The stock market saw considerable growth in the first half of the year, with Nasdaq Composite Index The stock index has risen about 19% since January 1. However, it is not too late to invest in companies that are likely to continue growing over the next six months.

Despite its explosive growth since last January, the artificial intelligence (AI) market remains an interesting one to start in. According to Grand View Research, the sector reached $197 billion last year and is growing at a rate that could see it reach nearly $2 trillion by the end of the decade.

The industry has made a lot of millionaires since the start of last year, but there’s still plenty of room for improvement. Demand for AI services and the powerful chips needed to power them continues to rise, boosting profits for some key companies.

So, get in before it’s too late. Here are two millionaire-making AI stocks to buy in 2024.

1. Nvidia

Nvidia (NASDAQ: NVDA) has made more than one millionaire since the AI boom in early 2023, with its stock up 745%. The company had already earned a reputation as a reliable growth stock thanks to its success in gaming, consumer products, and data centers. However, Nvidia Involvement in AI took its business to another level. It became the first chipmaker to reach a market capitalization of more than $3 trillion this year.

Some analysts wonder how much more growth the company could actually deliver after such a surge. But its near-unmatched dominance in AI chips and its growing cash reserves, which are far larger than those of its rivals, suggest that its lead isn’t likely to fade away anytime soon. In the meantime, developers have only scratched the surface of what’s possible with AI, indicating that demand for chips is far from reaching its ceiling.

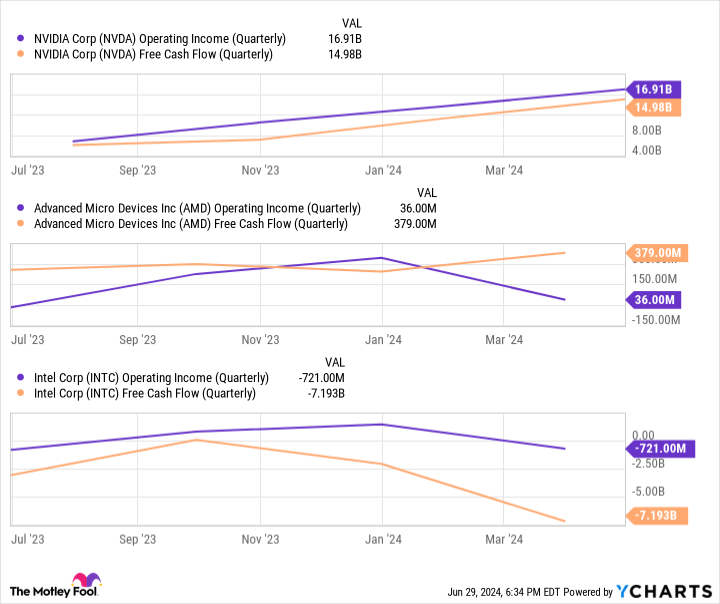

Advanced microsystems And Intel are Nvidia’s main rivals in the AI chip market. Despite significant investments over the past year by both companies, Nvidia maintains an estimated 90% market share in AI chips. Moreover, rising profits have widened the financial gap between the companies.

This chart shows that Nvidia’s quarterly operating income and free movement of capital Nvidia’s numbers eclipsed those of AMD and Intel last year, suggesting that Nvidia is much more capable of investing in its business and maintaining its lead in AI for years to come.

Nvidia has the cash and brand power to continue its long-term expansion. Despite its recent stock growth, its price-to-earnings-to-growth ratio remains below 1, which could mean the company’s value is still commensurate with its potential.

As a result, Nvidia is a multi-million dollar stock that is too good to ignore in 2024.

2. Alphabet

As Nvidia crushes the AI chip market, Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) Google is investing heavily in the software sector. Google is facing strong competition from cloud giants Microsoft And Amazon. However, stock valuations and recent earnings make Alphabet a clear investment this year.

Cloud platforms play a critical role in AI as businesses around the world increasingly turn to these services to increase productivity through this generative technology. Alphabet holds the third-largest cloud computing market share with Google Cloud (after Microsoft and Amazon). However, Alphabet is growing rapidly and outpacing its competitors. In the first quarter of 2024, Google Cloud revenue grew 28% year over year, outpacing Microsoft Azure’s 21% sales growth and Amazon Web Services’ 17% growth.

It’s been eight years since Alphabet announced it was going to become an AI company. However, the company has accelerated its development over the past year. Alphabet launched its Gemini AI model this year, which allowed it to add AI capabilities across its entire product line. Meanwhile, its AI research subsidiary DeepMind has become an AI product factory, developing commercial services.

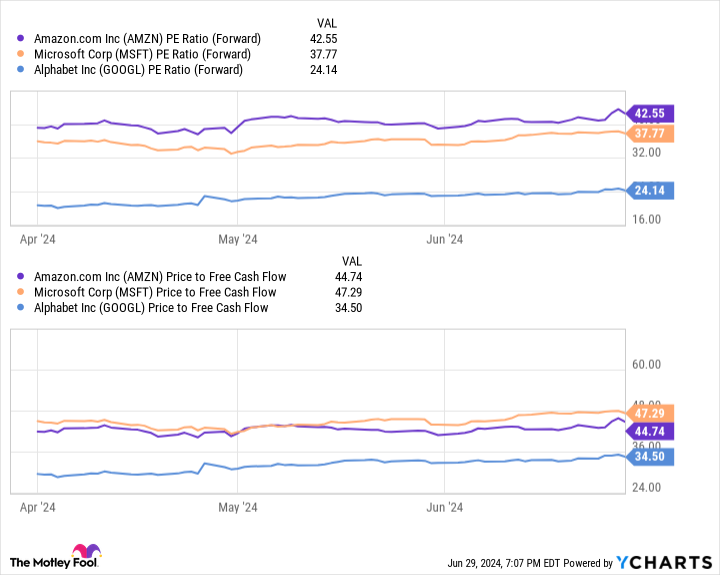

Additionally, despite outpacing Amazon or Microsoft in its stock growth over the past 12 months, Alphabet stock remains the best value among the three companies. The table above shows that Alphabet has the lowest forward price-to-earnings ratio and price-to-free cash flow ratio among its peers, meaning the company’s stock offers the best value.

With a 522% share price growth since 2014, Alphabet has created many millionaires. However, its AI potential and vast financial resources suggest it’s not done yet and is worth considering this year.

Should You Invest $1,000 in Nvidia Right Now?

Before you buy Nvidia stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors need to buy now…and Nvidia isn’t one of them. These 10 stocks could deliver monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $751,670!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Amazon’s Whole Foods Market, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a position in the stocks mentioned and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. disclosure policy.

2 Millionaire-Making Artificial Intelligence (AI) Stocks to Buy in 2024 was originally published by The Motley Fool