Artificial intelligence Artificial intelligence is the hottest trend in today’s market. While it may be getting some hype, AI seems to have some traction and is poised to have a real impact on the economy. Individuals and businesses are using AI to use and create all sorts of transformative applications. Unprecedented photographic imaging and data analysis at unprecedented speeds are just two examples.

Businesses are harnessing the power of AI to operate better and faster, and many are disrupting the status quo and gaining market share. Some of these companies are established winners using their strong assets to lead the charge, and others are small innovators disrupting the norm in niche segments of the economy.

Let’s look at an example from each category: Amazon (NASDAQ: AMZN) And Lemonade (NYSE:LMND) — and find out why each of them could help you build a portfolio that will make you a millionaire.

1. Amazon: Leading with Generative AI

Amazon has a long history of investing heavily in AI and is now focusing its attention and resources on integrating and developing generative AI. The company uses AI across many of its businesses, but its most exciting AI opportunities are in Amazon Web Services (AWS), its cloud computing segment.

People who know Amazon primarily as an e-commerce giant may not realize that it is also the world’s leading cloud computing company. $100 billion annualized Amazon is a leading company with a 31% global market share. Amazon has developed a competitive set of generative AI tools for AWS users that simplify access and create incredible opportunities. It offers a range of services in three tiers to meet different needs.

The foundational layer allows developers to create their own large language models (LLMs), which are the essential foundation of generative AI. These are models that have been trained on so much data that they can start creating, or generating, without intervention. This is what OpenAI’s ChatGPT is known for, and this is where NvidiaNvidia’s chips are in play. They’re powerful enough to handle the data load needed to make this work, and that’s a big reason why Nvidia’s sales and stock have exploded over the past two years.

The next tier allows developers to use Amazon’s LLMs to generate AI for specific businesses, and the top tier includes turnkey solutions for businesses that don’t need custom services. One example is a tool that creates page descriptions for products on Amazon stores when a user enters a URL.

AWS accounts for about 17% of Amazon’s total revenue, but 61% of its operating income. As AWS becomes a larger part of the whole, profitability could skyrocket. Amazon’s stock typically follows earnings, which could boost Amazon’s stock over the next few years, leading to incredible gains for investors who buy now.

As with any great stock, becoming part of a millionaire’s portfolio depends on how much you invest and how long you wait. Some stocks can turn into millions on their own; if you had invested $1,000 in Amazon stock when it first went public, you would have over $2 million today. I’m not sure they can do it again, but they can outperform the market average and contribute to a diversified portfolio of winning stocks that, together, can lead to millionaire status.

2. Lemonade: A Compelling AI Disruptor

Lemonade uses AI to power its innovative insurance model. It’s a young company that’s been in business for less than 10 years, has already attracted over 2 million members and continues to grow. It has seen consistent, strong growth every quarter since its IPO four years ago. In the first quarter of 2024, in-force premiums, which measure the average annual total number of policies, increased 22% year over year and revenue increased 25%.

Lemonade has a key advantage over traditional insurers because it was built on a digital infrastructure powered by AI. All of its pieces work together instantly, and management touts this connectivity as the main reason its model will eventually outperform the competition. Traditional models, which require more human intervention, won’t be able to keep up with Lemonade. However, the company is still building its database as it rapidly grows and adds new members and policies, so it will take time to get there.

Management gave a recent example where AI mechanisms are already producing significant results. In insurance, the loss adjustment expense ratio (LAE) measures how effectively an insurer manages its overhead costs. The norm for large companies is around 10%, but Lemonade’s is 7.6% despite its small size. The company attributes this to its reliance on technology to manage claims, which increases efficiency while improving the customer experience. It expects this type of impact to be felt more in its performance as it collects more data.

In the meantime, it’s taking longer than investors would like to become profitable, and Lemonade stock is still trading down nearly 90% from its all-time highs. Granted, that was back when it was trading at an exorbitant valuation. But today, it’s trading at 2.5 times trailing-12-month sales, which is dirt cheap for a growth stock. It may take a while, but Lemonade could become a standout stock once its algorithms kick in with better data and it starts reporting profits.

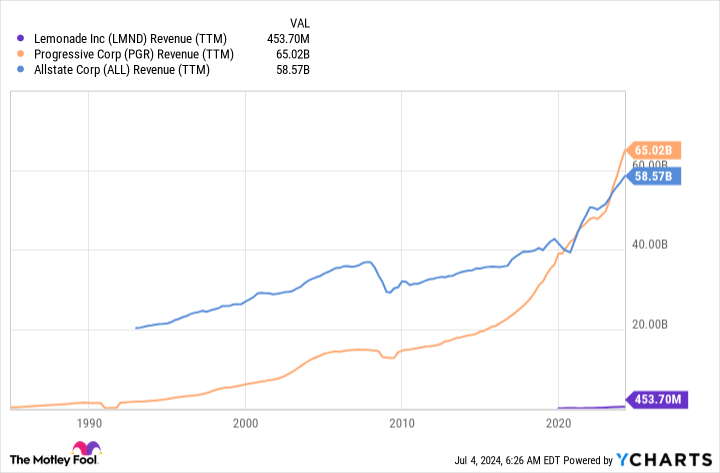

A large enough investment in Lemonade today could turn into $1 million over the years if Lemonade can turn its business into a profitable one. Consider how small Lemonade is compared to industry leaders like Progressive And Allstate.

If Lemonade can grow to generate revenue levels comparable to its competitors, its stock could generate significant returns and turn early-buying shareholders into millionaires.

Should You Invest $1,000 in Amazon Right Now?

Before you buy Amazon stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors need to buy now…and Amazon isn’t one of them. These 10 stocks could deliver monster returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $786,046!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Lemonade. The Motley Fool has positions in and recommends Amazon, Lemonade, and Nvidia. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

2 Artificial Intelligence Stocks That Could Make You a Millionaire was originally published by The Motley Fool