It has been an unforgettable year for shareholders of Palantir Technologies (NYSE:PLTR). Investors endured the pain of the stock’s single-digit drop after the company’s IPO. However, the technological marvel of artificial intelligence (AI) has breathed new life into the stock, and the company’s repeated quarters of strong performance have further fueled market sentiment.

While investors may rightly be concerned that the stock’s 48% rise since January leaves little leverage, fear not. Investing sometimes requires looking decades ahead, and Palantir may hold more promise than most companies you’ll encounter.

Here’s why long-term investors can buy stocks today and hold them for decades.

Government Loyalty Supports Palantir’s Business

The Internet created the digital world we know today. This means that humanity has spent more than two decades creating increasing amounts of data at breakneck speed. About 90% of all global data comes from the last two years. Just think about how much data the world will have in five, 10, or 25 years!

This is an underestimated aspect of artificial intelligence (AI), which has become the next evolution of technology. Data plays an important role; AI is trained on data, meaning organizations with the best data and those that leverage it the most can have a competitive advantage.

This simple concept is the key to understanding Palantir’s enormous investment potential. The company develops and deploys custom data analytics software through the Gotham, Foundry and AIP platforms. The goal of this technology is simple: to seamlessly transform data into actionable insights in real time.

Palantir can be an enigma because its complex product offers little visibility to investors and outsiders. So, take a look at who has relied and continues to rely on Palantir. The U.S. government, which uses its virtually unlimited resources to maintain a competitive advantage as a global superpower, has remained loyal to Palantir for more than a decade. Palantir’s technology reportedly helped the United States find terrorist Osama bin Laden in 2011.

The government continues to support Palantir today. Palantir recently received a new $480 million contract from the Department of Defense. CEO Alex Karp confirmed that the company’s technology is helping Ukraine in its war against Russia. These situations require cutting-edge tools, and Palantir’s relevance, then as now, should give investors a clear vote of confidence in the value its software delivers.

Unlocking years of potential in the private sector

The U.S. government and its allies are uniquely equipped to spend on the best of the best. That’s why it may take time for some of government’s best tools to trickle down to the private sector. However, Palantir is starting to gain traction with commercial customers. This is ultimately where Palantir’s long-term advantage lies.

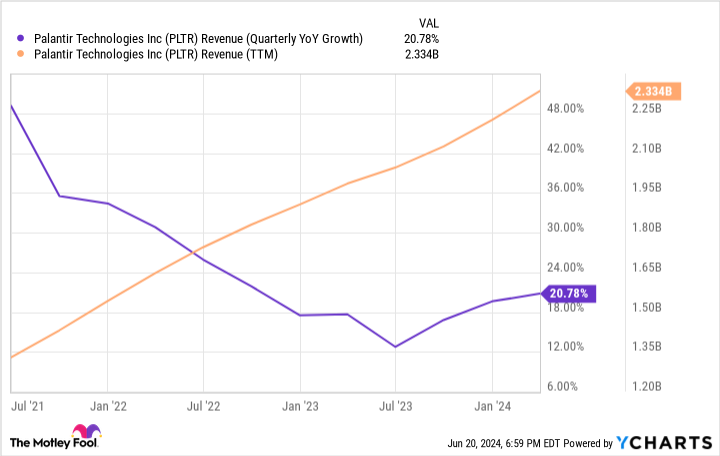

Businesses are beginning to realize that AI is essential to compete in the future and are working to position themselves accordingly. Palantir launched its AIP platform last spring to help companies develop and deploy AI applications. It was a huge success. Alex Karp stated that demand for AIP is unprecedented. Since then, Palantir’s financial performance has given substance to this claim.

You can see below that revenue growth has reaccelerated since AIP launched last year:

More importantly, Palantir’s customer count is growing faster than revenue, which could signal further growth as more apps come online. Palantir’s U.S. enterprise customer count grew 69% year-over-year in the first quarter and remains modest at 262. There are more than 20,000 large enterprises in the U.S. alone.

Think about the decades to come

Palantir does not sell a standard product. Developing and launching apps takes time, which means Palantir may never experience the explosive growth of Nvidia. However, Palantir appears poised for decades of steady double-digit growth.

Palantir’s uses range from fraud detection to military operations. Its latest contract with Starlab will see Palantir model a digital clone of a space station to simulate maintenance and testing operations. Such flexible technology makes any business (large enough to afford the software) a potential customer.

Additionally, the company is profitable based on generally accepted accounting principles (GAAP) and has $3.8 billion in cash with zero debt, making Palantir a candidate to spend years buying back stock and to generate returns on investment through relentless profit growth.

Where could Palantir be in two or three decades? The corporate opportunities alone give Palantir significant runway. Government affairs arguably also gives Palantir a high floor. Palantir’s current market capitalization exceeds $50 billion. Still, investors might consider a future large-cap stock if they are willing to buy and hold it for the foreseeable future.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Palantir Technologies was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $775,568!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool ranks and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

1 Brilliant Artificial Intelligence (AI) Stock Up 48% in 2024 to Buy Now and Hold for Decades was originally published by The Motley Fool