In June 2022, the consumer price index (CPI) reached an annualized rate of 9.1%, the highest level in 40 years, and well above the 2% target of the American Federal Reserve. To bring it down, the Fed aggressively raised the federal funds rate, from a historic low of 0.25% to 5.50%.

The real estate market was a big victim of this policy change. Rising interest rates can reduce the average buyer’s borrowing ability, often leading to fewer sales. In fact, U.S. existing home sales came in at an annualized rate of 4.1 million units in May, 38% below the 2021 peak of 6.6 million units, when interest rates were at historic lows.

Real estate technology company red fin (NASDAQ:RDFN) operates one of America’s largest brokerage firms, covering 98% of the entire geographic market. Unsurprisingly, its business collapsed in the wake of soaring interest rates and slowing home sales, sending its shares down 93% from its all-time high.

But Wall Street is forecasting two interest rate cuts from the Fed by the end of 2024, which could be the spark Redfin shares need to stage a recovery. Here’s why now might be a great time to buy stocks.

Redfin adjusted its business to survive the real estate winter

Redfin’s business used to have two distinct parts. There was direct buying (iBuying), which involved the company buying homes from willing sellers and reselling them for a profit. The other part was real estate services, which included its brokerage division. By 2022, iBuying accounted for more than half of Redfin’s total revenue, but the company decided to shut down that segment that year as soaring interest rates threatened to derail the real estate market.

Profit margins were razor-thin in the iBuying industry, so any decline in the value of Redfin’s real estate inventory could have triggered catastrophic losses. Now, the company is focusing on its service segments, which include its brokerage business, rental marketplace, title services and mortgage lending. They carry much higher gross profit marginsand it helps Redfin clean up its bottom line (which I’ll talk more about in a moment).

During the first quarter of 2024 (ended March 31), Redfin’s 1,658 master agents helped the company account for 0.77% of all U.S. home sales. Redfin charges a listing fee of just 1.5%, which is well below the industry standard of 3%. This drops to 1% if the seller also agrees to purchase their next home using Redfin. As a result, more than a third of its transactions in the first quarter came from loyal customers.

Additionally, a record 30% of customers who purchased a home through Redfin in March also used its mortgage service, helping the company generate more revenue on each transaction.

Revenue growth stagnates, but profitability is in sight

Redfin generated $225.5 million in revenue during the first quarter of 2024, an increase of 5% from the same period last year. While this seems like a modest jump, any growth is a win considering the drop in existing home sales I mentioned earlier.

During this difficult time, Redfin is focused on reducing costs and positioning its business to survive until conditions improve. This includes a new compensation plan for some agents who forgo salary to earn higher commission rates.

Redfin’s preferred profitability metric is adjusted EBITDA (non-GAAP earnings before interest, taxes, depreciation and amortization), which was still negative to the tune of $27.6 million in the first quarter. However, this is an improvement compared to the negative result of $63.6 million recorded in the same quarter last year.

Management says Redfin could generate $2 million in positive EBITDA in the current second quarter (ending June 30), and it also expects a positive result for the full year. The company only has $107 million in cash on its balance sheet, so reaching this profitability milestone will be very important. That said, it has an additional $165 million in loans on its balance sheet, which it intends to sell and convert into cash.

Late last year, Redfin also refinanced some of its debt and extended its maturity to 2027, reducing the risk of a liquidity crunch.

Redfin stock trades at rock-bottom valuation

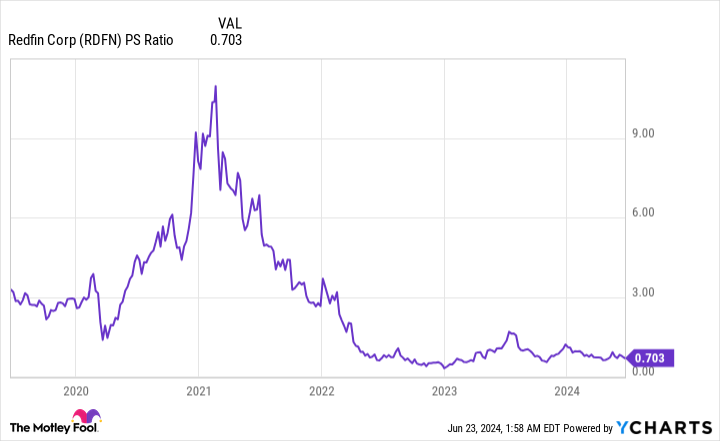

Following the sharp drop in its stock price, Redfin now has a market capitalization of just $720 million. Considering that Wall Street estimates the company will generate over $1 billion in revenue this year, that puts its price-to-sales (P/S) ratio at just 0.7.

In other words, the real estate market is currently so weak that investors are valuing Redfin at less than a year of revenue. For perspective, they valued the company at more than 9 times its annual revenue just three years ago:

One of Redfin’s peers in the real estate technology industry, Zillow Group, is currently trading at a P/S ratio of 5.5, although it has also reduced its activity and generated very little growth of late. By comparison, Redfin’s valuation seems unjustifiably low.

The CPI fell to a much more manageable 3.3% annualized rate in May, and while that remains above the Fed’s 2% target, many Wall Street analysts say its downward trend is clear enough for the central bank to start cutting rates. THE CME GroupFedWatch forecasts a 25 basis point cut in September, followed by another in December. The reductions could become more pronounced in 2025 if inflation continues to fall.

I think it’s very difficult to make a case for Redfin’s rock-bottom valuation right now. The real estate industry is expected to see a flurry of activity from homebuyers once rates begin to fall, which will almost certainly boost Redfin’s business. Investors willing to buy Redfin stock ahead of this change could position themselves for an extended period of gains.

Should you invest $1,000 in Redfin right now?

Before buying Redfin stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Redfin wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $775,568!*

Securities Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Anthony DiPizio has no position in any of the stocks mentioned. The Motley Fool features and recommends Redfin and Zillow Groups. The Motley Fool recommends CME Group and recommends the following options: Short August 2024 $11 Calls on Redfin. The Motley Fool has a disclosure policy.

1 Super Stock Down 93% to Buy Before the Fed Cuts Interest Rates was originally published by The Motley Fool