Have a quality portfolio dividend stocks This deposit of money into your account makes occasional market dips much easier to tolerate. Three Motley Fool contributors recently selected three solid companies with long records of paying consistent dividends to shareholders. here’s why Philip Morris International (NYSE:PM), Williams-Sonoma (NYSE:WSM)And Real estate income (NYSE:O) could provide you with years of passive income.

This Classic Dividend King Generates Surprising Growth

Jeremy Bowman (Philip Morris International): Philip Morris International may seem like a surprising choice for a lifetime dividend stock, but the company is more than just a tobacco stock in an era of declining cigarette consumption.

Philip Morris has the assets to compete with any dividend stock. Including the time when it was combined with Altria, Philip Morris has increased its dividend every year for more than 50 consecutive years. The international Marlboro seller also currently offers a dividend yield of 5.1%, enough to make it a high-yielding stock, but what really makes the stock attractive to long-term dividend investors is the how the company managed to move towards next-generation products. such as Iqos heated without combustion tobacco sticks and Zyn nicotine sachets.

In fact, smoke-free products now represent around 40% of its turnover and this business is growing rapidly. Overall shipment volume increased 3.6%, driven by 21% growth in heated tobacco units and 36% in smokeless oral products.

This performance helped push organic revenues up 11% to $8.8 billion and adjusted, currency-neutral earnings per share (EPS) to $1.50. The company also demonstrated its confidence in the Iqos brand by purchasing the sales rights in the United States from Altria for $2.7 billion, and is now strengthening its presence in this market.

Even though cigarette consumption is declining, the demand for nicotine products still exists and Philip Morris is ahead of its competitors in capturing it. This should pay dividends handsomely to investors over the coming years.

Price gains plus dividends

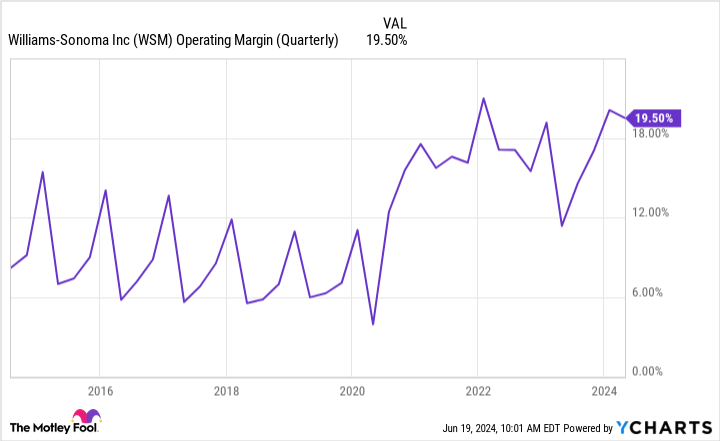

Jennifer Saibil (Williams-Sonoma): Williams-Sonoma is a great value stock that struggles with inflation but shows resilience. Sales are down, but the company is very profitable and maintains a strong operating margin despite inflationary pressures.

It serves a high-end clientele, so it’s less likely to see customers pinching pennies. However, some of its home goods brands, including its own name, Pottery Barn and West Elm, target a middle-to-affluent demographic, and those customers are dropping out or holding off. Despite the slowdown in sales, the company’s rigorous cost management helps maintain cash flow. This translates into solid business and a reliable dividend, even under these conditions.

In the first quarter of 2024 (ended April 28), sales fell 4.9% compared to last year. But EPS rose from $2.35 last year to $3.48 this year, or $4.07 with a one-time adjustment. Operating margin jumped from 11.4% last year to 16.6% this year, or 19.5% with adjustment. Operating margin has grown to much higher levels than before the COVID-19 pandemic, and it shows no signs of receding.

CEO Laura Alber said management plans to devote 75% of capital spending this year to e-commerce capabilities, supply chain efficiencies and returning excess cash to shareholders through dividend payments and the repurchase of shares. It has $1.3 billion in cash and no debt, and it will repurchase $44 million in stock and spend $63 million in dividends.

Williams-Sonoma has a somewhat inconsistent dividend history, in some years it has increased it more than once. But it has paid a dividend since 2006 and has increased it at least every year since 2010, and it has increased 850% since then.

Wall Street is praising Williams-Sonoma for its handling of a difficult period, and the company’s shares are up 58% this year. The flip side is that the dividend yield is currently much lower than normal, at 1.2%. But it illustrates why Williams-Sonoma is a winning stock that offers price appreciation and a stable, growing dividend.

A quality REIT with high yield

John Ballard (Real estate income): Investing in real estate investment trusts (REITs) while they are on sale is one way to significantly increase the average return on your portfolio. REITs are required to distribute at least 90% of their taxable income to shareholders. Realty Income has a long history of paying monthly dividends, and based on its current monthly dividend payout rate, the stock yields a forward yield of 5.94%.

Rising borrowing rates have been a headwind for the real estate market over the past year. But that’s why investors can buy this top-rated REIT with such a high yield. Realty Income has focused on generating stable free cash flow to support shareholder returns in all market environments throughout its history.

Even during the pandemic, it has maintained high occupancy rates across its highly diversified portfolio of more than 15,000 commercial properties. These high occupancy rates are the result of partnerships with relatively strong and healthy businesses that have stood the test of time. For example, some of its largest retail clients are industry stalwarts. Walmart, Dollar GeneralAnd Walgreens.

Realty Income has paid a monthly dividend for 55 years. Following the recent merger with Spirit, the company has $825 million in annualized free cash flow to make new investments to grow the business and pay increasing dividends to shareholders without the need for external financing through the market debt.

With interest rates rising, now is a great time to consider buying stocks, because once interest rates stabilize or fall, stocks could rise sharply.

Should you invest $1,000 in Philip Morris International right now?

Before buying Philip Morris International stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Philip Morris International was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $801,365!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Jennifer Saibil has no position in any of the stocks mentioned. Jeremy Bowman has no position in any of the stocks mentioned. John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Realty Income, Walmart and Williams-Sonoma. The Motley Fool recommends Philip Morris International. The Mad Motley has a disclosure policy.

3 Dividend Stocks That Could Help Set You Up for Life was originally published by The Motley Fool