Investing in artificial intelligence (AI) seems to have become more difficult in recent months. More than a year later Generative AI has sparked increased enthusiasm among tech investors, specific stocks such as Nvidia, Super MicrophoneAnd Crowd strike appear to have attracted most of the interest and have achieved eye-popping valuations.

Fortunately for investors who feel they missed out on these stocks, AI is likely to be more than just a flash in the pan. Thus, one can buy and hold specific AI stocks over the next decade with a reasonable expectation of significant returns. These three stocks should be a good fit for investors.

1. Palantir Technologies

At first glance, investors might think they missed Palantir Technologies (NYSE: PLTR)The stock is up fourfold since its lowest level in late 2022. Additionally, recent revenue growth is unlikely to impress growth investors.

However, investors may not have yet fully realized the game-changing potential of its generative AI product: the Artificial Intelligence Platform (AIP). AIP builds on the analytics capabilities of its legacy platforms Gotham and Foundry. While those platforms also rely on AI, the productivity gains reported by AIP users have been staggering.

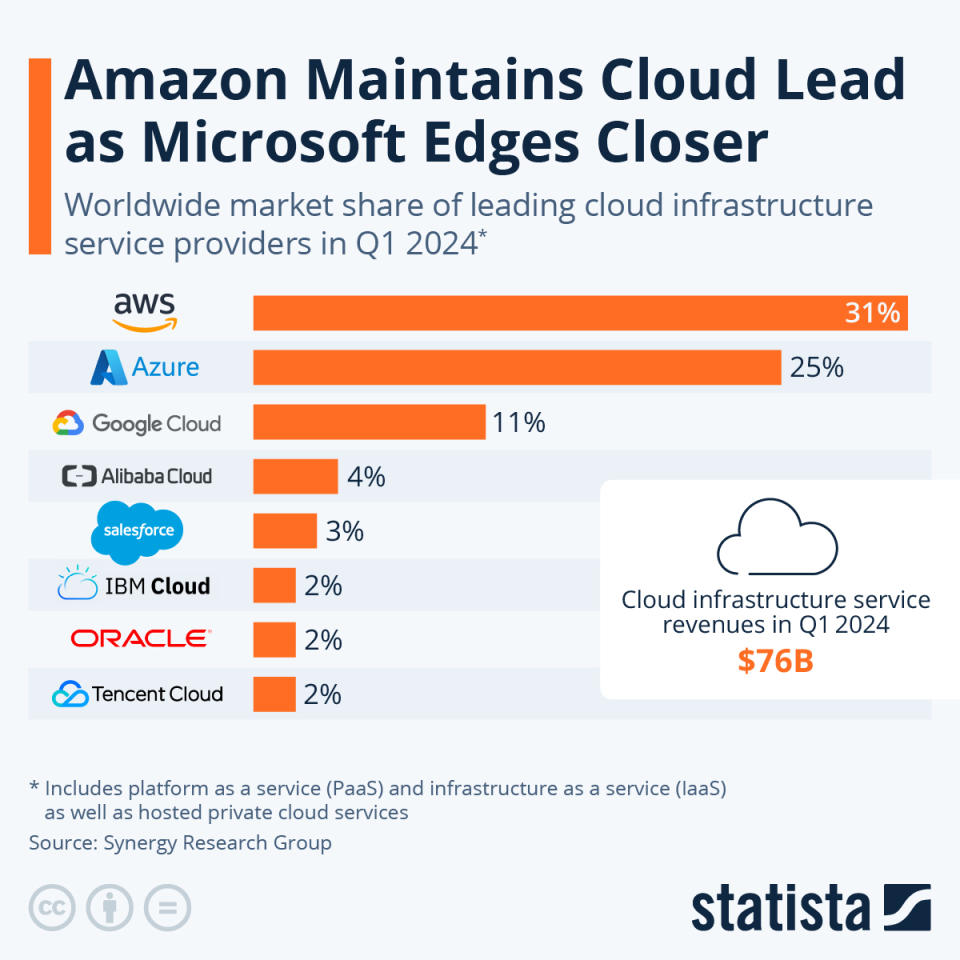

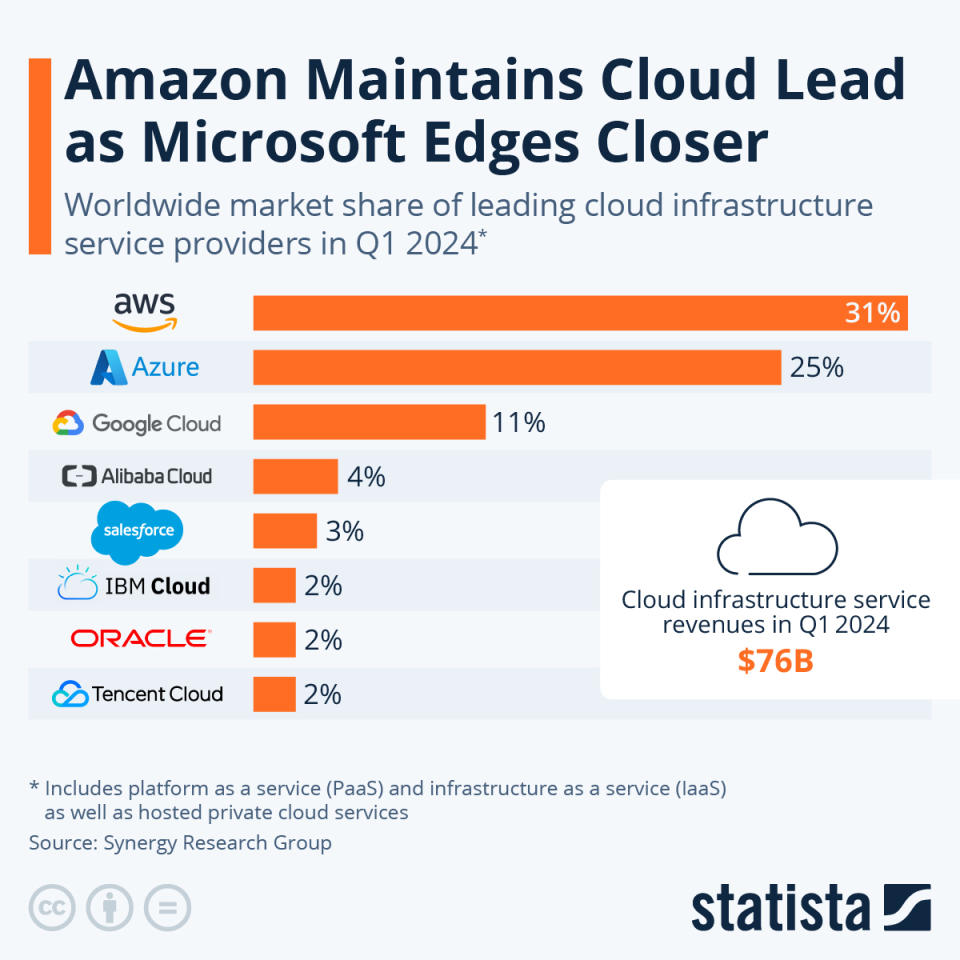

After attending AIP boot camps, companies seem to find multiple use cases. One potential customer accomplished more in a day with AIP than a hyperscaler (like Amazon Web Services) could have done it in four months, while another claimed to build ten times faster with three times fewer resources. Such results appear to quickly lead to new seven-figure deals for Palantir.

As mentioned earlier, results may take time. In the first quarter of 2024, revenue of $634 million grew 21%, which seems modest when comparing the growth to its price/sales ratio (P/S) of 24.

Still, its net income of $106 million is more than six times what it was last year. If revenue growth begins to reflect the productivity gains and increased trading volumes driven by AIP, share price growth should accelerate significantly in the coming years.

2. Alphabet

Besides promising AI companies, investors might also want to look at one of the pioneers in this field: Google’s parent company. Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG)Alphabet began using the technology in 2001 and became an AI-driven company in 2016, employing the technology in all subsequent product releases.

However, the rise of ChatGPT gave investors the impression that Alphabet had fallen behind its competitors. For the first time in decades, Google’s dominant search engine was facing a credible competitive threat.

Still, before abandoning Alphabet, investors should remember that it released its own generative AI tool in the form of Google Gemini. Additionally, Google Cloud, which is the third largest cloud company, assures that it will play a vital role in deploying this technology for its customers.

