Electric vehicle (EV) makers are facing multiple headwinds due to rising competition in key markets, the impact of macro pressures on demand, and the lack of adequate EV infrastructure. Moreover, additional tariffs announced by the U.S. and Europe as well as trade tensions between the two key EV markets – the U.S. and China, are also weighing on EV stocks. However, the long-term demand for EVs looks promising, given the growing concerns over climate change. Using TipRanks’ Stock Comparison Tool, we placed Tesla (NASDAQ:TSLA), General Motors (NYSE:GM), and Li Auto (NASDAQ:LI) against each other to find the best EV stock, according to analysts.

Tesla (NASDAQ:TSLA)

Tesla shares have declined about 25% over the past year, as subdued demand amid growing rivalry in the EV market, lack of innovative model launches, and margin pressures due to aggressive price cuts have impacted investor sentiment.

Analysts bullish on Tesla are confident about the company’s ability to stay ahead of the competition, backed by its technology and scale. They are also optimistic about other potential tailwinds, like the company’s AI endeavors, Robotaxi service, and autonomous driving.

However, critics believe that the company will lose ground to affordable models of rapidly emerging rivals in key markets like China.

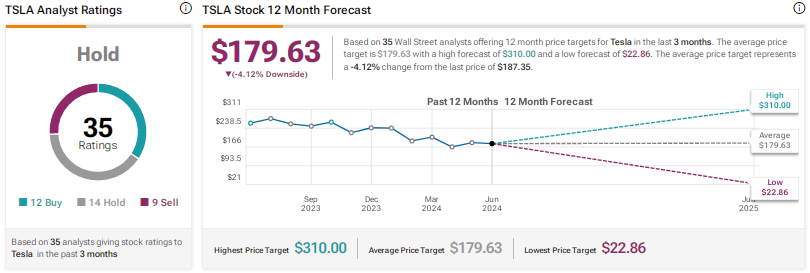

Is Tesla a Buy, Sell, or Hold?

In a research note dated June 24, UBS analyst Joseph Spak reiterated a Hold rating on Tesla stock with a price target of $147. The analyst expects the EV giant to miss analysts’ expectations for Q2 2024 deliveries. UBS estimates TSLA’s Q2 deliveries to decline by 10% year-over-year to 420,000 EVs but increase by 9% compared to Q1 2024. In particular, it projects a sharp drop in the company’s deliveries in Europe due to weak demand in key markets.

Additionally, UBS expects Tesla’s gross margin to be under pressure despite the projected improvement in U.S. and China deliveries. Analysts at the investment firm think that over the near-to-mid term, the market will focus on Tesla’s new vehicle launches, which could affect 2025 and 2026 estimates.

With 12 Buys, 14 Holds, and nine Sells, Tesla is assigned a Hold consensus rating. The average TSLA stock price target of $179.63 implies a possible downside 4.1%.

General Motors (NYSE:GM)

Shares of automaker General Motors have advanced nearly 29% so far this year. The company impressed investors with better-than-expected Q1 results and improved full-year earnings outlook. Strong truck sales growth in North America fueled the upbeat performance in the first quarter.

However, earlier this month, the company trimmed its full-year production guidance for EVs due to the slowdown in EV adoption in the U.S. It now expects EV production between 200,000 and 250,000 EVs this year, compared to the previous guidance of 200,000 to 300,000 units.

Despite near-term pressures, the company is bullish about the potential of its EV business. GM sold over 9,500 EVs in North America in May, supported by the solid performance of its Chevrolet Blazer and Cadillac Lyriq EVs. General Motors continues to believe that its EV business can deliver positive variable profit this year.

