This year has been full of significant events. Since mid-May, the iconic Dow Jones Industrial Average recorded its first close above 40,000, the broad base S&P 500 climbed above the 5,500 level, and growth Nasdaq Composite Index has surpassed the 18,000 mark. This full-fledged bull market is the result of the euphoria surrounding the rise of artificial intelligence (AI).

Without getting too complex, AI uses software and systems to perform tasks that would normally be overseen by humans. What makes AI so special is the ability of software and systems to learn and evolve without human oversight. If AI software and systems become better at their tasks over time or acquire new skills, virtually every sector and industry in the global economy would benefit.

While dozens of companies have benefited from investors pouring their capital into the AI revolution, none stands out more than the semiconductor giant Nvidia (NASDAQ: NVDA).

Nvidia has experienced a historic operational ramp-up

The calling card of Nvidia’s success is its AI-driven graphics processing units (GPUs). In particular, the company’s H100 GPU has quickly become the go-to chip for making split-second decisions in high-computing data centers.

According to semiconductor analysts at TechInsights, Nvidia was responsible for shipping 3.76 million of the possible 3.85 million AI GPUs in 2023Companies have lined up to buy the H100 to train large language models and run generative AI solutions.

One of Nvidia’s biggest advantages is that enterprise demand for GPUs for AI has far outpaced supply. According to the law of supply and demand, the price of a good or service is likely to increase if there is not enough supply to meet demand. Nvidia was able to quickly increase the price of its GPUs, which in turn helped boost its adjusted gross margin to over 78% in the fiscal first quarter (ended April 28).

Despite its first-mover advantages, the market-leading company isn’t resting on its laurels. In the second half of 2024, it is expected to roll out its new AI GPU architecture, dubbed Blackwell. The new platform can accelerate quantum computing, data processing, engineering simulations, and generative AI solutions, among other tasks.

Beyond Blackwell, CEO Jensen Huang introduced the world to its next-generation Rubin platform in June. Rubin will feature an all-new central processing unit (known as Vera) and is expected to debut in 2026. In other words, Nvidia appears to have a path to sustainable computing advantages over its peers.

Although Nvidia has completely crushed Wall Street’s highest revenue and profit projections in over a year, and its operational ramp-up has been nothing short of textbook, evidence is mounting that the company may be in a bubble.

While history doesn’t exactly repeat itself on Wall Street, it does tend to rhyme. Based on three compelling charts, we may have already seen a peak for Wall Street’s hottest AI stock.

Great innovations of the future always survive a startup bubble

Over the past 30 years, Wall Street and investors have not failed to follow the most promising investment trends. The advent of the Internet, genome decoding, business-to-business, Chinese stocks, nanotechnology, 3D printing, blockchain/cryptocurrency technology, cannabis, and the metaverse have captivated the attention of new and seasoned investors.

But these trends share one thing in common: financial bubbles in their early stages.

While it’s impossible to predict when the music will stop, industry-leading companies for all of the trends mentioned above eventually collapse.

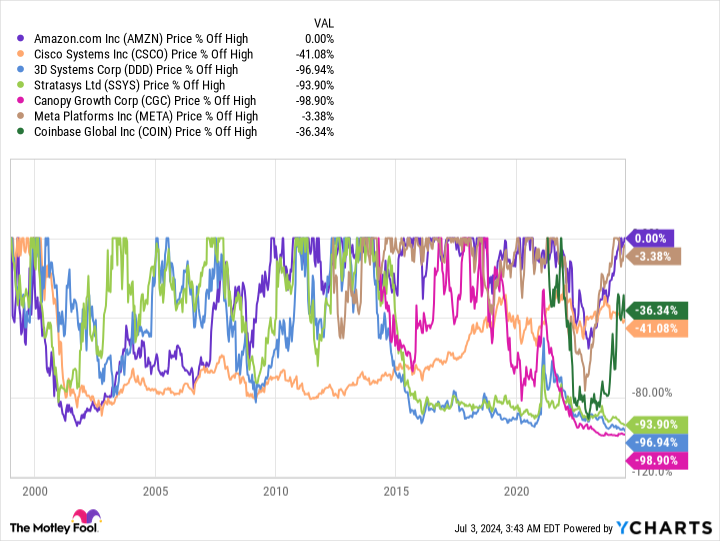

As you can see in the chart above, some of the hottest investments of the last quarter century have plunged after the bubble burst, due to their respective innovation, technology, or trend. In no particular order:

The networking/e-commerce revolution has seen Amazon And Cisco Systems lost about 90% of their value during the Internet bubble.

3D Systems And Stratasyswhich led the hype around 3D printing, have never managed to replicate their early 2010s rise and currently sit 97% and 94% below their respective all-time highs.

Canadian Cannabis Actions Canopy growth has fallen 99% since hitting its record closing high.

Cryptocurrency game Coinbase Global fell nearly 90% from its closing high before rebounding.

Social Media Expert Meta-platformswhich had been the face of the metaverse, fell by around 80% before rising again to new highs.

My point is that investors have overestimated the adoption of every new technology or trend over the past 30 years, and there is no reason to believe that AI will be any different. History (i.e. the chart above) strongly suggests that the lofty growth expectations for AI will not come to fruition, and that a maturation period will be necessary for this potentially revolutionary technology.

