Many people look for investments that create passive income — assets that will regularly distribute cash to them, hopefully in increasing amounts over the years. You can earn passive income from your stock market investments by purchasing shares of companies that pay dividends. The problem is that most stocks today have fairly meager dividends, or don’t pay them at all.

To illustrate this point, the average dividend yield of stocks in the broader market S&P500 the index is only 1.35%. If you want more passive income, you may be better off purchasing short-term U.S. Treasury bonds or putting your cash in a high-yield savings account. To build a passive dividend portfolio, investors should choose individual stocks that offer sustainable, high dividend yields.

Two stocks offering high dividend yields today are Altria Group (NYSE:MO) And Philip Morris International (NYSE:PM). Both are tobacco giants and, interestingly, they were once part of the same company. One stock yields 8.6%, while the other yields 5.2%. But what is the best passive income game now?

Altria Group: high yield of traditional tobacco

Altria Group owns Philip Morris USA, one of the leading tobacco and nicotine companies in the United States. Tobacco stocks have been among the market’s best performers over the past few decades because of the way the cigarette industry generates cash. The company faced declining sales volumes in the cigarette sector, but it offset the impact of this decline by steadily increasing cigarette prices. Last quarter, Altria management estimated that total estimated industry-wide domestic cigarette volume declined 9% year-over-year. But Altria’s revenues net of excise taxes fell only 2.2% year-over-year.

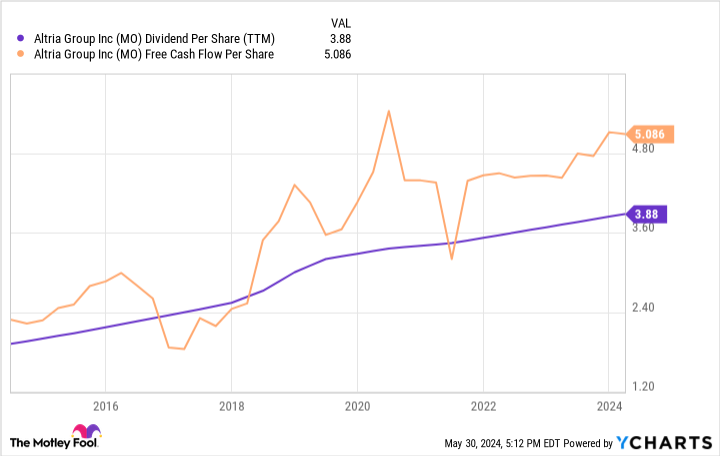

The combination of price increases and volume declines has led to consistent profit growth. Free cash flow per share has increased 122% over the last 10 years. One driver of this has been Altria’s share repurchase program, which helps generate free cash flow per share. The number of shares outstanding has fallen 13.4% over the past 10 years, and the company has accelerated its buybacks in recent quarters.

Free cash flow is what companies prefer to leverage for dividend payments, and it has fueled Altria’s shareholder payout growth. Currently, its annual dividend is $3.88 per share, well below its current free cash flow of $5.09 per share. This dividend yields an eye-watering 8.6% at the current share price.

Philip Morris International: Growth of new nicotine products

The international part of Philip Morris’ operations is – unsurprisingly – owned by Philip Morris International. The company sells cigarettes and tobacco products virtually everywhere except the United States. However, unlike the Altria group, Philip Morris is not experiencing a considerable drop in volumes in its cigarette business. In the last quarter, the volume of its fuel sales decreased by only 0.4% year-on-year.

Additionally, Philip Morris International is the leader in new technology nicotine products. It owns the first brand of heated tobacco without combustion, Iqos, which is growing like wildfire in Europe and Japan. In the United States, it owns the Zyn nicotine pouch brand, whose volumes have grown from virtually zero six years ago to 443 million cans in the past 12 months. These developments led to an overall increase in shipping volumes of 3.6% last quarter and an 11% increase in revenue due to higher prices.

The company currently pays a dividend of $5.17 per share, which is only slightly lower than its free cash flow of $5.76 per share. This narrow spread is something income investors should consider. At current stock prices, the stock’s dividend yields approximately 5.2%.

What is the best dividend stock?

Both Altria and Philip Morris International have advantages and disadvantages for income investors. Altria has a higher yield and more room to increase its dividend, based on its free cash flow numbers. However, it faces faster volume declines in the American market.

Philip Morris International pays a lower dividend and has little room to grow based on its free cash flow. Despite this, I think Philip Morris International is the best stock to buy for dividend investors for the long term. Sales of new technology nicotine products are growing rapidly and are expected to begin generating significant cash flow for Philip Morris over the next few years. Cigarette consumption outside the United States is also much more sustainable, which should lead to better revenue and profit growth. This combination should lead to faster dividend growth for Philip Morris International over the long term.

Altria Group should do well for investors over the next five to ten years. But the best passive income bet that you can “set it and forget it” in your portfolio is Philip Morris International.

Should you invest $1,000 in Altria Group right now?

Before buying Altria Group stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and the Altria group was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $671,728!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 28, 2024

Brett Schaefer has no position in any of the stocks mentioned. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

1 stock with a yield of 8.6% versus 1 stock with a yield of 5.2%: which is better for passive income investors? was originally published by The Motley Fool