine market is no longer a huge growth driver, it’s not the only business that has a significant impact on Alphabet. YouTube now accounts for about a tenth of the company’s revenue, and just over a tenth of the company’s total revenue comes from its still-young cloud computing arm. Alphabet’s cloud arm only recently reached an operating profit, and its results continue to grow at a much faster rate than any of its other businesses. The market may be underestimating the near-term earnings growth that is anticipated here.

The other detail worth highlighting is that even though Google, Alphabet’s moneymaker, already controls 90% of the global search engine market – according to figures from GlobalStats – there are still plenty of opportunities to above-average growth in this area. Market researcher Mordor Intelligence estimates that the market for next-generation search engines (enhanced by the addition of artificial intelligence, for example) is expected to grow at an annualized rate of nearly 15% through 2029. Alphabet’s first-quarter advertising revenue was also up 14.3% year-over-year.

Connect the dots. Every time it seems like the company is running out of opportunities, it finds a new lever or two to pull.

3. Amazon

Last but not least, add Amazon (NASDAQ:AMZN) to your list of magnificent actions that have already made many millionaires, but which could continue to make more.

The business doesn’t need much introduction. It’s arguably possible that it launched the entire e-commerce industry when Internet access became common in the late 1990s and early 2000s. Market research company eMarketer estimates that Amazon controls about 40% of the U.S. e-commerce market. But despite Amazon’s dominance of the North American online shopping landscape, eMarketer estimates that Amazon’s share of this market will continue to grow at least until 2025 rather than stagnate or even decline.

This dominance is only part of the bullish argument for owning Amazon stock, however. Amazon is also the largest provider of cloud computing services in the world, and this business is a beast. It represents more than 60% of the company’s operating profit, driven again by the 17% growth in its turnover in the first quarter. Although already well developed, Mordor Intelligence claims that the global cloud computing services market is poised to grow at an average annual rate of more than 16% until at least 2029.

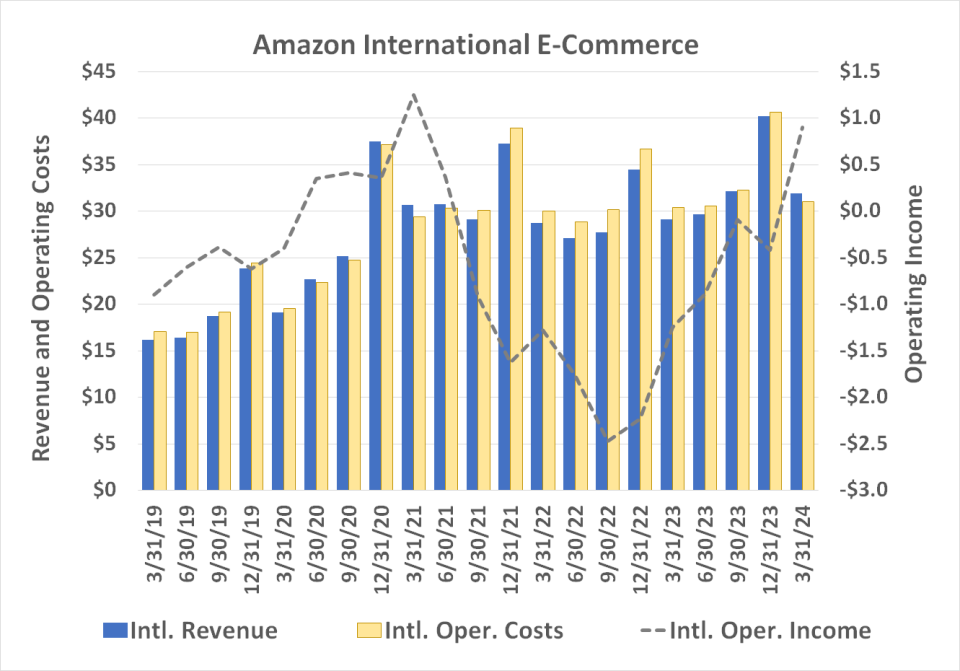

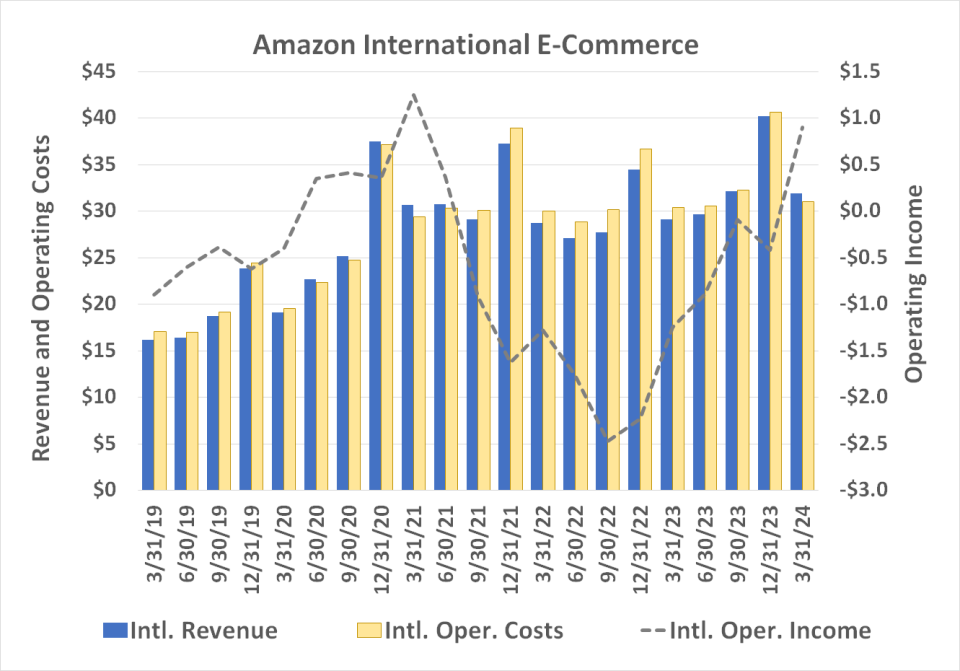

Amazon is finally firing on all cylinders on another front as well. This is international e-commerce. If this branch regularly operates in the red (except at the height of the coronavirus pandemic), it has been reducing the operating costs of its international activities for several years and increasing its sales. Last quarter’s international operating profit of $903 million was the most profitable this unit has ever seen since its record profit of $1.25 billion in the first quarter of 2021. Only this time, there’s room and reasons for the trajectory to continue to increase both its sales and revenues.

Meanwhile, Amazon remains the powerhouse of online commerce in North America.

Amazon stock is unlikely to be able to repeat the 244,000% gain since its 1997 IPO over the next 27 years. That certainly doesn’t mean it can’t continue to outperform the broader market.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Amazon was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $830,777!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley holds positions at Alphabet. The Motley Fool holds positions and recommends Alphabet, Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Magnificent Stocks That Have Created Many Millionaires and Will Continue to Make More Millionaires was originally published by The Motley Fool