The stock market is full of noise, but over the long term, some of the best investments are made by picking a quality company and holding it for several years or even decades.

For example, led by Warren Buffett Berkshire Hathaway acquired most of its Coca-Cola And American Express assets more than 30 years ago. Both investments grew considerably richer, each providing hundreds of millions of dollars in dividend income to Berkshire each year. Additionally, Berkshire’s stake in both companies increased through share buybacks.

Union Pacific (NYSE:UNP), United Parcel Service (NYSE:UPS)And Clorox (NYSE:CLX) all also have what it takes to hold securities for life, especially if you want to generate passive income. Here’s why these companies stand out as strong blue chip dividend stocks buy now and keep forever.

Union Pacific is a safe way to generate income by investing

Lee Samaha (Union Pacific): The West Coast Railway operates in an efficient duopoly within its geography. As railroads face competition from trucking and other forms of transportation, their ownership of their infrastructure creates a significant business gap.

If there are any doubts about the cash-generating and relatively safe nature of the railroad industry, consider that Warren Buffett’s Berkshire Hathaway owns BNSF, Union Pacific’s main rival and the largest railroad in the United States.

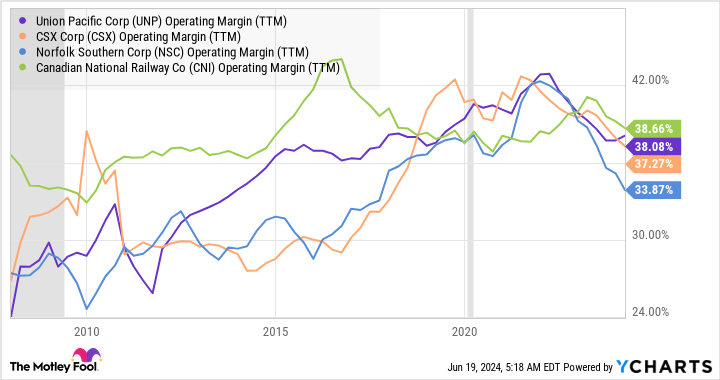

The outlook for rail revenue growth is generally aligned with the broader industrial economy. As long as there is a need to move physical goods across the United States, railroads will continue to be profitable. Additionally, over the past decade, the industry has made great strides in improving profitability through the implementation of precision scheduled railway (PSR) management techniques.

Under PSR, railroads focus on running trains at set times and schedules to move freight cars, rather than waiting for a long train to fill up with freight cars and then move on. With PSR, railroads can reduce nodes and monitor a range of metrics (terminal shutdown, freight car speed, locomotive productivity, etc.) to reduce operating expenses.

Although slowing economic growth will always impact profit margins, the adoption of PSR has increased profit margins for the entire industry. As such, PSR initiatives combine a secure market position, revenue linked to economic growth and additional profits.

Despite bears’ disapproval, UPS has a bright future

Scott Levine (UPS): Acquiring blue-chip stocks that pay dividends is a great way to fortify your portfolio and create a solid passive income stream. But finding blue-chip stocks like UPS that offer high-yielding payouts, like the 4.8% forward dividend offered by Big Brown, isn’t easy. UPS is a company well-positioned to continue rewarding its shareholders for years to come.

It’s no secret that market confidence in UPS has deteriorated over the past year. While the S&P500 rose more than 24%, UPS shares plunged about 23%. The stock’s decline mainly comes from the company’s weak performance in 2023. Revenue and operating profit fell 9.3% and 28.7%, respectively.

As disconcerting as this may seem to potential investors, it’s important to recognize that nothing catastrophic has happened with the company. Management attributes the poor performance to Europe’s weakness – a disappointment to be sure, but only a temporary headwind.

The company hopes to return to growth soon. Providing a promising outlook, management project revenue will climb to between $108 billion and $114 billion in 2026. Likewise, management projects free cash flow to reach approximately $17.5 billion in 2026, which would represent an increase considerable compared to the $5.3 billion in free cash flow the company reported in 2023.

