Dividend investing is not a one-size-fits-all activity. Some people like high yields, while others prefer to focus on dividends that increase over time. If you fall into the latter camp, you’ll want to take a look at Agree with real estate (NYSE:ADC), Federal real estate (NYSE:FRT)And Price T. Rowe (NASDAQ:TROW) as the month of June unfolds. Here’s why.

Okay, Realty isn’t the biggest, but it’s attractive

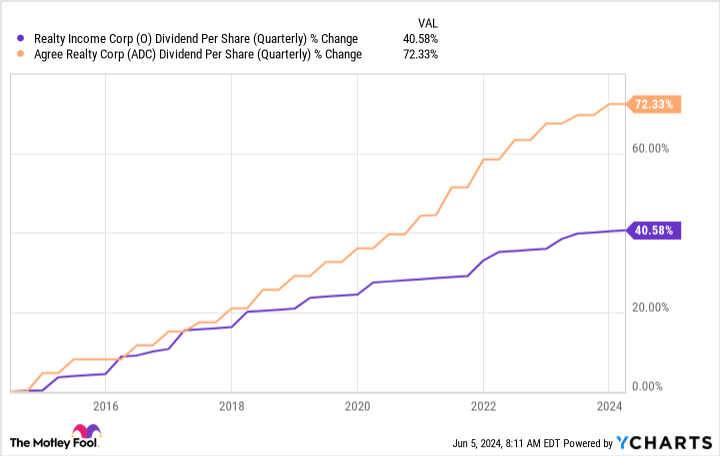

When Most Investors Think About Net Lease confidence in real estate investment (REIT), the first name that comes to mind will probably be Real estate income. This makes sense given that Realty Income is the largest player in this niche of the REIT sector. Net leases require tenants to pay most operating costs at the property level. In a large enough portfolio, this is a lower-risk investment tactic. The problem with Realty Income is that when it comes to the dividend, it’s a slow and steady turtle. Agree Realty is a smaller peer that has managed to grow its dividend at a faster rate.

As the chart above shows, Agree’s dividend growth has easily outpaced Realty Income’s over the past decade. This is not to say that Agree is achieving huge levels of dividend growth on an absolute basis. But if you view Realty Income as the default play in the net lease niche, you might want to pause for a second and consider its smaller, faster-growing counterpart. With a portfolio of approximately 2,100 properties, it will be much easier for Agree to grow than for Realty Income, which has more than 15,400 assets in its portfolio.

All right dividend yield is now an attractive 4.8%, significantly higher than the 4.3% yield of an average REIT. And Agree has increased its dividend every year for almost a decade.

Federal Realty is the (dividend) king of the REIT sector

If you’re looking at Agree’s dividend streak and think you’d rather own a stock with a more impressive track record, look no further than Federal Realty. This REIT focuses on owning strip malls and mixed-use developments, and has increased its dividend every year for 57 consecutive years. This makes it a dividend king. This is the only REIT that is a dividend king, with its next closest peer more than a decade away from reaching this impressive milestone. If consistent dividend growth is important to you, Federal Realty is the stock to watch.

What truly sets Federal Realty apart from its peers is its focus on quality over quantity. It only has about 100 properties, but they are generally some of the best properties in the areas they serve. The REIT tends to focus on areas with high average net worth and high barriers to entry, and which concentrate a large number of people in a relatively small area. It also invests heavily in its portfolio to ensure its assets are always top-notch. The stock’s yield today is about 4.3%, which is in line with that of the average REIT. But no REIT can match Federal Realty’s consistent back-to-back dividend growth.

Disgraced T. Rowe Price Has Recovery Potential

Last on this list is T. Rowe Price, who is something of a contrarian play. The dividend yield is approximately 4.2%, which is significantly higher than the average yield of 1.6% for financial stocks, using the SPDR funds for selected financial sectors (NYSEMKT:XLF) as agent. T. Rowe Price stock is also down nearly 50% from its 2021 highs. It has increased the dividend every year for an impressive 38 consecutive years.

As an asset manager, T. Rowe Price earns fees for investing money on behalf of its clients. The amount he earns will vary based on customer inflows and outflows, but will be most strongly affected by market ups and downs. T. Rowe Price’s profits can therefore fluctuate as wildly as the market. But the company has no long-term debt on its balance sheet, so it has a huge financial cushion for the dividend throughout the up/down cycle.

With the S&P500 near all-time highs, however, you might expect T. Rowe Price stock to perform better. The problem is that exchange-traded funds (ETFs) are eating into the assets of T. Rowe Price’s core mutual fund operations. This is something to watch, but investors’ assets tend to be fragile. So it’s a slow change.

And T. Rowe Price isn’t standing still. It increasingly offers ETFs and other services, such as alternative investments, which are increasingly in demand. Meanwhile, T. Rowe Price is returning value to shareholders via stock repurchases while the stock price is low. If you think it seems like a good idea to invest in a reliable dividend producer willing to invest in its own recovery, you might want to buy T. Rowe Price.

Dividend Growth in Different Forms

To be fair, okay, Federal Realty and T. Rowe Price aren’t going to wow you with 20% dividend growth. These are more fundamental dividend growth investments, upon which to layer higher-growing, but also lower-yielding, dividend growth stocks. The areas in which these companies shine are slightly different.

Okay, it’s a way to get higher dividend growth than you might find with the best-known stocks in a fairly safe niche of the REIT sector. Federal Realty’s consecutive dividend growth, spanning more than five decades, is something investors looking for dividend consistency will love. And T. Rowe Price is a reliable dividend growth stock that’s no longer in favor, which contrarians will appreciate, noting that the company itself is stepping in to buy shares.

Should you invest $1,000 in Agree Realty right now?

Before purchasing shares in Agree Realty, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Agree Realty wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $740,688!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Ruben Gregg Brewer holds positions in Federal Realty Investment Trust and Realty Income. The Motley Fool posts and recommends Realty Income. The Motley Fool recommends T. Rowe Price Group. The Motley Fool has a disclosure policy.

3 Dividend Growth Stocks to Buy Hand Over Fist in June was originally published by The Motley Fool