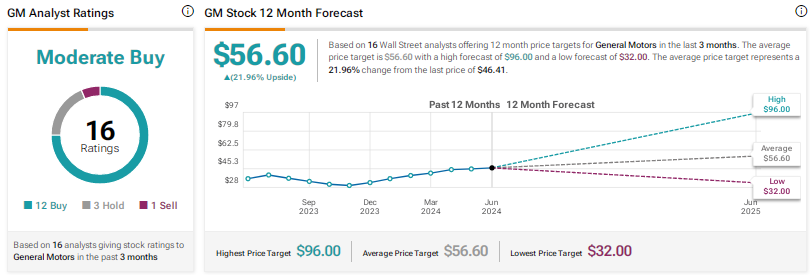

Is GM a Good Stock to Buy?

Following the announcement of the company’s $6 billion buyback plan, Bank of America analyst John Murphy reiterated a Buy rating on GM stock with a price target of $75. The analyst noted that the company expects its Q2 earnings to be “better” than the first quarter, which is consistent with his model estimates and indicates that there could even be an upside to the current expectations.

The analyst is bullish on the company, backed by the strategic initiatives under CEO Mary Barra’s leadership. He highlighted GM’s solid balance sheet and cash position and the expectation of robust free cash flow in the remaining part of the year, which would support the enhanced shareholder returns.

Overall, GM stock has a Moderate Buy consensus rating based on 12 Buys, three Holds, and one Sell. The average General Motors stock price target of $56.60 indicates nearly 22% upside potential from current levels.

Li Auto (NASDAQ:LI)

Li Auto shares have plunged 50% so far this year. Multiple factors are dragging down the Chinese EV maker’s stock, including macro uncertainty, growing competition in the domestic market, and poor reception to the company’s Li MEGA multi-purpose vehicle. To make matters worse, the U.S. and Europe are imposing hefty additional tariffs on imports from Chinese EV makers.

Despite Li Auto’s dismal Q1 results and the delay in launching the company’s three new all-electric SUVs into 2025, there are several positives that could help the stock bounce back. The company expects to deliver 105,000 to 110,000 vehicles in Q2 2024, reflecting a year-over-year growth of 21.3% to 27.1%.

Earlier this month, Li Auto announced a 23.8% year-over-year rise in its May deliveries to 35,020 vehicles. The company has rapidly emerged as one of the prominent players in the Chinese new energy vehicle (NEV) market and is expected to bolster its position once the near-term headwinds fade. Moreover, expansion into markets like the Middle East could boost the company’s prospects.

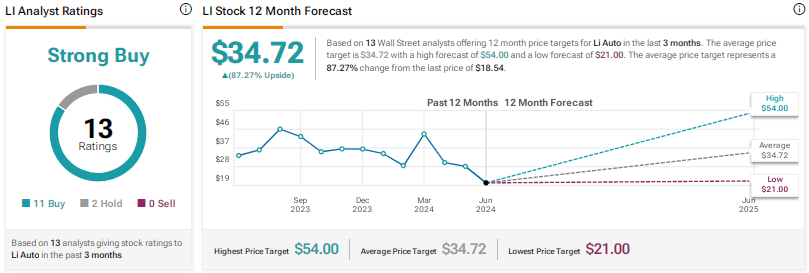

Is Li Auto Stock a Good Investment?

Recently, JPMorgan analyst Nick Lai initiated coverage of Li Auto stock with a Hold rating and a price target of $25. The analyst is awaiting a better entry price, given that the current share price already reflects the upside as well as volume and potential margin pressures over the next 6-9 months.

The analyst contends that the company’s recent foray into the battery electric vehicle (BEV) market exposes it to headwinds like intense competition.

Unlike Lai, most analysts remain bullish on the long-term prospects of LI stock. Overall, Li Auto earns a Strong Buy consensus rating based on 11 Buys and two Hold recommendations. The average Li Auto stock price target of $34.72 suggests 87.3% upside potential.

Conclusion

Wall Street is highly bullish on Li Auto stock but cautiously optimistic about General Motors. However, analysts are sidelined on Tesla stock due to several headwinds, including the impact of price cuts on margins. Currently, analysts see the pullback in Li Auto shares as an attractive opportunity to buy the stock and gain exposure to a prominent Chinese EV player.