Nvidia’s adjusted gross margin will not be sustainable

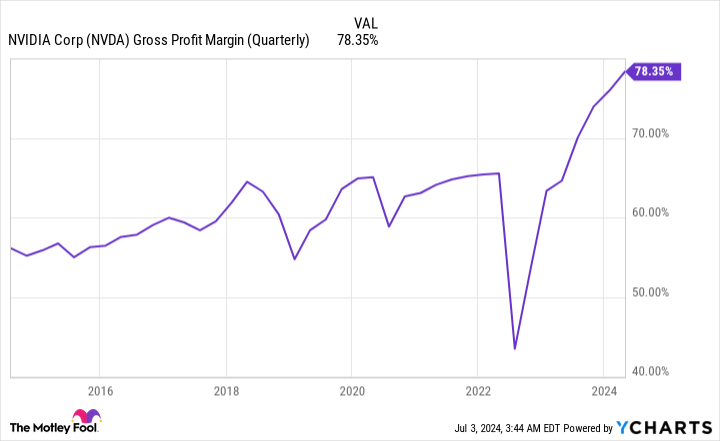

A second reason to suspect that Wall Street’s AI leader is in a bubble can be seen in the company’s current and forecast adjusted gross margin.

As I’ve noted before, Nvidia has undoubtedly benefited from demand for AI GPUs outpacing supply. The ability to raise prices has pushed its adjusted gross margin up 13.72 percentage points over the past five quarters.

But as you can see in the chart above, an adjusted gross margin of around 60%, give or take a few percentage points in either direction, has been the norm over the past 10 years. While this doesn’t mean that Nvidia has consistently improved its adjusted gross margin over time, it does suggest that a 13.72 percentage point increase in 15 months is not sustainable.

For example, Nvidia reported an adjusted gross margin of 75.5% (+/- 50 basis points) for its fiscal second quarter. While that figure is still well above its historical average, a sequential decline from 235 to 335 basis points for the current quarter suggests margin pressures are starting to take hold.

During the second half of 2024, Intel will deploy its Gaudi 3 AI accelerator chip on a large scale, and Advanced microsystems Nvidia to increase production of its MI300X AI GPU. Additionally, Nvidia’s four major customers are all developing AI GPUs internally for their respective data centers.

Even if Nvidia’s AI GPUs easily maintain their compute advantages, strong enterprise demand for GPUs could allow these competitors to thrive and/or reduce the data center space available for Nvidia’s chips. In short, Nvidia’s margin guidance for the fiscal second quarter reads like a warning that its adjusted gross margin has peaked.

We’ve seen this before – and it wasn’t a pretty sight

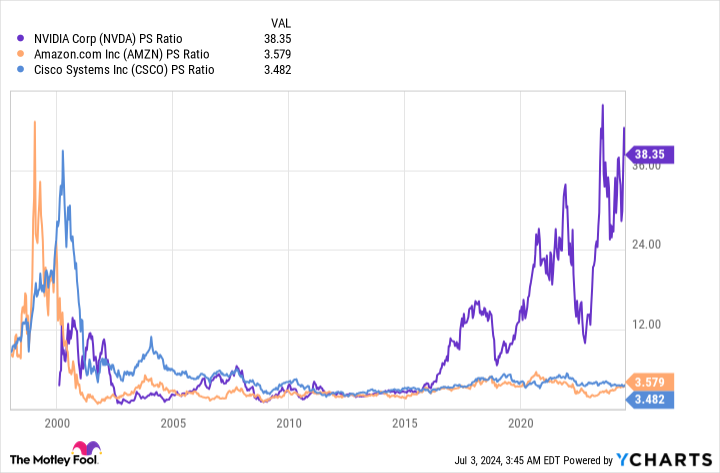

The third damning chart for Nvidia concerns its valuation.

To be fair, some traditional fundamental indicators suggest that Nvidia could still be a bargain for long-term investors. For example, Nvidia shares ended trading on July 2 at nearly 34 times forward annual earnings. While that’s a higher multiple of forward annual earnings than the benchmark S&P 500, it’s not unreasonable considering that Wall Street is forecasting a 46% annualized earnings growth rate for the company through 2028.

However, another assessment indicator is undeniably worrying.

As you can see in the chart above, Nvidia is valued at over 38 times its trailing-12-month (TTM) price-to-sales (P/S). For Wall Street’s market-leading companies, this is one of the highest numbers we’ve ever seen. In fact, Nvidia’s 42 times TTM P/S in mid-June was effectively the peak of Amazon and Cisco Systems before the dot-com bubble burst.

History has always shown us that extended valuations can be fueled by short-term euphoria. But when we look at the situation over a longer period, market leaders with exorbitant price-to-earnings ratios end up getting beaten up. While there is no concrete way to know in advance when a peak has been reached, we have seen this scenario play out before and the end result has not been very positive.

Even though Nvidia has the tools to remain a successful company over the very long term, these historical charts strongly suggest that the most direct beneficiary of AI is in a bubble.

Should You Invest $1,000 in Nvidia Right Now?

Before you buy Nvidia stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors need to buy now…and Nvidia isn’t one of them. These 10 stocks could deliver monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $786,046!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Randi Zuckerberg, former head of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon, Intel, and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Cisco Systems, Coinbase Global, Meta Platforms, and Nvidia. The Motley Fool recommends 3d Systems and Intel and recommends the following options: long January 2025 $45 call on Intel and short August 2024 $35 call on Intel. The Motley Fool has a position in Amazon, Intel, and Meta Platforms. disclosure policy.

3 Charts That Strongly Suggest Artificial Intelligence (AI) Giant Nvidia Is In A Bubble was originally published by The Motley Fool