Between the company’s declining business in 2023 and the current high dividend yield, skeptical investors might be hesitant to buy shares, fearing that the company’s financial health is at risk. But a quick glance at the financial data suggests otherwise.

Over the past five years, UPS has taken a judicious approach to rewarding shareholders, with an average payout ratio of 66%. Meanwhile, investors can see how well the company is meeting its 2024 guidance of $92 billion to $94.5 billion in revenue and an adjusted operating margin of 10% to 10.6%.

Clorox’s reliable and growing dividend presents an attractive opportunity

Daniel Foelber (Clorox): At their core, consumer-facing companies like Clorox increase profits through increasing sales volume of existing products, developing/acquiring new products, and increasing prices. To be successful, a business must be able to predict purchasing trends with a certain level of accuracy, although it is impossible to be perfect.

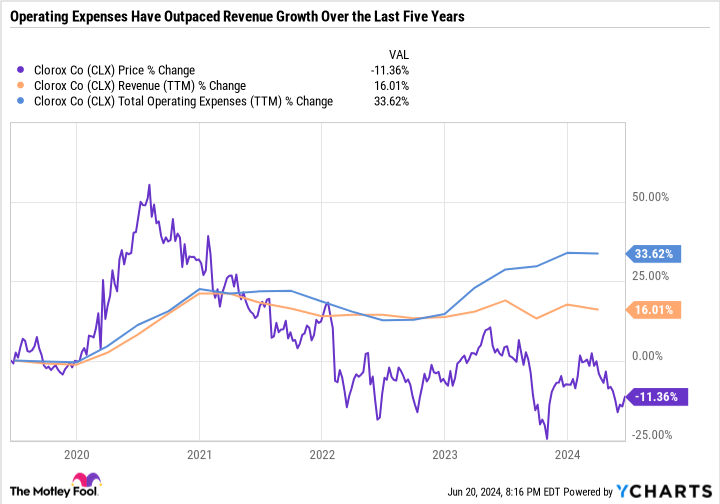

What you don’t want to see is a gross overestimation or underestimation of demand. And unfortunately, that’s exactly what Clorox did after the pandemic-induced boom in cleaning and hygiene products.

It’s hard to believe, but Clorox’s stock price is now in decline over the past five years, largely erasing its 2020 gains, even as its sales are up. The glaring problem is costs, which have exploded as Clorox mismanaged manufacturing expenses and increased operating expenses.

The good news is that management is fully aware of this problem and is managing to control costs. Analyst consensus estimates for Clorox’s forward earnings are quite pessimistic, so there’s no pressure for Clorox to stage an epic turnaround. At the same time, the stock offers a whopping 3.5% dividend yield, which is well above the Consumer Staples sector average of 2.7%.

It’s especially important to step back and examine the company’s strengths in times like these, specifically identifying the characteristics that will lead to compound earnings and dividend growth over time.

Clorox’s greatest strength is its brands. Although it only has a market capitalization of around $17 billion, compared to $395 billion for a giant like Procter & Gamble, Clorox offers cutting-edge products. Flagship brand Clorox can hold its own against competitors like Lysol. And Clorox-owned Brita, Glad, Pine-Sol, Kingsford, Hidden Valley Ranch and Burt’s Bees are just a few of the company’s other top brands.

Betting on Clorox means betting on the company’s ability to market these brands and continue to innovate or make smart acquisitions. In recent years, the company may not have the best track record when it comes to expense management. Nonetheless, it has built a strong and diverse portfolio that includes products for cleaning, grilling, cat litter, water filtration, personal care, food and much more.

For investors who believe in the strength of the company’s brands and its ability to turn things around, Clorox looks like a solid, reliable dividend stock to buy now.

Should you invest $1,000 in United Parcel Service right now?

Before buying stock in United Parcel Service, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what it believes to be the 10 best stocks for investors to buy now…and United Parcel Service wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $723,729!*

Securities Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool ranks and recommends Berkshire Hathaway and Union Pacific. The Motley Fool recommends Canadian National Railway and United Parcel Service. The Mad Motley has a disclosure policy.

3 Top Dividend Stocks to Buy and Hold Forever was originally published by The Motley Fool