Are you looking for a reliable dividend stock in the energy sector? There are some very good ones, including Chevron (NYSE: CVX) And Enbridge (NYSE:ENB). But you need to be careful, because some high-yield energy stocks aren’t what they seem at first glance, including Devon Energy (NYSE:DVN). Here’s why dividend investors will want to avoid Devon but should consider buying shares of Chevron and Enbridge.

Devon rewards investors in a different way

There’s nothing wrong with Devon Energy’s dividend policy. In fact, one could competently argue that it is the most effective way to reward shareholders when oil prices are high. The problem is that it also asks investors to share the pain when oil prices are low. What is happening here? Devon Energy has a variable dividend policy linked to the financial performance of the company.

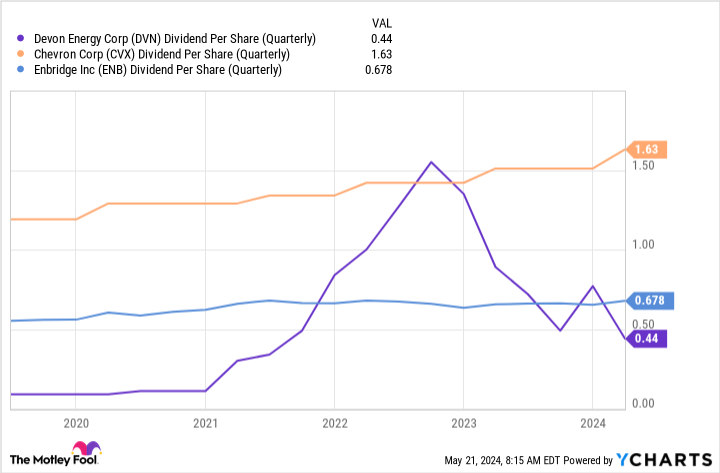

Since Devon Energy is an upstream oil and natural gas producer, its financial and financial results are directly linked to the highly volatile price of oil. energy goods. Investors benefit directly when oil prices are high through higher dividends and “suffer” directly when oil prices are low because dividends are reduced accordingly. For example, in 2022, the quarterly dividend increased from $1.00 per share to $1.55. It ended the year at $1.35 per share. In 2023, the dividend fell to $0.49 per share.

More recently, Devon Energy has changed its model slightly, increasing its use of share buybacks as a way to return value to investors. The second quarter 2024 dividend was just $0.35 per share, compared to $0.44 in the first quarter. If all of this doesn’t seem to be working for you, then you probably want to avoid Devon Energy, regardless of the dividend amount.

Chevron is built for the entire cycle

Chevron will be a better choice for most investors. The company is an integrated energy major, meaning its global operations are diversified into upstream (drilling), midstream (pipelines) and downstream (chemicals and refining). Although energy prices remain the main driver of performance, its broad exposure to the energy sector helps smooth out the ups and downs inherent to the sector.

More importantly for the dividend, Chevron has a rock-solid balance sheet. This gives the company the flexibility to take on debt in the event of an energy downturn so it can support its business and dividends. At this point, Chevron has increased its dividend every year for 37 consecutive years. This is a pretty incredible feat, considering the huge price fluctuations oil has seen in recent years only.

Chevron’s dividend yield is currently around 4%. That’s attractive relative to the overall market, but value investors might want to wait until Wall Street throws the baby out with the bathwater in the next energy crisis. In times like this, Chevron’s return can reach 10%.

Enbridge is a slow and steady turtle

Enbridge is a large North American energy company, but it focuses on the midstream segment of the industry. This means it has things like pipeline, storage, and transportation infrastructure. Enbridge is unique in that it also owns natural gas and renewable energy utility assets. But most importantly, all of Enbridge’s assets are dependent on fees, contracts or tariffs imposed by regulators. So, unlike Chevron and Devon, energy prices are not a significant factor in Enbridge’s financial performance. And unlike those two energy producers, Enbridge’s cash flows tend to be highly predictable over time.

This is how Enbridge managed to increase its dividend every year for 29 consecutive years. These are the type of stocks you buy if you want exposure to the energy sector while minimizing your exposure to commodity risk. The yield is 7.3%. That said, the yield will likely make up the lion’s share of the return over time. But this probably won’t be a problem for dividend investors looking to make a living from the dividends they receive on their portfolios.

Be careful what you add to your portfolio

When you step back, you can see that Devon, Chevron, and Enbridge actually represent three different ways of generating dividend income in the energy sector. There is nothing wrong with the approaches taken per se, but they are very different. Still, Devon Energy will not be a good choice for investors who need a reliable income stream. Chevron and Enbridge are simply much better choices in this regard.

Should you invest $1,000 in Chevron right now?

Before buying Chevron stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Chevron was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $581,764!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Ruben Gregg Brewer holds positions at Enbridge. The Motley Fool holds positions and recommends Chevron and Enbridge. The Mad Motley has a disclosure policy.

2 High-Yielding Energy Stocks to Buy and 1 to Avoid was originally published by The Motley Fool