Utilities run very boring businesses. They distribute electricity and natural gas to their customers under government-regulated rate structures. There aren’t many pros in this industry (demand and prices are relatively stable), but there aren’t many cons either. For this reason, utilities generate fairly stable returns, much of which comes from their high-yielding dividend payments.

Investors looking to add more stability to their portfolio should consider purchasing a boring stock. utility stock. Black hills (NYSE:BKH), Consolidated Edison (NYSE:ED)And Duke Energy (NYSE:DUK) stand out from a few Fool.com contributors as excellent options for those looking for a sustainable, high-yielding dividend.

Black Hills is the mouse that roared

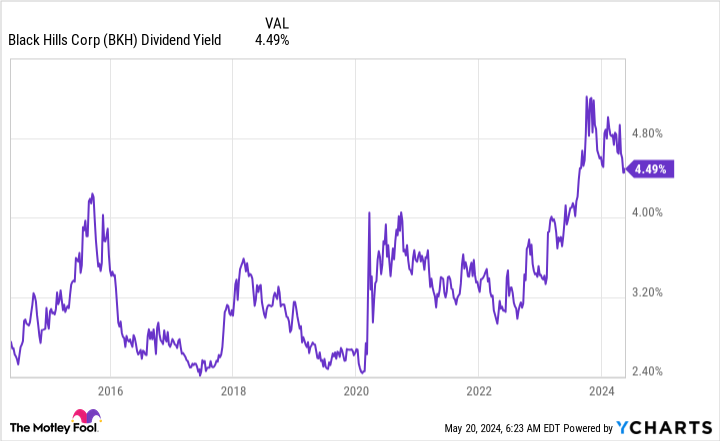

Ruben Gregg Brewer (From the black hills): When it comes to utility stocks, Black Hills, with a market cap of $3.9 billion, often flies under the radar. That’s a shame, because the regulated natural gas and electric utility is a dividend king with 54 consecutive years of annual dividend increases. The average dividend increase over the last three, five and ten years is around 5%, showing incredible consistency. Meanwhile, the yield is currently around 4.5%, which is at the high end of the yield range over the past decade.

In other words, Black Hills appears to be a dividend-for-sale king. There is good reason for this, however, as operating a utility is a capital-intensive business. The sharp rise in interest rates will increase Black Hills’ costs in the future. There’s no way around this, also knowing that the utility tends to use more leverage than some of its larger peers.

That said, Black Hills’ customer growth has increased at a rate nearly three times that of the U.S. population. It operates in highly attractive markets in Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota and Wyoming. This suggests that regulators will, over time, adjust the company’s rate structure to account for changing interest rates. If you have the patience to wait for that to happen, you can get a historically high dividend yield through a pretty boring Dividend King utility.

The king of consistency

Matt DiLallo (Edison consolidated): Consolidated Edison supplies electricity and natural gas to customers in the New York metropolitan area. Even though public services are boring activities, they generate very predictable cash flow supported by consistent demand and government-regulated pricing structures. This gives Consolidated Edison stable its revenues to pay dividends and invest in the maintenance and expansion of its public service infrastructure.

The public service encountered a major problem dividend milestone earlier this year. It made its 50th consecutive annual dividend increase. This is the longest period of consecutive dividend increases among utilities listed in the S&P500. This also brought the company into the elite group of Dividend Kings. Consolidated Edison’s dividend increase currently yields just under 3.5%, more than double the dividend yield of the S&P 500 (around 1.3% based on dividend payments over the past year ).

While the company expects continues to increase its dividend, growth will likely be moderate. Consolidated Edison plans to target a dividend distribution rate 55 to 65% of its adjusted profit to finance higher levels of investment in the transition to clean energy. That’s down from its previous target of 60 to 70 percent. It plans to retain more of its profits to fund internal growth. This strategy should allow Consolidated Edison to grow its earnings per share more quickly in the future. This allows it to potentially produce higher total returns by adding its dividend income to the stock price appreciation it is expected to generate as its earnings grow.

Consolidated Edison’s dividend is expected to become more sustainable in the long term as it reduces its payout ratio and invests in supporting the transition to clean energy. These features make it an attractive option for those looking for a very bankable income streams.

The refocusing of this public service should pay off big

Néha Chamaria (Duke Energy): Duke Energy is one of the largest regulated utilities in the United States and operates in growing regions like Florida and the Carolinas, among others. In fact, the company sold its unregulated commercial renewable energy business in 2023 for $2.8 billion and became a fully regulated utility. The company said it would use net proceeds from the sale of approximately $1.1 billion to reduce debt and strengthen its balance sheet.

2023 was also a good year for Duke Energy, as it added the most customers in its history and increased its five-year capital investment plan to $73 billion to lead its clean energy transition. The utility giant is targeting net zero carbon emissions from electricity generation by 2050 and has therefore planned massive investments to modernize its electricity network and expand its energy storage, renewable energy, natural gas and nuclear energy in the years to come.

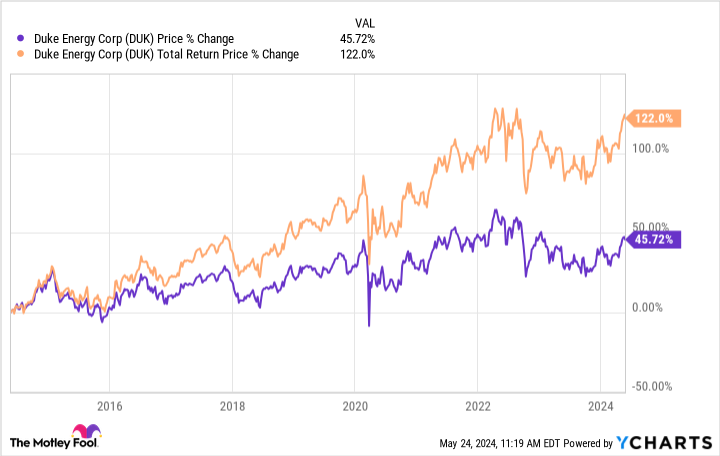

Supported by a portfolio of fully regulated assets in growing jurisdictions, Duke Energy expects to grow its adjusted earnings per share by 5-7% through 2028. Coupled with a 4% dividend yield, management estimates that Investors in Duke Energy could earn nearly 10% annualized returns. Duke Energy is also a bankable dividend stock. It has paid a dividend every quarter for 98 years and has increased its dividend over time. So far, this dividend growth has significantly boosted shareholder returns. Over the past 10 years, Duke Energy stock has more than doubled investors’ money when factoring in dividends.

With Duke Energy now shifting its focus entirely to regulated companies and strengthening its balance sheet, income investors have strong reasons to consider this boring utility stock.

Should you invest $1,000 in Duke Energy right now?

Before buying Duke Energy stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Duke Energy wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $652,342!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Matt DiLallo has no position in any of the stocks mentioned. Néha Chamaria has no position in any of the stocks mentioned. Ruben Gregg Brewer has positions in Black Hills. The Motley Fool recommends Duke Energy. The Mad Motley has a disclosure policy.

3 High-Yielding Stocks to Buy in This Boring Sector was originally published by The Motley Fool