The artificial intelligence (AI) market has exploded since the start of 2023. The debut of OpenAI’s ChatGPT illustrated key advances in generative AI technology and demonstrated its potential to change every aspect of technology.

As a result, a number of companies have ventured into the AI space, attempting to take pieces of a pie that was worth nearly $200 billion last year and which, according to Grand View’s forecasts, Research, will grow at a compound annual rate of 37% through 2030. And while many of the affected stocks have already seen meteoric rises, AI’s potential suggests it’s not too late to invest in trend and achieve significant gains in the long term.

Tech giants have barely scratched the surface of what’s possible with AI, suggesting that now may be the best time to invest in the companies that are moving the industry forward. So here are two AI stocks that could go parabolic.

1.Intel

You might be surprised to see me recommend Intel (NASDAQ:INTC), given that its stock is down 39% year to date. However, the company appears to be making a comeback that could send its stock price soaring in the years to come.

After a difficult decade, Intel is restructuring its business to regain its competitive advantage. The company is invest massively in AI, launching a range of new AI processors this year. Meanwhile, the chip giant is expanding its manufacturing division, a move it says will help it achieve non-GAAP gross margins of 60% and save it between $8 billion and $10 billion in costs. here 2025.

Restructuring is costly and it will take time for Intel to achieve significant returns on its investment. However, recent results indicate that the company is on the right track. In the first quarter, its revenue rose 9% year over year to $13 billion, in stark contrast to its 16% sales decline in 2023. The chipmaker also generated non-GAAP earnings of $0.18 per share, beating expectations by approximately $0.04 per share.

Intel has a lot of work to do Nvidia in the AI chip market and is developing its foundry division. However, the growth trajectory is promising. In addition to the positive earnings, the company’s trailing 12-month free cash flow increased by approximately $2 billion since January.

Negotiate with one forward price/earnings ratio around 28 and a stock price near its lowest level in months, Intel is a screaming buy this month.

2. Apple

AppleIt is (NASDAQ:AAPL) The stock price has jumped more than 10% since last month as Wall Street has become bullish on the company again. The iPhone maker has seen some slowdowns over the past year, when falling product sales led to a decline in revenue. However, recent developments have given investors insight into Apple’s plan to increase revenue from its products with the help of AI.

On June 10, the company unveiled Apple Intelligence, a platform that will bring generative AI capabilities to its devices. However, the catch is that to take advantage of it, users will need at least an iPhone 15 Pro, or a Mac or iPad equipped with an M1 to M4 processor. The move could prompt millions of consumers to upgrade to the company’s latest devices.

Despite recent challenges, Apple remains a consumer technology giant. The company has developed almost unrivaled brand loyalty within its user base, which could see it become a major growth driver in public adoption of AI. While businesses like Microsoft And Amazon Given the industry’s AI needs as a priority, Apple’s focus on consumers could allow it to dominate this part of the AI space.

In addition to its products, Apple has a growing services business that could also be boosted by AI. The company has entered into a partnership with OpenAI that will see Siri transfer users to ChatGPT to get answers to specific questions. However, this appears to be just the beginning. Ultimately, OpenAI technology could help Apple offer a range of paid AI services to improve the usability of its products.

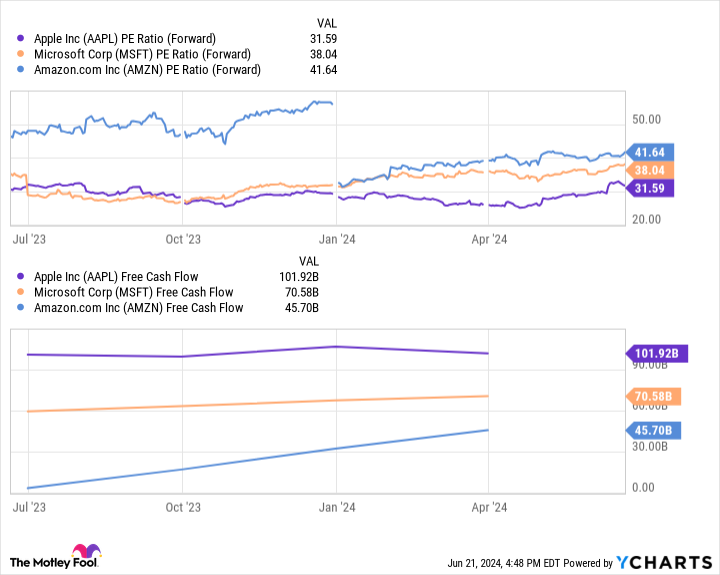

Additionally, Apple’s stock trades at an advantageous forward P/E relative to some of its AI competitors. The company’s gradual expansion into AI has led to a more moderate stock price rise than Microsoft and Amazon have experienced over the past year. Yet the iPhone maker far outperforms them in free cash flow, indicating it may be better equipped to continue investing in its business.

As a result, Apple is a no-brainer at the moment.

Should you invest $1,000 in Intel right now?

Before buying Intel stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $775,568!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Cook has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Amazon, Apple and Microsoft. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short $405 calls in January 2026 on Microsoft. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool