Last year, approximately 78 million passenger vehicles were sold worldwide, with about 75% powered by internal combustion engines (ICE). Generating far less sales, around 12% of the passenger vehicles sold globally were BEVs (battery electric vehicles).

In the short term, while the outlook for EV sales looks uncertain, it is thought long-term growth is inevitable and EVs are expected to account for about 50% of global sales by the mid-2030s.

A few years before that, by 2030, Stifel analyst Stephen Gengaro anticipates about 40% of global passenger sales will likely be BEVs. With all this growth on the way, the analyst thinks EV giant Tesla (NASDAQ:TSLA) stands to benefit from the rising adoption.

“We believe Tesla is very well positioned to deliver robust multi-year growth in 2025-27+,” said Gengaro. “In the near term, the revamped Model 3 and upcoming Model Y refresh should bolster sales, followed by the commencement of its next-generation vehicle (Model 2) production, which will likely garner very strong demand.”

With CEO Elon Musk at the helm, Tesla remains the biggest EV name out there, and has a “dominant market share” in the US. But as Tesla has shown over the years, it is far more than just a car company. Driven by innovation, the company’s strengths and growth drivers extend far beyond EV sales. They encompass Full Self-Driving (FSD) initiatives, RoboTaxis, Energy Generation & Storage, and the development of autonomous humanoid robots.

The FSD opportunity is particularly attractive. Gengaro thinks the initiative “has the potential to generate significant value through sales of FSD, possible licensing agreements, and as a critical driver of longer-term RoboTaxi initiatives.”

Adding to Gengaro’s bullish sentiment is the fact Tesla is “very well capitalized.” The company saw out Q1 with $26.9 billion in cash and short-term investments, compared to $5.4 billion in debt and finance leases. “We believe TSLA’s strong financial position and robust free cash flow will enable it to easily finance continued growth and research and development,” said Gengaro.

While Gengaro strikes a confident tone regarding Tesla’s prospects, there are nonetheless some risks to consider. These include concerns around delivery levels following lackluster Q1 results, as well as near-term challenges around EV adoption and uncertainties related to the U.S. election.

On balance, however, Gengaro takes a bullish stance, initiating coverage of Tesla with a Buy rating and $265 price target, implying shares will post growth of ~35% in the year ahead. (To watch Gengaro’s track record, click here)

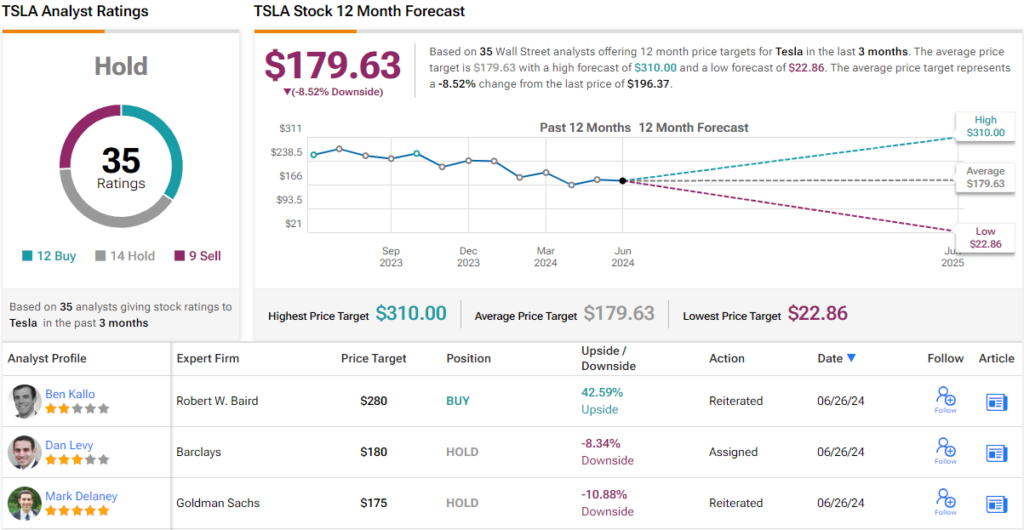

Gengaro, though, is amongst a loud minority on Wall Street. The stock currently claims a Hold consensus rating, based on a mix of 14 Holds, 12 Buys and 9 Sells. Moreover, going by the $179.63 average price target, a year from now, shares will be changing hands for a 4% discount. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.