Nvidia (NASDAQ:NVDA) is a great artificial intelligence (AI) action. However, it has become a bit expensive from a valuation perspective, prompting some investors to look elsewhere for AI investments. I’m in that camp, but fortunately there are plenty of AI companies worth buying right now.

Two that come to mind are Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) And Adobe (NASDAQ:ADBE). Both companies’ shares trade at reasonable valuations, and both companies are still fantastic businesses.

Generative AI represented a huge technological shift for both companies

Alphabet is better known by its former name, Google. It has been investing in its AI capabilities for many years, and it is starting to pay off. The most notable area is its generative AI platform, Gemini. Gemini is already used for several purposes, including creating announcements for customers, summarizing search results, and helping developers write code.

The tech giant is also seeing strong demand in its cloud computing wing: Google Cloud. While many companies want to use AI, few have the computing power necessary to create a model adapted to their business. Plus, buying a supercomputer to create one would be overkill, which is why they rent the computing power from a provider like Google Cloud. Many generative AI startups have done this because it is a more efficient use of capital. Its customer base includes some of the hottest startups, including 60% of funded generative AI startups and 90% of generative AI unicorns (private companies valued above $1 billion).

By creating an ecosystem full of AI tools, Alphabet has created a fantastic offering for anyone looking to develop and implement AI into a business.

Adobe is another keen provider of AI tools, although it is tackling the digital media market. Its generative AI tools have reduced the time needed to create media assets and enable users to create images tailored to the viewer. Adobe is also innovating in the document space, where its conversational AI can read documents and answer questions related to their content.

Although there are questions about whether Adobe might be out of touch with AI right now, its strong results in the second quarter of fiscal 2024, which ended May 31, have allayed those concerns. Adobe beat its revenue and earnings per share forecasts and raised its revenue forecast for the year.

Adobe is benefiting from the new wave of demand brought on by AI and can also be purchased at a deep discount to its average historical valuation.

Both stocks are reasonably priced for their growth

Both stocks trade at much more reasonable prices than Nvidia. Since there are many changes underway at both companies, I will use the forward price-to-earnings ratio to assess their valuations.

Although Adobe soared after its last earnings report, the stock is still valued below where it has been trading over the past year.

While some may consider a valuation of 29 times forward earnings to be expensive, Adobe has consistently been one of the best performers in the market and has earned its premium.

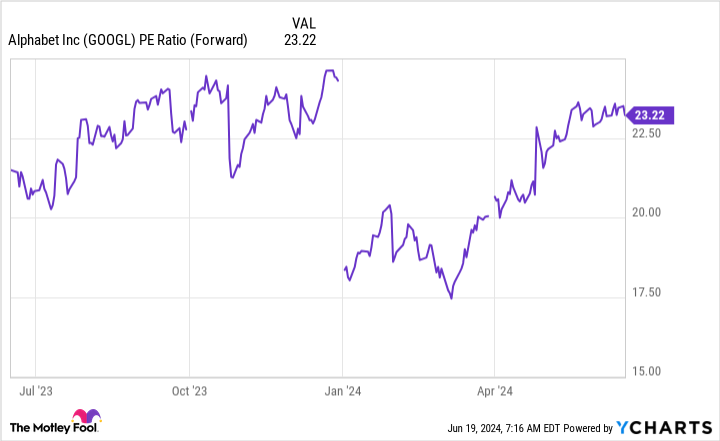

Alphabet, on the other hand, is even cheaper.

Although 23 times forward earnings are close to Alphabet’s trading high last year, they remain cheap from a broader market perspective. THE S&P500 currently trades at 22.1 times forward earnings, meaning Alphabet brings virtually no premium to the market as a whole.

Given Alphabet’s success and track record, it’s still a phenomenal buy at these prices.

Should you invest $1,000 in Adobe right now?

Before buying Adobe stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Adobe wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $801,365!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions at Adobe and Alphabet. The Motley Fool holds positions and recommends Adobe, Alphabet and Nvidia. The Mad Motley has a disclosure policy.

2 Artificial Intelligence (AI) Stocks I’d Buy on Nvidia Right Now was originally published by The Motley Fool