Furthermore, Alphabet brought together its research teams in April 2023 to form Google DeepMind. With $108 billion in liquidity to support its efforts, Alphabet is unlikely to lag behind in this area.

Finally, with a price-to-earnings ratio of 28, it is cheaper than its megatech competitors. Between its extensive AI experience and formidable resource base, Google’s parent company will likely remain a force in the AI industry for a long time to come.

3. VanEck Semiconductors ETF

Investors who prefer not to risk valuable capital on the fortunes of a particular company may simply want to invest in most major chip stocks through the VanEck Semiconductor ETF (NASDAQ:SMH). Most exchange-traded fund (ETF) companies design or manufacture AI-ready chips. Without this technology, AI would not have been possible.

This ETF invests about 20% of its assets in Nvidia, with another 13% in the leading chipmaker Semiconductor manufacturing in TaiwanThe rest of his holdings represent less than 10% of the fund each, although Broadcom, Advanced microsystemsAnd Micron are part of the 26 shares held.

Additionally, it has returned 28% per year over the past 10 years. In comparison, the reference SPDR S&P 500 reported an average annual return of 13% over the same period, less than half the return of the VanEck ETF.

Additionally, VanEck’s ETF expense ratio is 0.35%, slightly lower than the average expense ratio, which is 0.37%, according to The Morning Star. Thus, the fund has generated these exceptional returns at an affordable price.

Certainly, the fund does not guarantee that it will be able to match the average annual return of 28% over the last 10 years. However, if one wants to achieve exceptional returns with less risk and without the work required to find such stocks, one will likely find both in the VanEck Semiconductor ETF.

Should you invest $1,000 in Alphabet right now?

Before buying shares in Alphabet, consider this:

THE Motley Fool, securities advisor The analyst team has just identified what they think is the 10 best stocks Investors should buy now…and Alphabet wasn’t one of them. The 10 selected stocks could generate monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $759,759!*

Securities Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of the board of directors of The Motley Fool. Will Healy holds positions in Advanced Micro Devices, CrowdStrike, and Palantir Technologies. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, CrowdStrike, Microsoft, Nvidia, Oracle, Palantir Technologies, Salesforce, Taiwan Semiconductor Manufacturing, and Tencent. The Motley Fool recommends Alibaba Group, Broadcom, and International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 AI Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool